DALLAS, TX -- December 2nd, 2024 -- Incannex Healthcare Inc. (NasdaqGM:IXHL): Stonegate Capital Partners updates their coverage on Incannex Healthcare Inc. (NasdaqGM:IXHL). During 1Q 2025 the Company reported research and development costs of $2.9M, an increase of $0.3M from 1Q24. We expect R&D costs to continue to climb as the Company focuses on getting its drug candidates across the finish line. IXHL recovered 28.0% of these costs with an R&D tax incentive of $0.8M. We expect that this will normalize around 43.5% for the foreseeable future.

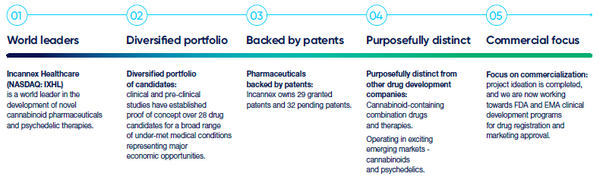

Company Summary:

Leadership Updates: In October of 2024 the Company appointed Lou Barbato, M.D. as Chief Medical Officer. Dr. Barbato has over 25 years of experience in the industry with expertise in psychiatric and neurological disorders. Dr. Barbato’s work spans a variety of drug classes including synthetic cannabinoids, SSRIs, and MAO inhibitors.

Equity Line of Credit: Recently Incannex completed a strategic financing agreement with Arena Investors. This transaction strengthens Incannex's ability to advance their lead programs through key late-stage clinical milestones by providing up to $59M in liquidity to Incannex which is a combination of a $50M equity line of credit and the sale in future closings of convertible debentures with an aggregate principal amount of up to $9M. We view this as further proof that the Company still has access to financing.

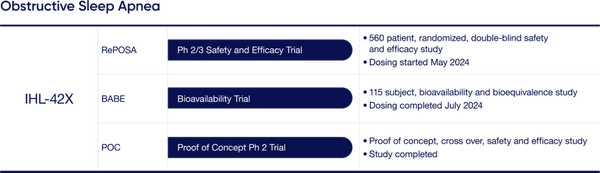

IHL-42X Update: IHL-42X is a novel treatment designed to treat people suffering from Obstructive Sleep Apnea (OSA) which is characterized by interrupted breathing while asleep. Most recently the Company has initiated dosing for the Phase 2/3 FDA trial. This trial will encompass 560 patients in a randomized double-blind safety and efficacy study. Top line results are expected in the first half of calendar 2025. Additionally, the Company is expecting results from its 115 participant TGA bioavailability and bioequivalence clinical trial; data to be available before the end of Calendar 2024.

PSX-001 Update: PSX-001 is Incannex’s psilocybin drug product designed for use with psychological therapy to treat people suffering from Generalized Anxiety Disorder (GAD). Most recently the Company has announced positive top line results from the Phase 2 TGA proof of concept trial. The psilocybin and psychotherapy combination was observed to significantly reduce anxiety scores in patients. Additionally, IXHL has received IND clearance from the FDA and Clinical Trial Authorization form the UK Medicines and Healthcare Products Regulatory Agency, further derisking the asset.

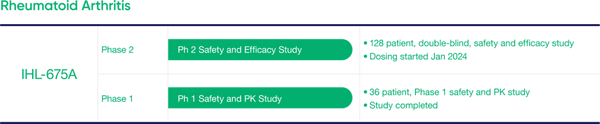

IHL-675A Update: IHL-675A is a novel treatment designed to treat people suffering from inflammation which is a major contributing factor to rheumatoid arthritis. Most recently the Company completed dosing a TGA phase 2 clinical trial. This trial is planned to include approximately 128 subjects, with top line date expected in the second half of 2025.

Valuation: We use a probability-adjusted Discounted Cash Flow Model when valuing IXHL. Our valuation model returns a valuation range of $5.07 to $5.93 with a midpoint of $5.49 based on a discount rate range of 12.25% to 12.75% and a current risk adjustment range of 14% to 16%. Further details on our model can be found on page 5 of this report. We note that this model is highly levered to the out years due to the long term nature of IXHL's industry, leading to the potential for dramatic re-ratings as new information becomes available.

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking services for public and private companies.