DALLAS, TX -- October 23rd, 2023 -- BluGlass Limited (ASX:BLG): Stonegate Capital Partners initiates their coverage on BluGlass Limited (ASX:BLG).

Business Overview

BluGlass Limited (“BLG” or “the Company”) is an Australian and US based laser diode manufacturer that specializes in visible light Gallium Nitride (GaN) lasers. BluGlass offers a full suite of end-to-end laser diode services that includes design, fabrication, and packaging capabilities that can range from off-the-shelf products to unique customized products. The Company supports this with vertically integrated manufacturing capabilities at its fabrication centers located in Fremont, California, Nashua, New Hampshire, and Sydney, New South Wales.

BluGlass Limited was originally established in 2006 after spinning out from Macquarie University. In the same year, the company was listed on the Australian Stock Exchange under the ticker symbol “BLG”. In 2012, the Company completed its proof-of-concept for the delivery of semiconductor materials grown using its proprietary remote plasma chemical vapor depositions (RPCVD) manufacturing technology. This method is more efficient than the legacy methods of manufacturing, while retaining the scalability of MOCVD. In 2019 the Company launched its direct-to-market GaN laser diode business unit. In 2023 the Company began commercial production of its products and won membership into the Commercial Leap Ahead for Wide-bandgap Semiconductors (CLAWS) Hub, discussed in more detail below. As of 2Q23 BLG holds 53 international patents.

COMPANY UPDATES

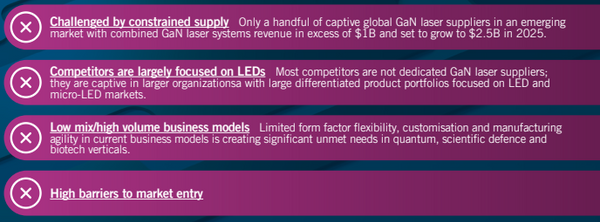

- 2H23 Results: BluGlass ended FY23 with revenues of A$9.5M, an increase of 123% year over year. This was primarily revenue from R&D grants of A$8.3M, up 148% from the prior year. Most notable was the addition of revenue from laser diode sales, which the Company did not have in FY22. We expect that BLG will see a significant increase in laser diode revenues over the coming quarters as it increases manufacturing capabilities. We believe that BLG is well positioned as a pure play GaN laser provider to grow its portfolio and capitalize on the GaN laser systems market that is expected to reach $2.5B by 2025.

- Strong Partnerships: BLG has strong partnerships across a number of different institutions, both public and private. On the public side BLG is partnering with Ganvix to develop Vertical Cavity Surface Emitting Lasers (VCSELs) with the goal of bringing commercial viability to green wavelength lasers. The Company is also in partnerships with both the University of Santa Barbara California (USBC) and North Carolina State University (NCSU). The partnership with USBC is to bring visible Distributed Feedback (DFB) Lasers to commercial viability, which are lasers that are very narrow in width and high in purity, leading to uses in highly technical applications. The partnership with NCSU is BLG’s most recent partnership and is funded by CHIPS Act spending. It is anticipated that these partnerships will help the Company further develop its portfolio.

- Vertical Integration: In 2022 BLG acquired a purpose-built laser diode fabrication facility located in Silicone Valley. This acquisition quadrupled the wafer capacity and development turns to help meet customer demand. The Silicone Valley facility makes BLG a vertically integrated operation that can be with the customer from design to packaging and testing. By becoming vertically integrated the Company is able to add functionality and increase ASP, while expanding interest among several verticals.

- Current Portfolio: BLG offers a portfolio of lasers spanning several wavelengths, launched in 2023. This initial cohort of wavelengths included violet at 405nm and 420nm as well as blue at 450nm. BLG shows a rapidly progressing improvement curve with devices already rivaling comparable companies’ performance. As the Company continues to innovate, we expect the portfolio to grow and take advantage of the above-mentioned manufacturing capabilities to serve an often-ignored portion of the laser diode market.

- Valuation: We use a combination of comparative analysis and DCF analysis frame our valuation for BLG. Given the lack of public comparable companies we apply a 60% weighting to our DCF analysis and a 20% weighting to our EV/EBITDA and EV/Revenue ranges. This arrives at a valuation range of A$0.15 to A$0.19 with a mid-point of A$0.17. At an exchange rate of A$1.58AUD/USD, this is equal to a range of $0.09 to $0.12 with a mid-point of $0.10.

-