DALLAS, TX -- June 13th, 2024 -- Third Coast Bancshares, Inc. (NasdaqGS:TCBX): Stonegate Capital Partners initiates their coverage on Third Coast Bancshares, Inc. (NasdaqGS:TCBX).

Company Summary

- Financial Results: For 1Q24 Third Coast reported net income of $10.4M, up from $9.7M in 4Q23. This was equal to a basic and diluted EPS of $0.68 and $0.61, respectively. This sequential increase was due to a decrease in non-interest expenses and increase in non-interest income as net interest income remained largely unchanged. We expect the Company to keep operational efficiency a focus for the foreseeable future to help navigate the current macro environment.

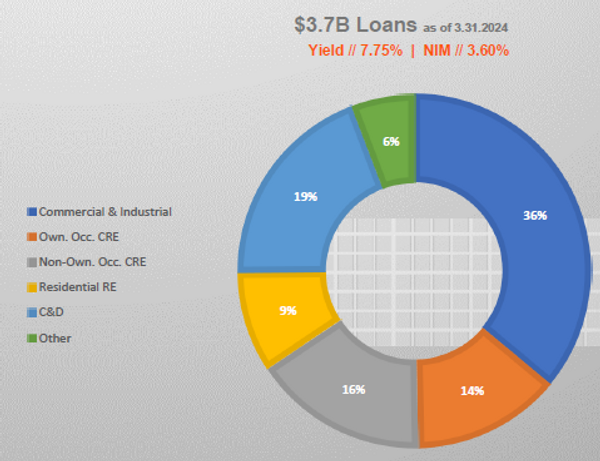

- Interest Income and Expenses: TCBX reported a net interest margin of 3.60% for the quarter, which is down from 3.79% in 1Q23. We note that this remains elevated compared to average comps NIM of 3.11%. The year over year decrease in NIM is primarily due to a 66.2% increase in interest expenses that outweighed the 37.5% year over year increase in interest income.

- Deposits and Loans: The Company’s loan portfolio remains on strong footing with mix well balanced and growth of $530.6M year over year. Over that same time frame net deposits increased by $728.1M. The Company did see an increase in non-performing assets of $4.4M, split between $1.5M of non-accruals and $2.9M of loans over 90 days past due. The increase in non-accruals is related to 4 relationships placed on non-accrual, 2 of which had 75% SBA guarantees. Net charge-offs for the quarter were $742,000. Lastly, we note that the quarter end book value and tangible book value were $26.18 and $24.79, respectively. This was up from 4Q23 values of $25.41 and $24.02.

- Financial Ratios: At the end of 1Q24, tier 1 capital ratio was 9.54%, down slightly from 9.70% in 4Q23. Third Coast’s non-performing loans to total loans percentage was 0.58%, a slight increase from 0.48% in 4Q23 due to the factors discussed above. Additionally, TCBX had a ROAA and ROAE of 0.95% and 10.44%, respectively. The efficiency ratio for the quarter was 64.11%, down from 66.89% last quarter. The Bank currently has $498.3M in cash and equivalents, which is equal to $36.49 per share or approximately 183% of the stock value.

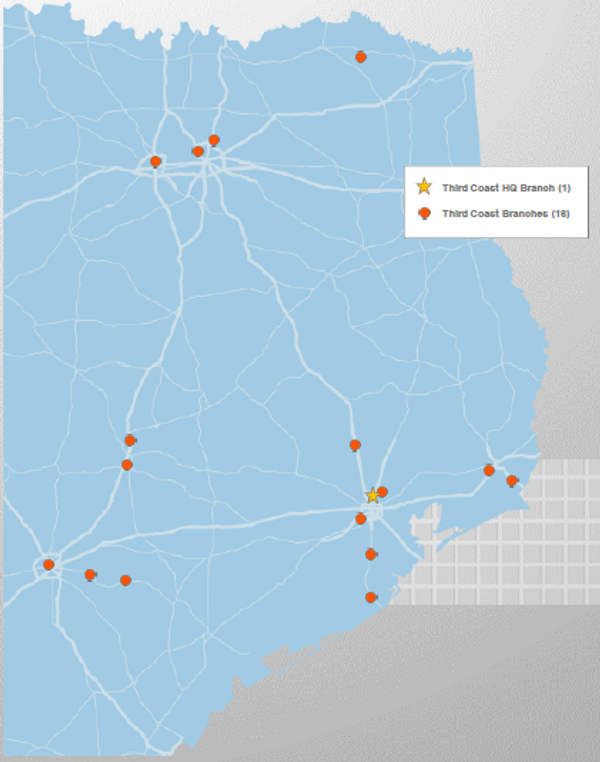

- Growth Initiatives: Growth was seen following the end of the first quarter when the Company opened its 17th location in April of 2024. Management also noted that the Company continues to execute strategic objectives, as was mentioned earlier with regards to operational efficiency. Additional priorities include diversifying the deposit portfolio, reducing the cost of funds, and managing expenses. It is expected that this, combined with a strong loan pipeline, will lead to continued growth.

- Valuation: We use a comp analysis on P/E and P/BV to frame our valuation of TCBX. Using a forward P/E range of 9.0x to 11.0x with a mid-point of 10.0x on FY25 estimates results in a valuation range of $21.84 to $26.69 with a mid-point of $24.26. Using a P/BV range of 1.0x to 1.1x with a mid-point of 1.1x results in a valuation range of $26.18 to $28.80 with a mid-point of $27.49.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.