DALLAS, TX -- June 7th, 2024 --Hooker Furniture Corporation (NASDAQ: HOFT): Stonegate Capital Partners updates their coverage on Hooker Furniture Corporation (NASDAQ: HOFT)

Company Update

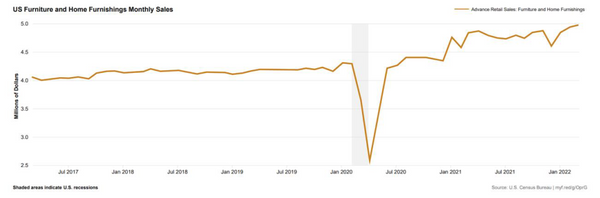

- Quarterly Results: HOFT reported revenue, operating income, and adj EPS of $93.6M, ($5.2)M, and ($0.39), respectively. This compares to our/consensus estimates of $98.4M/$94.9M, ($0.4)M/($0.4)M, and ($0.01)/($0.03). It is noted that revenues were below consensus estimates and a decrease of 23.6% year over year. This was primarily due to the current headwinds seen in the macro environment leading to decreased volumes. Despite these headwinds HOFT reporting consolidated GPM of 20.5%, a decrease of ~237bps since this quarter last year. The macro picture remains challenging in the short term, however, easing inflation, a record stock market, and unemployment remaining under 4% gives us reason to be cautiously optimistic. As HOFT looks through the current market turbulence it has stated the goal to reduce fixed costs by 10%, or approximately $10.0M in FY25. Lastly, we note that the Company has reclassified a portion of its debt as current due to a breach of covenants. We do not believe this is cause for alarm as HOFT has more than enough cash to pay off this debt should it choose, and management was optimistic that a resolution would be reached with debtors. We expect a low impact resolution to be announced shortly.

- Capital Allocation: HOFT maintains its commitment to being a consistent dividend payer by distributing $0.23 per share for an annualized rate of $0.92 per share, equivalent to a 5.4% dividend yield. This was flat since the prior quarter and equal to a 4.5% increase from the same quarter last year. To fund capital allocation priorities HOFT ended the quarter with $40.9M in cash. This cash is coupled with $28.3m in revolver availability for total liquidity of $69.2M, slightly down from $71.5M last quarter.

- Strengthening Liquidity: The Company has taken impressive steps to normalize its balance sheet and liquidity position over the last year. This is highlighted by the reduction in the Company’s inventory levels over the last 5 quarters. As of 1Q25, HOFT has reduced its inventory by $40.0M since FY23. By rightsizing the balance sheet, HOFT is simultaneously improving liquidity, improving gross profit margins, and improving working capital levels. This strong balance sheet position is expected to allow the Company to acquire market share as the industry improves.

- Backlog: HOFT reported a backlog of ~$85.0M, a decrease of ~2.7% from $87.4M in 1Q24 and an increase of ~18.4% from $71.8M in 4Q24. With this being the third quarter in a row of sequential backlog growth, combined with orders growing 11% from 4Q24, we believe this may be the Company showing the beginning of a turnaround, setting HOFT up to take advantage of any cyclical tailwinds that may arise. We expect orders and backlog to increase further over the next 12-18 months due to the concentrated efforts to increase customer interactions.

- Valuation: We use a Dividend Discount Model, DCF Model and EV/EBIT comp analysis to guide our valuation. Our Dividend Discount Model arrives at a valuation range of $21.47 to $27.86 with a mid-point of $24.27. Our DCF analysis produces a valuation range of $18.96 to $22.40 with a mid-point of $20.51. Our EV/EBIT valuation results in a range of $19.59 to $21.87 with a mid-point of $20.73. Lastly, HOFT pays one of the highest dividend yield of the comp set.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.