DALLAS, TX -- October 28th, 2024 -- Isabella Bank Corporation (OTCQX: ISBA): Stonegate Capital Partners updates their coverage on Isabella Bank Corporation (OTCQX: ISBA).

Company Summary

- Growth Overview: Isabella Bank reported yet another impressive quarter with strong growth during 3Q24. Total loans grew $42.6M in the quarter, which is an annualized growth rate of 12%. The Wealth Management division increased fees by 13.9% year-over-year. ISBA paid a 3Q24 dividend of $0.28 per share. This is currently equal to a dividend yield of 5.3%, which compares favorably to peer dividend yield at an average of 3.1%. This growth was seen despite the industry headwinds stemming from the current interest rate environment.

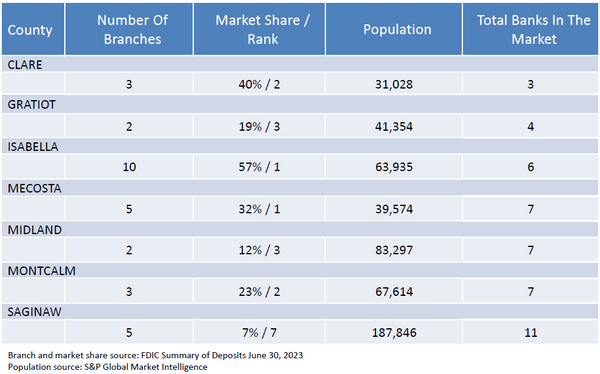

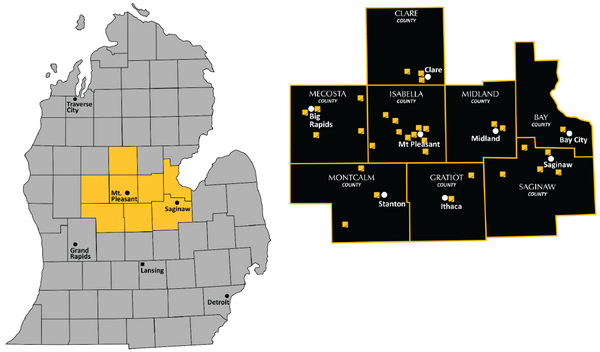

- History of Acquisitions and Expansions: Isabella has a history of organic growth and acquisitive expansion. Since 2008, ISBA has acquired Greenville Community Bank, the Saginaw Office, and the Midland East Office. Concurrently, the Bank opened 6 offices in Lake Isabella, Freeland, and Saginaw. From this, Isabella had secured strong shares in its target markets, commanding 57% control of the Isabella County market and 40% of the Clare County market as of 2Q23. Most recently, the Company has opened its Bay City office that offers both loan and wealth services, expanding the Company footprint into Bay County.

- Strong NIM Outlook: Isabella Bank has delivered on its Q/Q expansion in its net interest margin, despite a deteriorating trend seen in previous quarters, posting a gain of 13bps from 2Q24. Management credited this improvement to the recovery of full contractual interest from two loans that had previously been charged off. This recovery accounted for approximately 50% of the NIM growth observed during the quarter. ISBA reported a growth in commercial loans of $4.2M during the quarter compared to 2Q24, with management highlighting a robust loan pipeline.

- Financial Condition: At the end of 3Q24 deposits totaled 1.78B, which is up from 1.72B in 2Q24, a change of 3.4%. This compares to a loan portfolio increase of 2.9%. Total assets for the quarter were 2.10B, an increase from 2.06B in 2Q24. It is notable that the percentage of past due and accruing accounts between 30 to 89 days was down to 0.16% from 0.05% at the end of 3Q23. The increase is mainly driven by the stabilization of a key agricultural loan, which now stands at a current balance of $1.1M. Overall, credit quality remains strong, with no adverse trends observed.

- ISBA Has Strong Ratios: At the end of 3Q24, Tier 1 Capital Ratio was 12.08%. Isabella’s non-performing loans to gross loans percentage was 0.04%, which has steadily decreased from 0.25% in 3Q21. Additionally, ISBA had a Tier 1 leverage ratio of 8.77% in the quarter, which compares very favorably to the minimum requirement of 5%. The Bank currently has $27.4M in cash and equivalents, which is equal to $3.68 cash per share or approximately 17% of the stock value. The tangible book value at quarter end was $22.14, well above the Company’s current stock price.

- Valuation: We use a comp analysis on P/E and P/BV to frame our valuation of ISBA. Using a forward P/E range of 10.0x to 12.0x with a mid-point of 11.0x on FY25 estimates results in a valuation range of $22.33 to $26.79 with a mid-point of $24.56. Using a P/BV range of 1.0x to 1.2x with a midpoint of 1.1x results in a valuation range of $28.63 to $34.36 with a mid-point of $31.50.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking services for public and private companies.