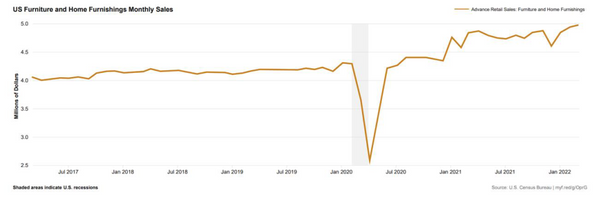

DALLAS, TX -- December 6th, 2024 --Hooker Furniture Corporation (NASDAQ: HOFT): Stonegate Capital Partners updates their coverage on Hooker Furniture Corporation (NASDAQ: HOFT). HOFT reported revenue, operating income, and adj EPS of $104.4M, ($7.3)M, and ($0.39), respectively. This compares to our/consensus estimates of $102.8M/$101.4M, $6.8M/$3.3M, and $0.53/$0.28. It is noted that revenues were slightly above consensus estimates this quarter, despite consolidated revenues decreasing 10.7% from 3Q24. The declines were due to the current headwinds seen in the macro environment leading to decreased volumes along with a bankruptcy filing by a major HMI customer. Despite the headwinds, HOFT reported consolidated GPM of 23.0%, an increase of 100bps q/q. The macroeconomic and furniture retail environment remains challenging, with varying interest rates, maintained housing shortage, and elevated home prices contributing to a prolonged downturn. Despite this, the company is focusing on controllable factors to position itself for future growth. As HOFT looks through the current market turbulence it has retained the goal of reducing fixed costs by 10%, or approximately $10.0M in FY26 and is still on pace to reach this goal. Lastly, the Company announced a global licensing agreement with Margaritaville, which is expected to boost revenues as demand normalizes. This strategic partnership aligns well with HOFT’s growth initiatives.

Company Update:

Capital Allocation: HOFT maintains its commitment to being a consistent dividend payer by distributing $0.23 per share for an annualized rate of $0.92 per share, equivalent to a 5.1% dividend yield. This was flat since the prior quarter and equal to a 4.4% increase from the same quarter last year. To fund capital allocation priorities HOFT ended the quarter with $20.4M in cash. This cash is coupled with $28.3M in revolver availability for total liquidity of $48.7M, a decrease from $70.4M last quarter. This decrease was primarily due to $7.4M paid in dividends, $2.8M for ERP system development, and $2.7M in CapEx. We note that this strategic allocation supports the Company’s growth and operational efficiency initiatives.

Strengthening Liquidity: Despite macro headwinds, the Company has taken impressive steps to normalize its balance sheet and liquidity position over the last year. This is highlighted by the reduction in the Company’s inventory levels over the last 4 quarters. As of 3Q25, HOFT has reduced its inventory by $44.9M since FY23.

Backlog: HOFT reported a backlog of ~$65.7M, a decrease from $69.4M in 3Q24. Despite this sequential decrease in order backlog, year-to-date backlogs are still up 8.4% and remain elevated from pre-pandemic levels. Additionally, we expect orders and backlog to increase further over the next 12 months. HOFT provided further confidence in market demand, as shown by the initial cuttings prior to the High Point Market in October. This increased stock allows HOFT to get ahead of supply chains to increase speed-to-market availability.

Valuation: We use a Dividend Discount Model, DCF Model and EV/EBIT comp analysis to guide our valuation. Our Dividend Discount Model arrives at a valuation range of $19.23 to $24.27 with a mid-point of $21.47. Our DCF analysis produces a valuation range of $19.13 to $22.50 with a mid-point of $20.66. Our EV/EBIT valuation results in a range of $19.82 to $21.88 with a mid-point of $20.85. Lastly, HOFT pays one of the highest dividend yield of the comp set.