DALLAS, TX -- August 1st, 2023 -- NCS Multistage Holdings, Inc. (NASDAQ: NCSM): Stonegate Capital Partners initiates their coverage on NCS Multistage Holdings, Inc. (NASDAQ: NCSM). The full report can be accessed by clicking on the following link: NCSM Initiation Report

COMPANY UPDATES

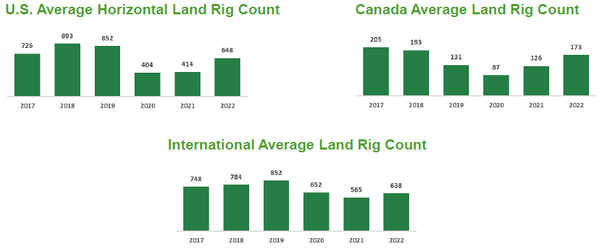

- Strong Market Share: NCSM is involved with approximately 30% of Canadian well completions. As the Canadian market continues to rebound faster than the United States market post-Covid, we view this as a strong positive for NCSM going forward. While there is less market share to capture in the US due to the majority of completions using traditional methods, we believe the Company’s investment in Repeat Precision gives NCSM diversification among completion methods. This was seen in 2Q23 when repeat precision grew revenues 13% sequentially as compared to the rest of the US market that declined 17% sequentially.

- 2Q23 Results: NCSM reported revenue, adj EBITDA, and EPS of $25.4M, $(2.2)M, and $(13.02), respectively. This compares to our estimates of $32.0M, $(1.3)M, and $(1.71), respectively. Negative EPS results were largely due to the litigation update mentioned below. NCSM reported an adjusted EPS of $(2.50), which is more in-line with our estimate of $(1.71). The softness was largely due to the expected seasonal factors in Canada and the lower commodity prices in the United States delaying operations.

- Robust Balance Sheet and Liquidity Position: NCMS ended 2Q23 with a net working capital of $55.7M, which is an increase from $55.2M in 4Q22. The Company also closed the quarter with $13.7M in cash and $12.6M of undrawn revolver for liquidity position of $26.3M. This compares favorably to only $8.8M in debt and YTD capex of $1.0M

- Litigation Updates: Recently the Company received a judgement against NCSM that awarded the plaintiff $42.5M. This is increased from the $17.5M that was assessed last quarter as a litigation provision. The Company believes it has standing to appeal the judgement and could reduce the awarded amount should the appeals be granted. Lastly, NCSM believes that a large portion, potentially all of the damages, will be covered by insurance.

- Cash Flows: After posting a negative FCF in 1Q23 the company posted positive cash flows in 2Q23. For the first half of the year, NCSM has a negative FCF balance of $2.0M. This is compared to a negative FCF balance of $5.5M in 1H22. The current negative balance is due to seasonality, and management is optimistic that FCF will be positive for the year.

- Reiterated Guidance: Due to the macro backdrop NCSM has updated their guidance. Currently, the Canadian market is expected to grow 5% y/y and the United Stats market is expected to decline 5% to 10% y/y. The Company believes it will outpace this growth and is guiding to a revenue range of $160.0M to $175.0M which is equal to y/y growth of 7.6% at the midpoint. This is coupled with a $18.0M to $22.0M adjusted EBITDA guidance. We have made modest adjustments to our model.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $26.80 to $33.07 with a mid-point of $29.53. Our EV/EBITDA valuation results in a range of $22.25 to $36.11 with a mid-point of $29.18.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.