DALLAS, TX -- October 28th, 2024 -- Third Coast Bancshares, Inc. (NasdaqGS:TCBX): Stonegate Capital Partners updates their coverage on Third Coast Bancshares, Inc. (NasdaqGS:TCBX). For 3Q24, Third Coast reported net income of $12.8M, up from $10.8M in 2Q24. This was equal to a basic and diluted EPS of $0.85 and $0.74, respectively. The Q/Q increase was mainly driven by higher net interest income due to increased loan rates, higher non-interest income, and ongoing savings from cost-cutting efforts implemented in previous quarters. This rise in net income was due in part to a slightly lower provision set aside for credit losses during the quarter. We expect the Company to keep operational efficiency a focus for the foreseeable future to help navigate the current macro environment.

Company Summary

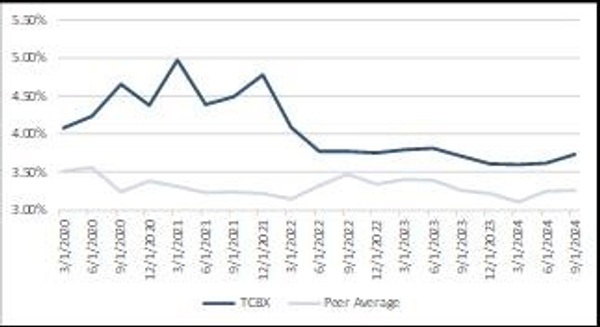

- Interest Income and Expenses: TCBX reported a net interest margin of 3.73% for the quarter, which is up from 3.62% in 2Q24. We note that this remains elevated compared to the median comps NIM of 3.30%. Year over year NIM increased from 3.71% primarily due to an increase in net interest income, resulting from loan growth and higher rates on loans, and a slightly lower provision for credit loss during the third quarter of 2024.

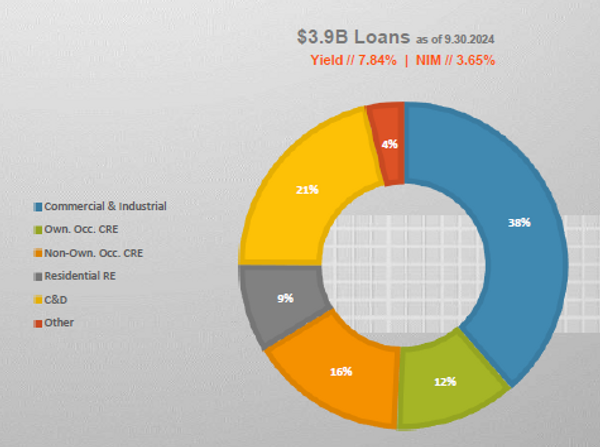

- Deposits and Loans: The Company’s loan portfolio remains on a strong footing with growth of $329.9M year over year. Over that same period net deposits increased by $347.6M. Nonperforming assets for 3Q24 were comparable to the previous quarter, at $24.0 million and $24.4 million, respectively. This relates to nonperforming loans to a total loan ratio of 0.62%, compared to 0.65% in 2Q24. The Company recorded net recoveries of $57,000 and net charge-offs of $24,000 for the third quarter of 2024 and 2023, respectively. Lastly, we note that the quarter end book value and tangible book value were $28.13 and $26.75, respectively. This was up from 2Q24 in values of $26.99 and $25.60.

- Financial Ratios: At the end of 3Q24, Tier 1 capital ratio was 9.93%, up slightly from 9.88% in 2Q24. Third Coast’s non-performing loans to total loans percentage was 0.62%, a slight decrease from 0.65% in 2Q24. TCBX had a ROAA and ROAE of 1.14% and 12.12%, respectively. The efficiency ratio for the quarter was 59.57%, an improvement from 61.39% last quarter. The Bank currently has $270.5M in cash and equivalents, which is equal to $19.79 per share or approximately 72% of the stock value.

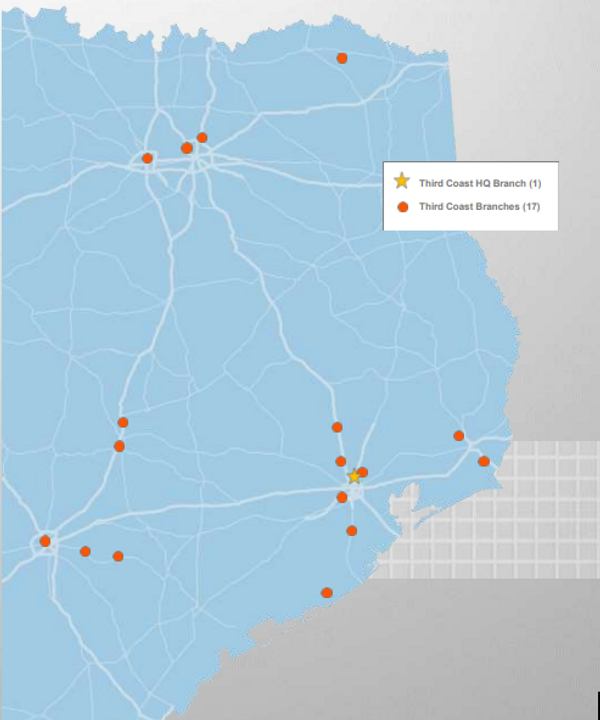

- Growth Initiatives: TCBX experienced significant growth in the first half of the year, opening its 17th and 18th branch locations in 2Q24, followed by the launch of its 19th branch in Houston, Texas. Management also noted that the Company continues to execute strategic objectives, as was mentioned earlier with regards to operational efficiency, achieving a sub 60% efficiency ratio. Additional priorities include diversifying the deposit portfolio and managing expenses as well as refining it’s loan portfolio. It is expected that this, combined with a strong loan pipeline, will lead to continued growth.

- Valuation: We use a comp analysis on P/E and P/BV to frame our valuation of TCBX. Using a forward P/E range of 11.0x to 13.0x with a mid-point of 12.0x on FY25 estimates results in a valuation range of $30.92 to $36.54 with a mid-point of $33.73. Using a P/BV range of 1.0x to 1.3x with a midpoint of 1.2x results in a valuation range of $28.13 to $36.57 with a mid-point of $32.35.