DALLAS, TX -- May 10th, 2024 -- ProStar Holdings Inc. (OTCQB: MAPPF): Stonegate Capital Partners updates coverage on ProStar Holdings Inc. (OTCQB: MAPPF).

Company Summary

- Expansion Leads to Revenue Growth: This expansion in customer base and partnerships is turning into significant growth on the income statement, with full year revenue increasing 100.6% Y/Y. This is in addition to deferred revenue growth of 63% year over year. We view this as an early sign that the groundwork ProStar has laid will continue to translate into tangible financial results such as recurring revenue growth of 5% Y/Y. As ProStar transitions its focus towards sales metrics we expect the cash burn rate to meaningfully decrease due to cost associated with employing sales professionals being lower than tech professionals. We are seeing early indications that the sales focus is working as the Company closed 22 deals in 1Q24, up from 3 deals in 1Q23.

- Material Progress with Providers: ProStar® continues to make meaningful progress among hardware providers, recently highlighted by Prostar’s partnership with TopCon Corp, one of the largest remaining hardware companies that did not integrate. This partnership combines PointMan with Topcon’s fixed and portable GNSS antennas, giving Topcon users access to a seamless and easy-to-use data collection solution. We believe this continued growth among hardware providers gives ProStar an outsized chance to become the preferred software of choice, with the results showing customer growth of 15% in the month of April over March. Expect an API with Esri in Q2, integration with One Call ticket management systems in the next 6 months and other partnerships on the software side that strengthen Prostar’s strategy of working with the leading hardware and software providers. By being hardware and software agnostic, PointMan dramatically increases the odds of having a dominant market share over the next decade.

- New CTO Louis Suchy brings in a new era of technical expertise: Mr. Suchy’s contribution is already being felt as the Company launched its new e-store in January of 2024. This new e-commerce platform simplifies the sales process and opens new channels for revenue capture by providing a direct to market avenue. This is allowing for increased margins, leading to better pricing and a reduced sales cycle as April invoices were up 81% Y/Y, with momentum remaining strong. Mr. Suchy has been instrumental in lowering the main input to COGS, cloud hosting costs, to near zero. Improving gross margins significantly which we expect to see over 2024.

- What’s next: We think it is reasonable to expect continued significant expansion of the customer base, including further penetration into its existing customer base and increased visibility of the product as PointMan® becomes more widely adopted. Near term growth is expected to come from expansion within Stake Center Locating, which is the 2nd largest utility locators in the U.S. with ~1,000 utiliity locators. Currently, Stake Center has purchased 10 licenses for its first cohort of users and is training a second group in Atlanta in May. We firmly believe that Stake Center will expand its user base, with indications that this customer alone could be worth upwards of $300,000 per annum. Further clarity on the Company’s organic growth progress is expected before ProStar announces Q1 earnings.

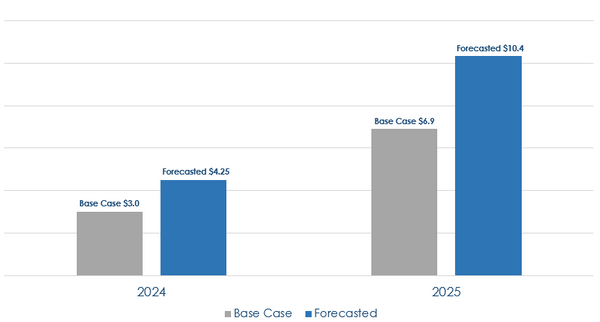

- Valuation: We use a comparative analysis to frame valuation. Using an EV/Sales range of 7.0x to 9.0x with a midpoint of 8.0x, we arrive at our valuation range of $0.35 to $0.50 with a mid-point of $0.40.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.