DALLAS, TX -- July 2nd, 2024 --Burcon Nutrascience Corporation (TSX: BU): Stonegate Capital Partners updates their coverage on Burcon Nutrascience Corporation (TSX: BU).

Company Updates

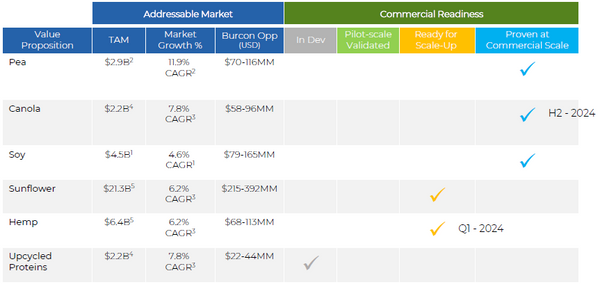

- Large Addressable TAM: Plant based proteins remain in the early innings of adoption with Markets and Markets estimating the plant-based protein market accounted for a value of $18.5B in 2019 and will grow at a 14.0% CAGR until 2025 to reach $40.6B. We expect the Company to continue to capture market share as products like hempseed, sunflower, and canola-based proteins go to market. We saw Burcon take another step towards serving these plant-based end markets in 4Q24 as it tapped into a new revenue stream via contract revenue services.

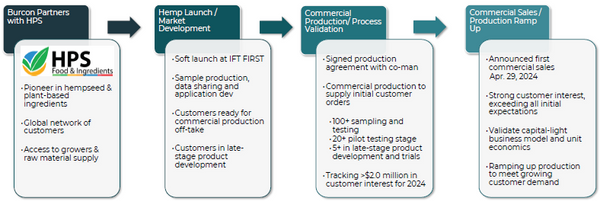

- Growth from Hempseed: We expect the near-term growth of BU to be driven primarily by its hempseed proteins isolate going to market. During FY24, Burcon received funding approval from Protein Industries Canada (“PIC”) for the scale-up and commercialization of hempseed and sunflower seed proteins. The $6.9M project led by Burcon includes funding of $3M from PIC. As BU entered into production agreements with its partner manufacturers, it was able to achieve the world’s first 95% hempseed protein isolate. After this commercial release, Burcon received remarkable validation from customer demand indexes for all protein products, which exceeded all initial expectations. Overall, we are encouraged by the high protein content, large TAM, and beneficial partnership model that the company is using to bring this product to market. We expect the Company to apply a similar model to its canola protein product.

- Cash Flows Turning Positive: Given the exceptional demand built for the Company’s hempseed protein isolate as well as their Canola Protein, we expect that Burcon will turn cash flow positive in FY26. The extent of cash flow positive results is illustrated further in our DCF model. We note that the inherent scalability in Burcon’s model and operations along with the capital-light focus allows for rapid growth in margins.

- Strong Balance Sheet: The Company has a strong balance sheet with an estimated $4.2M in cash. Current loan draws allow for operations through April of 2024, with enough liquidity to maintain operations until the Company turns cash flow positive in 2026, further bolstering the Company’s balance sheet and liquidity position. Through a combination of equity financing, non-dilutive debt, government assistance, and recurring sales, we believe Burcon has a fully funded business plan to achieve positive cash flow.

- New Management Brings New Focus: Starting July 1st, 2024, Burcon will appoint Mr. Robert Peets to the executive team as their new CFO, succeeding Mrs. Jade Cheng. Mr. Peets brings a wealth of experience with a distinguished career spanning over 30 years in financial management, strategic planning, and capital markets. Mr. Peets currently holds the role of fractional CFO for multiple technology companies, leading their development in corporate and financial strategies. He was formerly a Partner in Venture Investments at TELUS Ventures, where he was part of the team which managed a $400 million investment portfolio.

- Valuation: We use a DCF Model to frame our valuation of BU. Our DCF analysis relies on a range of discount rates between 10.75% and 11.25% with a midpoint of 11.00%, which we believe accurately accounts for the size and relative illiquidity of BU. This arrives at a valuation range of $1.96 to $2.45 with a mid-point of $2.17.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.