DALLAS, TX -- November 5, 2024 -- NCS Multistage Holdings, Inc. (NASDAQ: NCSM): Stonegate Capital Partners updates their coverage on NCS Multistage Holdings, Inc. (NASDAQ: NCSM).

COMPANY UPDATES

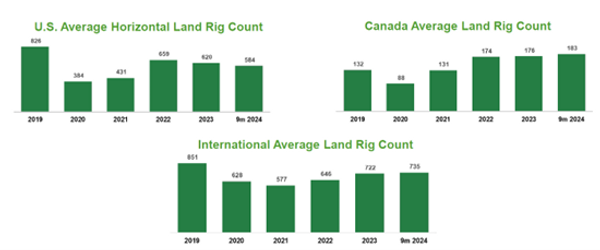

- Offset Growth: In 3Q24, the Company experienced a 15% year-over-year increase in total revenues, reaching $44.0M. This growth was driven by a significant rise in international services revenues, particularly from Middle East tracer work and North Sea frac systems. U.S. product sales also saw an increase, primarily due to higher sales of frac plugs and perforating guns by Repeat Precision, LLC. However, U.S. services revenues and international product sales declined. In Canada, revenues increased by 139% compared to the previous quarter, recovering from the seasonal declines during the spring “break-up”. The Company continues to gain market share both internationally and in deep water rigs.

- Quarterly Results: NCSM reported revenue, gross profit, and adj EBITDA of $44.0M, $18.5M, and $7.1M, respectively. This compares to our estimates of $42.8M, $17.7M, and $6.1M, respectively. This growth was driven by a 15% year-over-year increase in total revenues and a slight improvement in Adjusted EBITDA margin. The EPS for this quarter was $1.60, compared to $1.77 in the same quarter last year. We expect NCSM to maintain reasonably strong margins due to increasing market capture in the international markets through the balance of FY24 and into FY25.

- Strong Balance Sheet and Liquidity Position: NCSM ended 3Q24 with net working capital of $64.1M, representing a 5.8% increase from $60.6M, reported in 3Q23. The Company also closed the quarter with $15.3M in cash and $21.7M of undrawn revolver for liquidity position of $37.0M, a substantial increase from last quarter’s liquidity of $33.0M. This compares favorably to only $8.6M in debt.

- International Growth Despite Headwinds: In the third quarter of 2024, NCSM reported $4.0M in international revenues, marking an 88.7% year-overyear increase. This growth was driven by Middle East tracer work and North Sea frac systems. Despite a 31% sequential decline in international revenues due to the timing of tracer service work in the Middle East, the overall year-over-year growth highlights the company’s expanding footprint. NCSM’s strategic focus on high-margin international projects has positioned it well for continued growth.

- Cash Flows: As of 3Q24, NCSM delivered $0.4M of YTD FCF after distributions to non-controlling interests. This is compared to a FCF balance of $(3.0)M over the same period in FY23. The increase in free cash flow was mainly due to improved operating results, changes in net working capital, and reduced net cash used in investing activities, partially offset by distributions to non-controlling interest.

- Updated Guidance: Currently, we anticipate improved revenue performance in the fourth quarter of 2024 compared to 2023 across the U.S., Canadian, and international markets. However, management expects a sequential decline of 5% to 15% in revenue in each market. The Company is guiding to a full year revenue range of $155.5M to $159.5M. This is coupled with a full year $18.0M to $20.5M adjusted EBITDA guidance, an increase of 49% y/y at the midpoint. We have made modest adjustments to our model.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $25.23 to $30.89 with a mid-point of $27.68. Our EV/EBITDA valuation results in a range of $28.79 to $32.95 with a mid-point of $30.87.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.