DALLAS, TX -- April 30th, 2024 --Burcon Nutrascience Corporation (TSX: BU): Stonegate Capital Partners initiates their coverage on Burcon Nutrascience Corporation (TSX: BU).

Business Overview

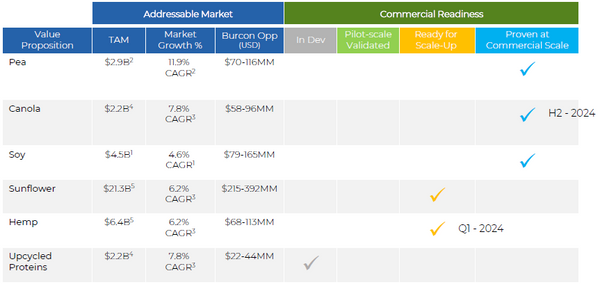

Burcon NutraScience Corporation (“BU”, “Burcon”, or “the Company”) is a global leader in innovative technologies for the large-scale production of high-quality, cost-effective plant-based proteins and ingredients for use in the global food and beverage industries. Burcon is a leader in the development of plant-based proteins amassing over 100 issued patents and over 80 additional patent applications. Burcon’s portfolio includes pea, canola, soy, sunflower, hemp, and upcycled based proteins, for a combined TAM of ~$40.0B. Each of these proteins have unique nutritional and functional value that can be used in a variety of consumable products including dairy foods, coffee creamers/whiteners, protein bars, vegetarian and vegan foods, ready-to-drink beverages, baked goods, and meat substitutes to name a few. Burcon is headquartered in Vancouver, BC and began trading on the Toronto Stock Exchange in 1999 under the ticker symbol “BU”.

Company Updates

- Large Addressable TAM: Plant based proteins are in the early innings of adoption with Markets and Markets estimating the plant-based protein market accounted for a value of $18.5B in 2019 and will grow at a 14.0% CAGR until 2025 to reach $40.6B. We expect the Company to continue to capture market share as products like hempseed, sunflower, and canola based proteins go to market.

- Growth from Hempseed: We expect the near-term growth of BU to be driven primarily by its hempseed proteins isolate going to market. With the launch of hempseed expected to begin in 1H24 we believe the company will be able to use the ~$2.0M worth of initial market interest as a springboard for future growth. We are encouraged by the high protein content, large TAM, and beneficial partnership model that the company is using to bring this product to market. We expect the Company to apply a similar model to its canola protein product.

- Cash Flows Turning Positive: Given the exceptional demand built for the Company’s hempseed protein isolate, we expect that Burcon will turn cash flow positive in FY26. The extent of cash flow positive results is illustrated further in our DCF model. We note that the inherent scalability in Burcon’s model and operations along with the capital-light focus allows for rapid growth in margins.

- Strong Balance Sheet: The Company has a strong balance sheet with an estimated $4.0M in cash. Current loan draws allow for operations through April of 2025, with enough liquidity to maintain operations until the Company turns cash flow positive in 2026, further bolstering the Company’s balance sheet and liquidity position. Lastly, the Company has access to non-dilutive government funding as well as non-brokered private placements, the most recent of which was closed in March of 2024. We view this as a strong indication that the Company has substantial access to capital if needed.

- New Management Brings New Focus: In 2H22 the Company appointed Kip Underwood as CEO. Mr. Underwood is a seasoned veteran executive with over 25 years of experience in the food and specialty protein industry. Since then, Burcon has refocused its direction with Burcon 2.0. Mr. Underwood has thus far shown an ability to bring new product lines to market with the launch of hempseed in 2024, opening new lines of revenues for Burcon and giving us the confidence that BU will turn cash flow positive in the short term.

- Valuation: We use a DCF Model to frame our valuation of BU. Our DCF analysis relies on a range of discount rates between 10.75% and 11.25% with a midpoint of 11.00%, which we believe accurately accounts for the size and relative illiquidity of BU. This arrives at a valuation range of $1.82 to $2.30 with a mid-point of $2.02.