DALLAS, TX -- November 16th, 2023 -- Cassiar Gold Corp. (TSXV: GLDC): Stonegate Capital Partners initiates their coverage on Cassiar Gold Corp. (TSXV: GLDC).

Business Overview

Cassiar Gold Corp. (“Cassiar: or “the Company”), formerly known as Margaux Resources Ltd., is a gold mine exploration and development company based out of Calgary, Canada that is focused on developing its existing assets in British Columbia, Canada. The Company owns 100% of the Cassiar Gold Project consisting of 59,000 hectares containing orogenic gold. The Company also owns 100% of the Bayonne and Sheep Creek properties collectively known as the Sheep Creek Camp.

The Company was originally known as Margaux Resources Ltd. and traded on the TSX.V with the symbol MRL. In September 2023, Margaux Resources acquired Cassiar Gold Corp, known as “Old Cassiar”, from Wildsky Resources Inc. in an option agreement, issuing 4,656,000 post-consolidation Common Shares to Wildsky. The Company then changed its name to Cassiar Gold Corp. and began trading under the new symbol GLDC.

COMPANY UPDATES

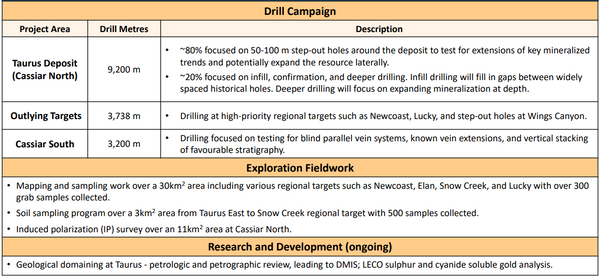

- Technical Report Released: In May 2022, the Company released its technical report (NI 43-101) which summarized the available technical information for the Cassiar North and South projects. The report is based off historical drilling from prior owners as well as more recent sample drilling done by Cassiar. The report concludes that there are high grade corridors of mineralization present. Based on the technical report, Cassiar North’s Taurus deposit is estimated to have 1.4 million oz of orogenic gold. This is a significant outcome that will encourage management to proceed with continued resource expansion and eventually reserve estimation as well as a pre-feasibility study at the Taurus Mine permit area. The Company also has a significantly high grade (10-20 g/T) unmined mineralization at the Table Mountain Mine Permit area at Cassiar South. This area is wide open for further expansion with significant potential for new blind and parallel and stacked veins systems. The company also has significant regional targets in areas that could potentially host multiple deposits similar to Taurus, as well as high grade veins similar to the past producing veins at Table Mountain.

- Historic Gold Districts: The area of British Columbia that Cassiar is operating in has a strong history of gold production. The Cassiar Property was the site of the Cassiar Gold Rush that had a total historic gold production of 425,000oz. The Sheep Creek Property is one of the largest past-producing gold districts in British Columbia with historic production of 742,000oz. The historically productive region, along with Canada being an accommodative jurisdiction, leads to Cassiar being well positioned to either continue to expand and advance their current deposits or sell to a strategic buyer.

- Significant Infrastructure and Access: Due to a long mining history, the Cassiar Property is well situated with pre-existing infrastructure and access. The property has 160km of access roads, is bisected by Highway 37, and can utilize the nearby Cassiar airstrip. Additionally, there is a permanent camp with access to the power grid and water. Most of the infrastructure and access is in good condition, which will help the Company keep CapEx low.

- Experienced Management with Vested Interest: Cassiar has an accomplished management team consisting of geologists, engineers, operators, marketing, and capital markets professionals. Management, along with its board and advisors, have a collective 238 years of managerial and technical experience. Insiders currently hold 11% of shares outstanding, displaying that they have confidence in their ability to develop Cassiar’s projects or market them to strategic buyers.

- Sustainability Focus: Management has been clear in its commitment to high ESG standards. The Company adapted its water and natural resource management to mitigate negative impacts on the environment. Cassiar also samples water quality to ensure that local wildlife is not negatively impacted.

- Valuation: We are using a comparative analysis and a sensitivity analysis to help frame our valuation of Cassiar. We adjust an estimated NPV value to account for Cassiar’s infrastructure advantage, and then apply an EV/NPV multiple range of 0.08x-0.12x to arrive at an initial valuation range. When we apply these variables to our sensitivity analysis, adjusting for potential increases in resources, we arrive at a valuation range of $0.91 to $1.53 with a midpoint of $1.20.