DALLAS, TX -- October 31st, 2023 -- NCS Multistage Holdings, Inc. (NASDAQ: NCSM): Stonegate Capital Partners updates their coverage on NCS Multistage Holdings, Inc. (NASDAQ: NCSM).

BUSINESS OVERVIEW

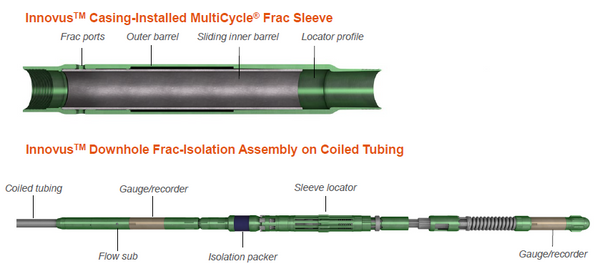

NCS Multistage Holdings, Inc. (“NCS”, “NCSM”, “NCS Multistage”, or “the Company”) is a Houston based Oil & Gas Equipment and Service company that provides engineered products and support services for oil and gas wells both domestically and internationally. NCS Multistage is on the leading technological edge among both fracturing services hardware offerings and service offerings.

The products and services provided by NCS are primarily used by exploration and production oil and gas companies for both onshore and offshore wells. These wells tend to be drilled with horizontal laterals in both unconventional and conventional formations. The downhole needs of these wells are a complex niche that requires the expertise that NCS has gained over the past 15+ years. As wells become more complex and cost effective, the demand for the pinpoint stimulation that NCS provides is expected to increase.

NCS Multistage was founded in 2006. The Company began trading on the NASDAQ Stock Exchange in 2017 under the ticker NCSM. Since then, the Company has made two acquisitions to help diversify its revenue stream, while also growing to over 245 customers, with 59 U.S. utility patents, and 50 International utility patents.

COMPANY UPDATES

- Strong Market Share: NCSM is involved with approximately 30% of Canadian well completions and has moved up to the second largest plug and perf provider by market share in Canada. While there is less market share to capture in the US due to most completions using traditional methods, we believe the Company’s investment in Repeat Precision gives NCSM diversification among completion methods. The Company is also building inroads to capture market share both overseas and on deep water rigs which we expect to continue as the Company maintains focused on long term goals.

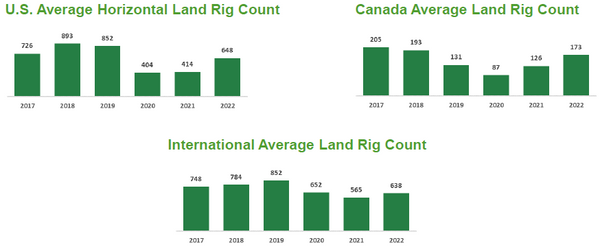

- 3Q23 Results: NCSM reported revenue, adj EBITDA, and EPS of $38.3M, $6.8M, and $1.78, respectively. This compares to our estimates of $51.1M, $8.9M, and $2.59, respectively. Negative EPS results were largely due to the challenging macro environment that saw a greater than expected decrease in Canadian rigs. We expect this to be a short-term headwind as the current futures curve is trending in a positive direction. We note that despite headwinds the Company is still maintaining strong GPM and EBITDA margins, which we expect to lead to modest margin expansion should the macro environment improve.

- Robust Balance Sheet and Liquidity Position: NCMS ended 3Q23 with net working capital of $60.6M, which is an increase from $55.2M in 4Q22. The Company also closed the quarter with $11.4M in cash and $19.7M of undrawn revolver for liquidity position of $31.1M. This compares favorably to only $8.3M in debt and YTD capex of $1.5M.

- Litigation Updates: NCSM has made progress among two outstanding legal challenges. In the first, NCSM received a judgement that was settled as expected with the Company receiving unpaid invoices and the plaintiff received funds from NCSM’s insurance policy. In the other, NCSM has stated that the two parties are still in negotiations with the settlement range narrowing. We expect the outcome to be covered by insurance.

- Cash Flows: For the first nine months of the year, NCSM has a negative FCF balance of $3.0M. This is compared to a negative FCF balance of $9.5M for the first nine months of FY22. CapEx for the year is guided to $2.0M to $3.0M. The current negative balance is due to seasonality, and management is optimistic that FCF will be positive for the year.

- Updated Guidance: Due to the macro backdrop NCSM has updated their guidance. Currently, the Canadian market is expected to be flat y/y and the United Stats market is expected to decline 5% to 10% y/y. The Company is guiding to a revenue range of $144.0M to $148.0M which is down from $160.0M to $175.0M. This is coupled with a $13.5M to $15.5M adjusted EBITDA guidance. We have made modest adjustments to our model.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $18.44 to $23.72 with a mid-point of $20.73. Our EV/EBITDA valuation results in a range of $18.97 to $23.80 with a mid-point of $21.39.