DALLAS, TX -- November 8th, 2023 -- Gladstone Commercial Corp. (NASDAQGS: GOOD): Stonegate Capital Partners updates their coverage on Gladstone Commercial Corp. (NASDAQGS: GOOD).

Business Overview

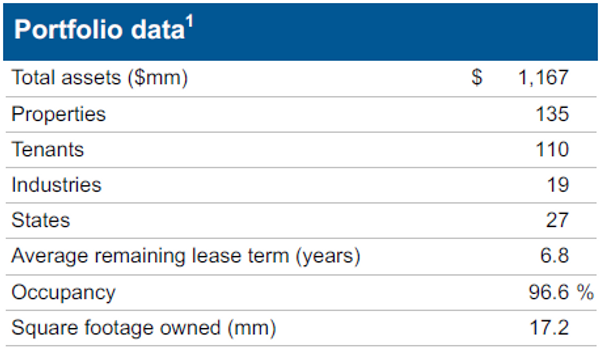

Gladstone Commercial Corp (“Good” or “The Company”) is a real-estate investment trust (REIT) that primarily focuses on acquiring, owning, and managing single tenant and anchored multi-tenant net-leased office and industrial properties. The Company also has the capacity to make long-term industrial and commercial mortgage loans to companies of various industries across the United States. Gladstone’s investment portfolio consists of real-estate properties that are leased to tenants with small- to medium-sized unrated businesses and larger rated businesses, occupied by companies controlled by buyout funds, and are purchased from and leased back to businesses that are seeking to raise capital. As of June 30, 2023, Gladstone owns 136 properties totaling 17.2 million square feet. GOOD IPO’d on the NASDAQ in 2003 under the trading symbol GOOD and is currently headquartered in McLean, Virginia.

Company Updates

- Transactions: GOOD has remained acquisitive, prioritizing mission critical properties in growth markets at attractive cap rates. The Company reduced its property portfolio by one property to 135 with 110 tenants. This is in-line with management’s stated objective to reduce holdings in non-core locations with six exits in the year to date. Most recently, the Company acquired a 67,709 sqft. industrial property located in Indianapolis at a weighted GAAP cap rate of 10.1%.

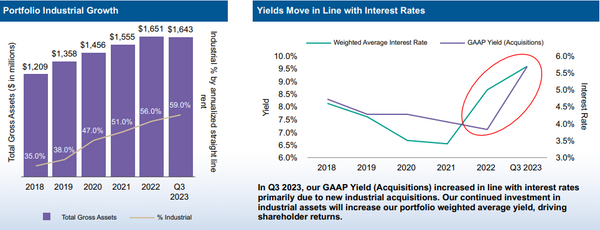

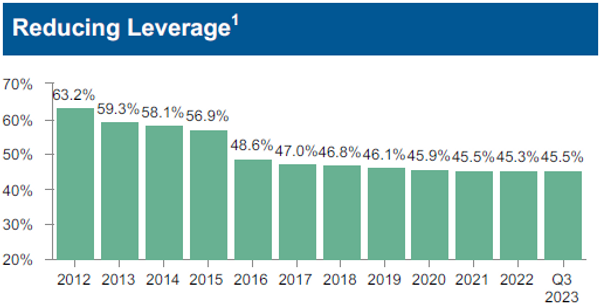

- Decreasing Debt Levels: The Company ended the quarter with a total debt level of $754.3M with an average interest rate of 5.7%. This translates to a Net Debt/Gross Assets percentage of 45.5%. This is in-line with the 2022 ratio of 45.3%. As the Company continues to recycle assets, we expect debt levels to continue to decrease. We note that the Company repaid $43.8M in fixed rate debt during 3Q23. Subsequent to the end of the quarter the Company repaid an additional $9.0M of fixed rate debt.

- Fundamentals Remain Strong: GOOD fundamentals remain very strong. Occupancy at the end of the quarter was 96.6% with 100% rent collection throughout the quarter. Lease terms remain strong at 6.8 years, down from 7.1 years in 3Q22. Subsequent to the end of the quarter GOOD collected 100% of rents in October.

- Quarterly Results: GOOD reported revenue, EPS, and adj FFO per share of $36.5M, ($0.04), and $0.29, respectively. This compares to our/consensus estimates of $40.2M/$38.8M, ($0.00)/$0.00, and $0.42/$0.35.Net Income to common stockholders was a loss of $1.4M, largely due to $6.8M worth of impairment charges in the quarter. Core FFO for the quarter was $0.34 per share, a decrease from $0.41 in the last quarter.

- Improving Diversification: GOOD continues to pivot from office properties into industrial. In 3Q23 the Company’s portfolio consisted of 59% industrial properties and 37% office properties. This was up from 54% industrial and 42% office in 3Q22. This pivot is even more pronounced since 2019 when the Company ended the year with 38% industrial and 57% office.

- Payout Ratios: The Company currently pays a 9.6% dividend yield, paying out an annualized $1.20 per share. This is down from the $1.50 per share paid out in FY22. As is noted in the valuation segment, despite the decreased dividend the company still appears undervalued. Based on a 3Q23 per share values for FFO of $0.33, Core FFO of $0.34, and AFFO of $0.29 GOOD has payout ratios of 91%, 87% and 103% respectively.

- Valuation: We use a combination of comp analysis, Revalued Net Asset Value (reNAV) per share analysis, and a Perpetual Growth Model to frame our valuation of GOOD. When we average these valuation methods it returns a valuation range of $13.44 to $16.49 with a mid-point of $14.93.