DALLAS, TX -- April 16th, 2024 -- BFF Bank S.P.A (BIT: BFF): Stonegate Capital Partners initiates their coverage on BFF Bank S.P.A (BIT: BFF).

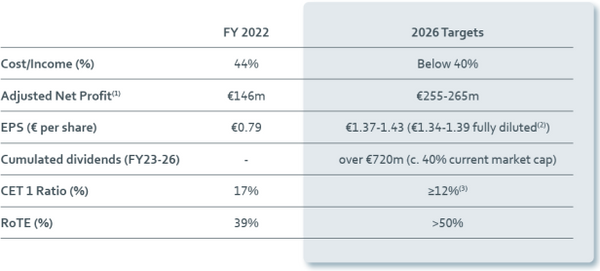

- Company Summary Financial Results: BFF reported Net Banking Profit, EBT, and Net Income of €119.7M, €83.9M, and €60.7M, respectively. This compares to consensus estimates of €135.5M, €87.5M, and €60.9M. For FY23 BFF reported Net Banking Profit, EBT, and Net Income of €387.3M, €249.8M, and €183.2M, respectively. Net income for the year was at a record high and grew 25% over FY22. These strong results drove FY23 dividends to €183.2M, of which €81.9M was paid as an interim dividend in September of 2023.

- Strong Balance Sheet: BFF ended the quarter with a solid balance sheet that includes a cash balance of €257.2M, or €1.37 per share. On its own, this accounts for 11.3% of BFF’s current stock value. The loan book was €5,617.0M at year end, an increase of €175.0M from year end 2022. This was impacted by liquidity injections from the Spanish and Portuguese governments.

- Asset Quality: BFF only saw €2.5M of impairment losses in the quarter and €4.9M in the year. This is a full year improvement from the impairment losses of €5.9M that the Company recorded in FY22. Excluding Italian municipalities in conservatorship, net non-performing loans were €7.2M, or 0.1% of net loans. This included a coverage ratio of 75%, which is in-line with the FY22 coverage ratio of 74%. Cost of risk was 9.4bps at year end 2023.

- Ratios: Common equity tier 1 (“CET1”) ratio was 14.2% and total capital ratio (“TCR”) was 19.1% at the end of the quarter. These were measured excluding the €101.2M of accrued dividends, expected to be paid in September of 2024. Recently the Company announced that its target capital ratio has moved from 15% TCR to 12% of CET1, which is more inline with other banks’ capital targets. This is in addition to the €68.0M of excess capital.

- Late Payments Directive Updates: The Late Payments Directive that is still under revision would result in a favorable scenario for BFF as it is currently proposed. Of note the recovery costs would increase to at least €50.00 from €40.00 per invoice in the European Commission proposal or up to an average of €100.00 per invoice as per the European Parliament Draft Report. This is in addition to the payment terms being set at 30 days across all sectors. Valuation: We use a Dividend Discount Model and a P/E comp analysis to guide our valuation. Our Dividend Discount Model assumes that both the TCR and CET1 Ratio remain above 15% for the foreseeable future. Additionally, we agree with the Company stated potential for medium term growth. This arrives at a valuation range of stated range of payout ratios on 2024E Net Income to arrive at a valuation range of €14.47 to €16.26 with a mid-point of €15.27. Our P/E comp analysis valuation results in a range of €14.04 to €16.60 with a mid-point of €15.32. Lastly, we note that BFF pays one of the highest dividend yields of the comp set.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.