DALLAS, TX -- August 15th, 2024 --Burcon Nutrascience Corporation (TSX: BU): Stonegate Capital Partners updates their coverage on Burcon Nutrascience Corporation (TSX: BU).

Company Updates

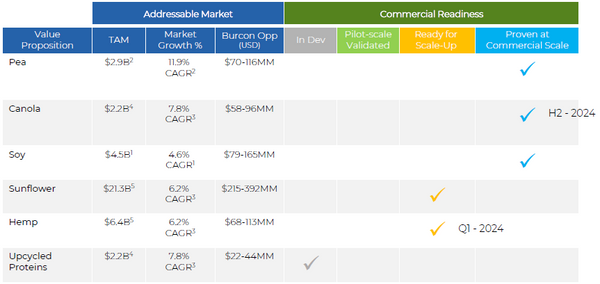

Large Addressable TAM: Plant based proteins remain in the early innings of adoption with Markets and Markets estimating the plant-based protein market accounted for a value of $18.5B in 2019 and will grow at a 14.0% CAGR until 2025 to reach $40.6B. We expect the Company to continue to capture market share as products like hempseed, sunflower, and canola[1]based proteins go to market. We saw Burcon take another step towards serving these plant-based end markets in July of 2024 when BU completed the first commercial run of its canola protein isolate.

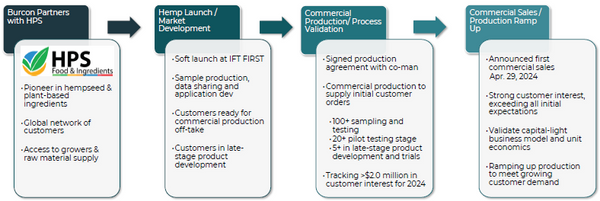

- Growth from Hempseed: We expect the near-term growth of BU to be ledprimarily by its hempseed proteins isolate going to market. During FY24, Burcon received funding approval from Protein Industries Canada (“PIC”) for the scale-up and commercialization of hempseed and sunflower seed proteins. The $6.9M project led by Burcon includes funding of $3M from PIC.As BU entered into production agreements with its partner manufacturers, it was able to achieve the world’s first 95% hempseed protein isolate. In 1Q25 Burcon posted its first commercial sale from hempseed protein isolate.

- Canola Brings Optionality: In July 2024 the Company announced that it had completed the first commercial run of its canola protein isolate. This launch was 6 months ahead of schedule, driven by strong market demand. We are very encouraged by this development as it shows Burcon’s ability to adapt as market conditions evolve. We also note that this additional product line provides BU with additional optionality when meeting customer needs.

- Cash Flows Turning Positive: Given the exceptional demand built for the Company’s hempseed protein isolate as well as its canola protein, we expect that Burcon will turn cash flow positive in FY26. The potential extent of cash flow positive results is illustrated further in our DCF model. We note that the inherent scalability in Burcon’s model and operations along with the capital[1]light focus allows for rapid growth in margins.

- Strong Balance Sheet: The Company has a strong balance sheet with an estimated $2.2M in cash. The current liquidity position allows for the Company to maintain operations until BU turns cash flow positive, which is projected for early FY26. Through a combination of equity financing, non[1]dilutive debt, government assistance, and recurring sales, we believe Burcon has a fully funded business plan to achieve positive cash flow.

- New Management Brings New Focus: On July 1st, 2024, Burcon appointedMr. Robert Peets to the executive team as their new CFO, succeeding Mrs. Jade Cheng. Mr. Peets brings a wealth of experience with a distinguished career spanning over 30 years in financial management, strategic planning, and capital markets. Mr. Peets currently holds the role of fractional CFO for multiple technology companies, leading their development in corporate and financial strategies.

- Valuation: We use a DCF Model to frame our valuation of BU. Our DCF analysis relies on a range of discount rates between 10.75% and 11.25% with a midpoint of 11.00%, which we believe accurately accounts for the size and relative illiquidity of BU. This arrives at a valuation range of $1.96 to $2.43 with a mid-point of $2.16.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking services for public and private companies.