DALLAS, TX -- March 25th, 2024 --Hooker Furniture Corporation (NASDAQ: HOFT): Stonegate Capital Partners updates their coverage on Hooker Furniture Corporation (NASDAQ: HOFT)

Company Update

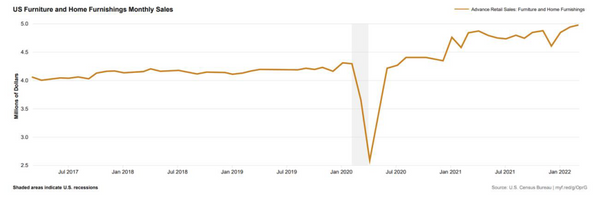

- Market Conditions: Current market challenges give us cause to reassess our short-term outlook on the home furnishings sector. We still believe that HOFT is well positioned due to its diversification and its strengthening liquidity. Changes made to our model primarily reflect the macroeconomic environment and will be reassessed following 4Q24 results.

- Quarterly Results: HOFT reported revenue, operating income, and adj EPS of $116.8M, $8.8M, and $0.66, respectively. This compares to our/consensus estimates of $122.8M/$116.3M, $4.9M/$3.9M, and $0.32/$0.26. It is noted that revenues were in-line with consensus estimates and a decrease of 22.9% year over year. This was primarily due to the Company’s divestiture from less profitable business lines. This divestiture contributed to the strong margin improvement with HOFT reporting consolidated GPM of 28.9%, an increase of ~774bps since this quarter last year. The macro picture remains challenging in the short term, however, moderating raw material costs and freight costs also contributed to the improving margins as the industry continues to normalize. We expect the Company to see gross margins between 20% and 30% going forward. This is expected to translate into mid-single digit net income margins going forward, an increase from the low-single digit margins seen historically.

- Capital Allocation: HOFT maintains its commitment to being a consistent dividend payer by distributing $0.23 per share for an annualized rate of $0.92 per share, equivalent to a 4.1% dividend yield. This was equal to a 4.5% increase from the prior quarter. This is in addition to the $25.0m spent to repurchase 1.4m shares of common stock since 2Q23. To fund capital allocation priorities HOFT ended the quarter with $39.8m in cash, up from $19.0m to end FY23. This is coupled with $27.2m in revolver availability.

- Strengthening Liquidity: The Company remains on track with its plans to improve the balance sheet. This is highlighted by the reduction in both the Company’s warehouse footprint and the Company’s inventory levels. As of 3Q23, HOFT has reduced its inventory by $68.8m y/y. This is in concert with another reduction of 200,000 sq/ft in warehouse footprint with the Company targeting a total 500,000 sq/ft footprint, down from ~1.0m sq/ft. By rightsizing the balance sheet, HOFT is simultaneously improving liquidity, improving gross profit margins, and improving working capital levels. This is expected to allow the Company to acquire market share as the industry improves.

- Backlog: HOFT reported a backlog of $69.4m, a decrease of 21.3% from $88.2m in the last quarter and 49.4% from $137.3m in 3Q23. This was seen as incoming orders increased by 15.7% compared to the prior-year quarter. This is expected to increase further over the next 12-18 months due to the concentrated efforts to increase customer interactions.

- Valuation: We use a Dividend Discount Model, DCF Model and EV/EBIT comp analysis to guide our valuation. Our Dividend Discount Model arrives at a valuation range of $24.38 to $33.73 with a mid-point of $28.39. Our DCF analysis produces a valuation range of $25.47 to $29.97 with a mid-point of $27.50. Our EV/EBIT valuation results in a range of $46.61 to $55.77 with a mid-point of $51.19. Lastly, HOFT pays one of the highest dividend yields of the comp set.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.