DALLAS, TX -- May 8th, 2024 -- Gladstone Commercial Corp. (NASDAQGS: GOOD): Stonegate Capital Partners updates their coverage on Gladstone Commercial Corp. (NASDAQGS: GOOD).

Company Updates

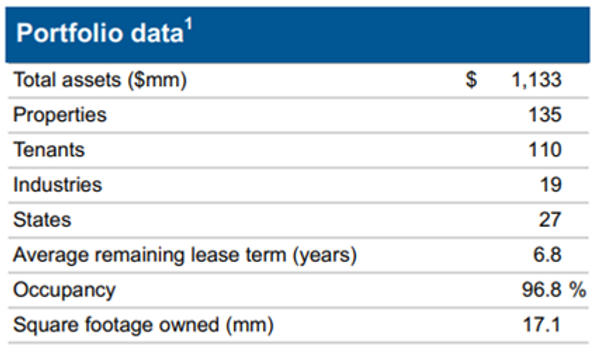

- Transactions: GOOD has remained acquisitive, prioritizing mission critical properties in growth markets at attractive cap rates as well as selling properties as part of its capital recycling program. As of May 06, 2024 the Company owned 131 properties, a decrease from 135 at the end of FY23. This is in-line with management’s stated objective to reduce holdings in non-core office assets.

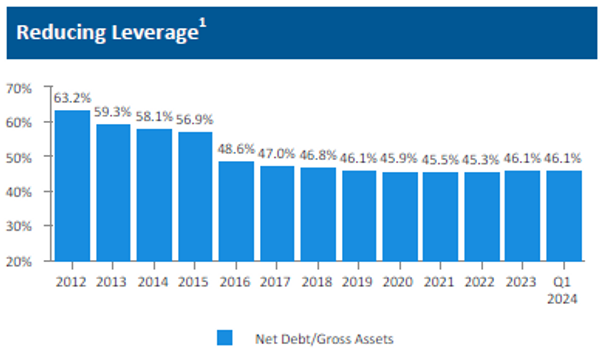

- Decreasing Debt Levels: The Company ended the quarter with a total debt level of $723.9M with an average interest rate of 5.78%. This translates to a Net Debt/Gross Assets percentage of 46.1%. This is in-line with the 2022 ratio of 45.3%. As the Company continues to recycle assets, we expect debt levels to continue to decrease. We note that the Company repaid $17.7M in fixed rate debt during 1Q24.

- Fundamentals Remain Strong: GOOD fundamentals remain very strong. Occupancy at the end of the quarter was 98.9% with 100% rent collection throughout the quarter. The portfolio weighted average lease terms were at 6.7 years, down from 6.9 years in 1Q23. Subsequent to the end of the quarter GOOD occupancy rate was stable at 98.9% over 131 properties as of May 6, 2024.

- Quarterly Results: GOOD reported revenue, EPS, and AFFO per share of $35.7M, $0.01, and $0.28, respectively. This compares to our/consensus estimates of $37.0M/$36.3M, $0.01/$0.00, and $0.29/$0.27. Core FFO for the quarter was $0.34 per share, an increase from $0.36 in the last quarter. The sequential decrease was due to the incentive fee recorded in 1Q24 as well as higher property expenses.

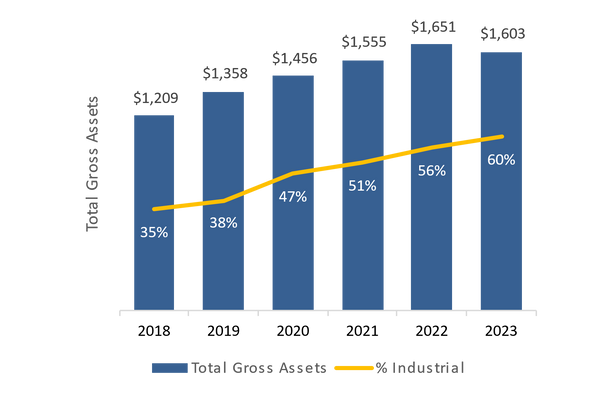

- Improving Diversification: GOOD continues to pivot from office properties into industrial. In 1Q24 the Company’s portfolio consisted of straight-line rent consisted of 60% industrial properties and 36% office properties, respectfully as it relates to straight line rent. This was a change from 59% industrial and 37% office in 1Q24. This pivot is even more pronounced since 2019 when the Company ended the year with 38% industrial and 57% office.

- Payout Ratios: The Company currently pays a 8.8% dividend yield, paying out an annualized $1.20 per share. This is down from the $1.50 per share paid out in FY22. As is noted in the valuation segment, despite the decreased dividend the company still appears undervalued. Based on a 1Q24 per share values for FFO of $0.34, Core FFO of $0.34, and AFFO of $0.28 GOOD has payout ratios of 89%, 87%, and 107% respectively.

- Valuation: We use a combination of comp analysis, reNAV per share analysis, and a Perpetual Growth Model based on the most recent FFO Payout Ratio to frame our valuation of GOOD. When we average these valuation methods it returns a valuation range of $14.01 to $17.71 with a mid-point of $15.82.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.