DALLAS, TX -- May 23rd, 2024 -- BlackSky Technology, Inc. (NYSE: BKSY): Stonegate Capital Partners initiates their coverage on BlackSky Technology, Inc. (NYSE: BKSY).

Business Overview

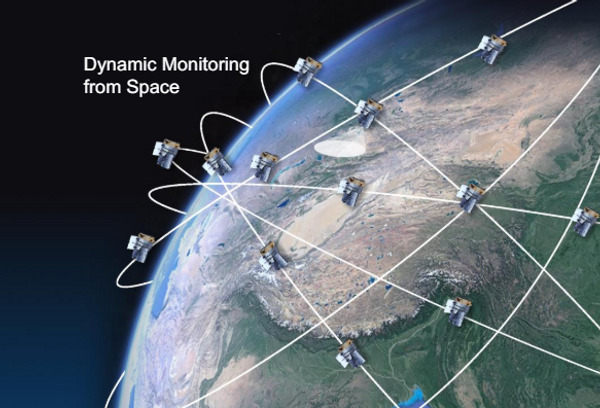

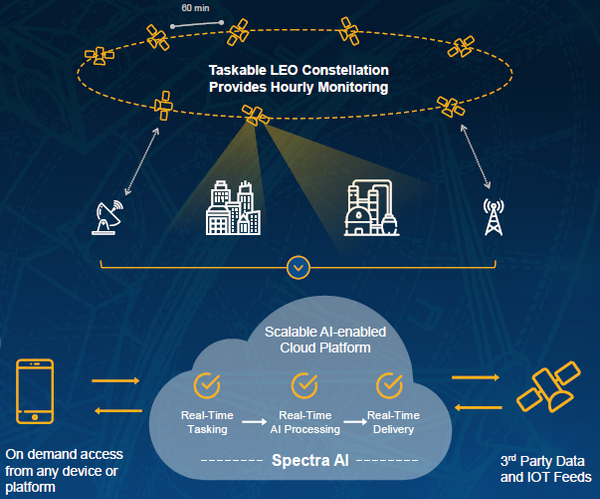

BlackSky Technology, Inc. (“BlackSky”, “BKSY”, or “the Company”) is a space-based intelligence company that delivers real-time imagery, analytics, and high-frequency monitoring of the world’s most critical and strategic locations, economic assets, and events. BlackSky designs, owns, and operates an industry leading low earth orbit small satellite constellation. This constellation relays space-based data to BlackSky Spectra, the Company’s tasking and analytics software platform. BlackSky was established in 2014 and is headquartered in Herndon, VA. BlackSky is listed on the New York Stock Exchange under the ticker symbol “BKSY”.

- Financial Results: BKSY reported revenue, adj EBITDA, and EPS of $24.2M, $1.4M, and ($0.11), respectively. This compares to our/consensus estimates of $25.7M/$25.1M, $1.0M/$1.5M, and ($0.10)/($0.08). This marks the second quarter in a row of positive adjusted EBITDA, driven by revenue growth and strong operating leverage. The revenue growth was headlined by 23% y/y growth in the Imagery segment and Professional Services revenue of $4.1M, up from $0.01M in the prior year. Gross margins for Imagery and Software grew to 80.7% and Professional and Engineering Services gross margins grew to 44%. Adj. EBITDA margin was 5.7% in the quarter, up from (22.4)% in 1Q23.

- Contracts: The Company remains on strong footing with 60.9% of revenues derived from the U.S. Federal Government and 37.2% derived from International Government. We believe that these are stable contracts of long duration, most of which contain significant potential for expansion. This potential for expansion is driven by BKSY being a trusted mission partner to entities and organizations that require the highest level of intelligence and insight. This is exemplified by BKSY being awarded $30.0M worth of new contract and renewal agreements in 1Q24.

- Technological Advances: The Company continues to make significant progress on the completion of its Gen 3 satellites. The current plan is for the first launches to begin in FY24. These Gen 3 satellites will combine high-frequency monitoring with 35cm very high-resolution imaging giving BKSY significant potential to expand revenues and margins. Additionally, the Company continues to invest in advanced AI technologies with a $24.0M contract win to provide advanced AI technology to the Air Force Research Laboratory.

- Balance Sheet and Liquidity: BKSY ended 1Q24 with a strong balance sheet. Cash and restricted cash at the end of the quarter was $15.4M. When combined with $20.4M in Stort Term Investments and a new commercial bank line worth $20.0M, the Company ended the quarter with $55.8M in liquidity. BKSY is expecting an additional ~$24.0M in liquidity over the coming 12 months as cash is collected from customers now that BKSY has reached certain milestones in these contracts.

- Guidance: BKSY maintained its FY24 revenue guidance in a range of $102.0M to $118.0M, driven by sizeable multi-year sales opportunities. The Company guides to an adj. EBITDA range of $8.0M to $16.0M. This guidance implies a year-over-year revenue growth of 16.4% at the midpoint and an adj. EBITDA margin of 10.9% at the midpoint, up from (1.1)% in FY23. Due to the Company’s strong backlog and strong potential for step-ups in contracts we view this guidance as reasonable and have adjusted our model accordingly.

- Valuation: We use a DCF Model and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $2.41 to $2.90 with a mid-point of $2.63. Our EV/EBITDA valuation results in a range of $2.28 to $2.66 with a mid-point of $2.47.