DALLAS, TX -- August 26th, 2024 -- NZX Limited (NZSE: NZX): Stonegate Capital Partners updates their coverage on NZX Limited (NZSE: NZX).

COMPANY UPDATES

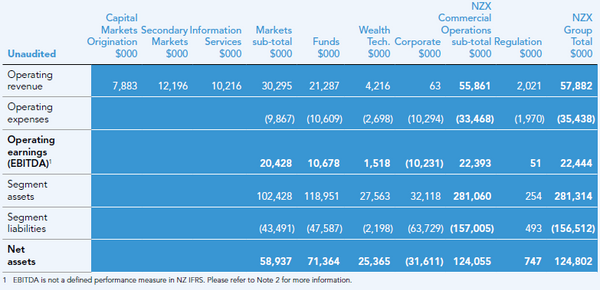

- Quarterly Results: NZX reported revenue, adj EBITDA, and adj EPS of $57.9M, $22.4M, and $15.27, respectively. This compares to our estimates of $55.1M, $20.8M, and $6.98. Topline outperformance was due to strong results in all segments. This outperformance was exacerbated by higher GPM than expected in the Funds segment and Wealth Management segment.

- Markets: Capital raised and listed in the half totaled $6.3B. While this is a y/y decrease, we attribute this to the current market environment and expect NZX to improve as the market improves. We expect a more conducive market condition in the near future as central banks have begun cutting rates. The Company also recorded $16.6B worth of traded values in the secondary market. Information services revenue totaled $10.2M in the half. NZX also traded 320K in dairy derivative lots.

- Smartshares: Smartshares ended the half with FUM of $11.88B, which is up 8.2% from 2H23. FUM grew from positive cashflows and positive market returns of $203.0M and $694.0M, respectively. The Company expects to have QuayStreet fully integrated by 4Q24. This along with positive macro drivers like the KiwiSaver growth potential gives us confidence in NZX’s ability to continue growing its FUM.

- Wealth Technology: Wealth tech ended the half with FUA of $14.21B, which is up 23.2% from 2H23. This has led to $8.93M in annual recuring revenues (“ARR”) as of 2H24. Growth was driven in part by the onboarding of 5 new clients onto the platform in 1H24 bringing the active client count up to 25. Additionally, the Company is currently onboarding an additional 5 custody clients. The Wealth Tech segment is forecasted to be cashflow positive by the end of 2024 with a total expected ARR of $13.47M.

- Financial Position: The Company maintains a strong balance sheet with $12.5M in cash and $124.8M in equity. When combined, cash and equity account for $0.44 per share, equal to 32% of the share price. NZX also announced a 3.0 cents per share dividend. Capital expenditures are still above historical averages due to the continued product development and new client migration activity. This is expected to continue through 2024.

- Updated Guidance: NZX has reiterated its full year 2024 EBITDA guidance in a range of 40.0M to $44.5M and is on pace to reach the higher end of guidance. Following the strong FY23 results we believe this guidance is reasonable. This is in large part due to the strong results seen in the dairy derivatives segment and the recuring nature of the Wealth Tech and Smartshares segments. We have made slight changes to our model.

- Valuation: We use a Dividend Discount Model, DCF Model and EV/EBITDA comp analysis to guide our valuation. Our Dividend Discount uses the NZX stated range of payout ratios on 2025E Net Income to arrive at a valuation range of $1.23 to $1.52 with a mid-point of $1.38. Our DCF analysis produces a valuation range of $1.35 to $1.60 with a mid-point of $1.46. Our EV/EBITDA valuation results in a range of $1.27 to $1.56 with a mid-point of $1.41. Lastly, we note that NZX is the only company in the comp set with a BV/Share value below $1.0.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking services for public and private companies.