DALLAS, TX -- October 31st, 2023 -- Isabella Bank Corporation (OTCQX: ISBA): Stonegate Capital Partners updates their coverage on Isabella Bank Corporation (OTCQX: ISBA).

Business Overview

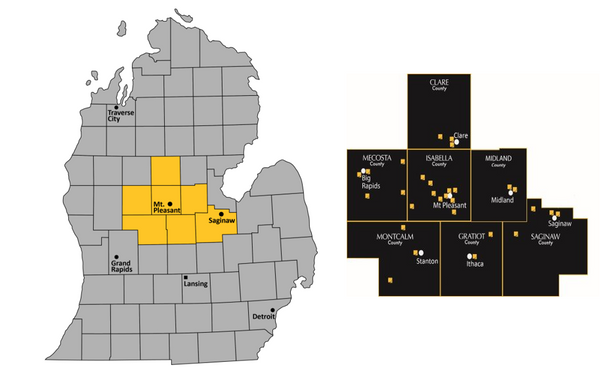

Isabella Bank Corporation (the Company, the Bank, or Isabella) operates as a holding company that wholly owns Isabella Bank. Isabella Bank was founded in 1903 and is headquartered in Mount Pleasant Michigan. Isabella provides a variety of banking, lending, and wealth management services in Central Michigan. The Company serves institutions, businesses, individuals, and families in 8 counties across central Michigan.

The Bank is primarily involved in the business of attracting deposits from the general public in the Bank’s market areas. The Bank grows by investing these deposits, as well as other sources of funds, in loans that are secured by commercial and residential real estate, business assets, and personal guarantees. Isabella has kept itself competitive by offering competitively low rates and a diverse set of financing options.

Isabella also engages in wealth management services and currently has approximately $3.0B in assets under management. The Bank offers comprehensive investment, trust, estate, and tax planning services as well as a full range of investment products, such as ETFs, mutual funds, and fixed and variable annuities. Through the wealth management division, Isabella provides group life, health, accident, disability, and other insurance services.

Company Summary

- Growth in the Second Quarter: Isabella grew considerably in the third quarter of 2023. Core loans were up $14.6M in the quarter and rose $45.7M since the end of FY22. The Wealth Management division grew fees 26.4% compared to 3Q22. ISBA paid a 3Q23 dividend of $0.28 per share. This is currently equal to a dividend yield of 5.2%, which compares favorably to peer dividend yield at an average of 4.0%. This growth was seen despite the industry headwinds due to the current interest rate environment.

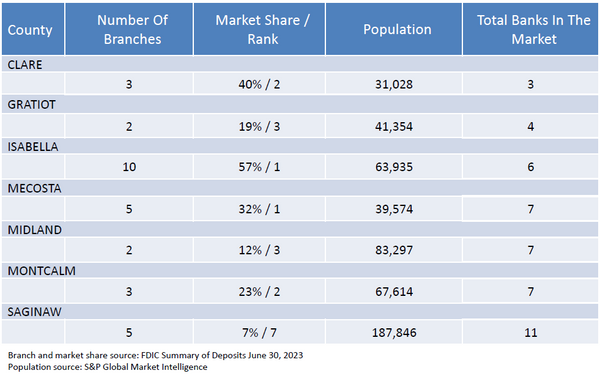

- History of Acquisitions and Expansions: Isabella has a history of organic growth and acquisitive expansion. Since 2008, ISBA has acquired Greenville Community Bank, the Saginaw Office, and the Midland East Office. Concurrently, the Bank opened 6 offices in Lake Isabella, Freeland, and Saginaw. From this, Isabella had secured strong shares in its target markets, commanding 58% control of the Isabella County market and 41% of the Clare County market. Most recently, the Company has opened its Bay City office that offers both loan and wealth services, expanding the Company footprint into Bay County.

- Strategic Plan: The Company embarked on a strategic turn around starting in 2017 with a 5-year plan. Since the start of the plan, ISBA has grown its NIM from 2.95% at the end of 1Q18, which was approximately 80bps below peers. At the end of 3Q23 NIM stood at 3.02%, which we forecast is in line with industry comps. This growth trend is also shown in ISBA’s deposits growing from $1.3B at the end of 1Q18 to $1.8B at the end of 3Q23. This growth was accomplished while growing the Wealth Management Division and paying a dividend yield that is consistently greater than peers.

- Experienced Team: The Bank’s executive leadership team has over 190 years of combined industry experience, with some officers serving the Bank for decades. Chief Executive Officer Jae Evans will retire in January 2024 and will be succeeded by President Jerome Schwind, who has been with ISBA for 24 years. Additionally, the Company shows strong employee retention metrics with approximately 38% of its workforce having a tenure greater than 10 years, and an overall employee turnover rate of 18% in 2022 vs peers at 28%.

- ISBA Has Strong Ratios: At the end of 3Q23, tier 1 capital ratio was 12.75%. Isabella’s non-performing loans to total loans percentage was 0.04%, which has steadily decreased from 0.25% in 3Q21. The Bank currently has $115.9M in cash and equivalents, which is equal to $15.47 cash per share or approximately 75% of the stock value.

- Valuation: We use a comp analysis on P/E and P/BV to frame our valuation of ISBA. Using a forward P/E range of 8.5x to 10.5x with a mid-point of 9.5x on FY24 estimates results in a valuation range of $24.29 to $30.00 with a mid-point of $27.14. Using a P/BV range of 1.0x to 1.2x with a mid-point of 1.1x results in a valuation range of $24.71 to $29.66 with a mid-point of $27.19.