DALLAS, TX -- May 3rd, 2024 -- NCS Multistage Holdings, Inc. (NASDAQ: NCSM): Stonegate Capital Partners updates their coverage on NCS Multistage Holdings, Inc. (NASDAQ: NCSM).

COMPANY UPDATES

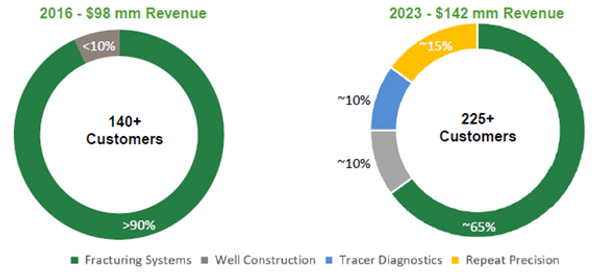

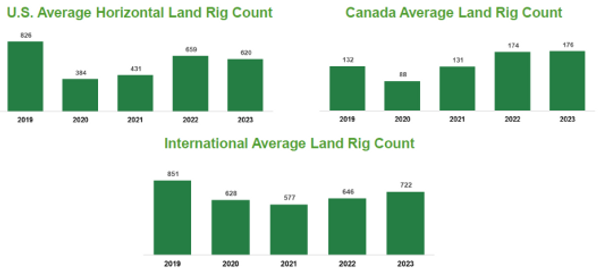

- Growth Potential: In the quarter the Company grew relative to the markets that it operates in. In Canda NCSM grew revenues by 27% sequentially as compared to Canadian rig count growth of 16%. In the U.S. market sequential revenue growth was 10% compared to rig count declines of 11%. The Company is also capturing market share both overseas and on deep water rigs, with the North Sea customer base expected to expand further in FY24. We note that NCSM generated 28% of revenues in 1Q24 from its services segment, making the Company well diversified across operations and geographies.

- Quarterly Results: NCSM reported revenue, gross profit, and adj EBITDA of $43.9M, $17.6M, and $6.1M, respectively. This compares to our estimates of $39.4M, $16.3M, and $3.2M, respectively. EPS results grew significantly from 1Q23, with last year’s results impacted by litigation expenses. After adjusting for the litigation provision, the Company still posted solid Adj. EBITDA results of $6.1M for 1Q24, a growth of 24.8% year over year. We expect NCSM to maintain reasonably strong margins due to cost optimization through FY24.

- Robust Balance Sheet and Liquidity Position: NCMS ended 1Q24 with net working capital of $62.2M, which is flat from $61.7M in 1Q23. The Company also closed the quarter with $14.0M in cash and $20.4M of undrawn revolver for liquidity position of $34.4M. This compares favorably to only $8.9M in debt.

- International Expansion: NCSM is poised for outsized growth in international markets. We note that NCSM generated $2.2M of revenues from international markets in 1Q24, which is growth of 39% y/y. The Company is guiding to a y/y growth of almost 200% in 2Q24, at the midpoint. Given the traction NCSM is gaining in its services segment we believe there is significant room for continued growth.

- Cash Flows: For the quarter, NCSM delivered $(2.5)M of FCF after distributions to non-controlling interests. This is compared to a FCF balance of $(2.0)M in 1Q23. We are unconcerned with the negative FCF balance to begin the year as the Company typically has a seasonally weak first quarter. CapEx for FY24 is guided at $1.5M to $2.5M. It is expected that NCSM will be FCF positive in FY24.

- Updated Guidance: Currently, the Canadian market is expected to be flat y/y and the United Stats market is expected to decline 5% to 10% y/y, with Repeat Precision expected to help buoy this decline. It is expected that the international market will improve by 5% to 10% y/y. The Company is guiding to a revenue range of $150.0M to $160.0M. This is coupled with a $14.5M to $17.5M adjusted EBITDA guidance. We have made modest adjustments to our model.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $22.45 to $28.85 with a mid-point of $25.22. Our EV/EBITDA valuation results in a range of $21.98 to $28.75 with a mid-point of $25.37.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.