DALLAS, TX -- November 8th, 2024 -- BlackSky Technology, Inc. (NYSE: BKSY): Stonegate Capital Partners updates their coverage on BlackSky Technology, Inc. (NYSE: BKSY). BlackSky reported revenue, adj EBITDA, and EPS of $22.5M, $0.7M, and ($0.66), respectively. This compares to our/consensus estimates of $29.2M/$27.5M, $3.7M/$3.1M, and ($0.08)/($0.49). This marks the fourth quarter in a row of positive adjusted EBITDA, driven by revenue growth and strong operating leverage. The revenue growth was headlined by 13.2% y/y growth in the Imagery and Software Analytics segment which was $17.3M, up from $15.3M in the prior year. Consolidated gross margins grew to 70.5%, an increase from 68.2% in 3Q23. Adj. EBITDA grew $1.2M from the $(0.4)M posted last year.

Company Updates:

Contracts: The Company remains on strong footing with ~60% of revenues derived from the U.S. market and ~40% derived from international markets. In the quarter BKSY was awarded a $290.0M contract with NGA for the Luno A program. Along with this single large contract award, BKSY also secured a $476.0M contract with NASA to support the agency’s Commercial Smallsat Data Acquisition Program. Additionally, the Company continued to win and expand other large contracts with new and existing clients. We note that BKSY has added non-Earth imaging services to its offerings this quarter further expanding the utilization and revenue capacity of its constellation.

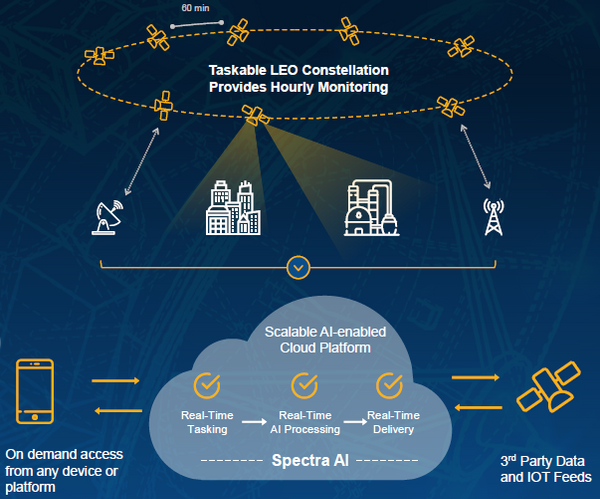

Technological Advances: The Company continues to make significant progress on the completion of its Gen 3 satellites. The current plan is for the first launches to begin in 1Q25. Assembly and integration of the next Gen 3 satellites are underway, optimizing the supply chain and planning for a regular cadence of launches. These Gen 3 satellites will combine high-frequency monitoring with 35cm very high-resolution imaging giving BKSY significant potential to expand revenues and margins. Additionally, the Company continues to win task orders under the multi-year contract with the U.S. Air Force Research Laboratory which is developing and demonstrating an AI-enabled moving target detection, tracking, and identification service.

Balance Sheet and Liquidity: BKSY ended 3Q24 with a strong balance sheet. Cash and restricted cash at the end of the quarter were $56.2M following the successful $45.0M capital raise, completed in 3Q24. When combined with $7.1M in Short Term Investments, the Company ended the quarter with $64.6M in liquidity. BKSY is expecting an additional ~$26.7M in liquidity over the next 12 months as cash that will be collected now that BKSY has reached certain milestones with certain customers.

Guidance: BKSY maintained its FY24 revenue guidance in a range of $102.0M to $118.0M, driven by sizeable multi-year sales opportunities. The Company guides to an adj. EBITDA range of $8.0M to $16.0M. This guidance implies a year-over-year revenue growth of 16.4% at the midpoint and an adj. EBITDA margin of 10.9% at the midpoint. Due to the Company’s strong backlog and strong potential for step-ups in contracts we view this guidance as reasonable and have adjusted our model accordingly.

Valuation: We use a DCF Model and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $10.42 to $12.62 with a mid-point of $11.42. Our EV/EBITDA valuation results in a range of $9.35 to $12.28 with a mid-point of $10.81.