DALLAS, TX -- December 11th, 2023 -- Steppe Gold Ltd. (TSX:STGO): Stonegate Capital Partners Updates Coverage on Steppe Gold Ltd. (TSX:STGO).

Company Updates

- Updated Technical Report: In March of 2023 the Company released an updated technical report that showed very promising updates to the ATO project. Highlights include an increase in proven and probable reserves to 29.1 million tons, up from 26.4 million tons. This is at a grade of 1.13 g/t gold and 12.43 g/t silver for a total estimation of 1.1million ounces of gold and 11.7 million ounces of silver at the ATO site. This brings the total expected gross revenue for the project to $2.2 billion.

- Funding Secured: In May 2023, STGO completed a non-brokered private placement raising a total of $12.1 million. Proceeds will be deployed to accelerate the Phase 2 Expansion at ATO, fund exploration, and complete a proposed dual listing on the Hong Kong Stock Exchange. In July 2023, the Company signed a binding term sheet that will provide up to US$150M to fully fund the construction and completion of Phase 2. This transaction significantly de-risks the project and provides three tranches of financing, starting with US$50M in July 2023, with payback not scheduled until after the completion of the Phase 2 Expansion. The most recent drawdown of this financing was for $9.6M in October of 2023.

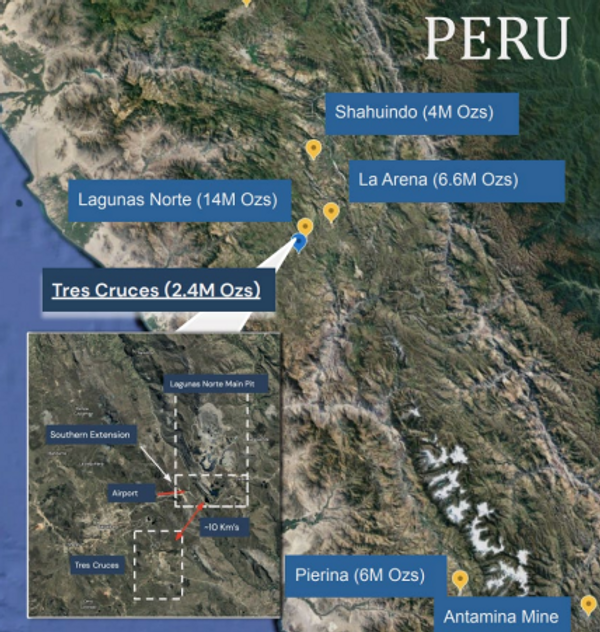

- Anacortes Acquisition: In May of 2023 the company announced the signing of an Arrangement Agreement, notifying the market that it had acquired all outstanding shares of Anacortes Mining Corp. (“Anacortes”). We note the positive synergies expected to result from this transaction, largely based on the expansion of STGOs’ footprint into Peru. This transaction closed in July of 2023.

- ATO Continues Production: Steppe Gold’s flagship project Altan Tsaagan Ovoo (ATO) is fully constructed and began producing gold and silver in the Spring of 2020. For F22, the Company has updated that they produced 33,500 ounces of gold in FY22. This was driven by 958,288 tons mined and 922,051 tons crushed and stacked. To date the Company has produced over 100,000 gold ounces with an estimated 70,000 gold ounces of fresh rock left.

- ATO Expansion Project Moving Forward: Steppe has three diamond core exploration drilling rigs focusing on resource extensions at AT01 and AT04 as well as Mungu, a high grade, near surface gold and silver potential site located northeast of the current resources at the ATO project. This project is highlighted by an expected production of >100,000 oz of gold annually, an estimated mine life of 14 years, and an after-tax NPV 5% of $242M. Production on phase 2 is expected to start in H2 2025. Steppe has just recently announced they have discovered a new high grade zinc sulphide intercept beneath the ATO gold deposits.

- Additional Exploration Assets: Steppe’s Uudam Khundii (UK) property currently encompasses 14,397 hectares located 800km south-west of Ulaanbaatar and holds one exploration license. Steppe Gold has commenced initial exploration activities on the property. Steppe has announced the completion of initial drilling at the Mungu location results showing 3.2 million tons of proven and probable reserves at an average gold grade of 1.20 g/t for a measured gold equivalent of 122,000 ounces.

- Valuation: We combine the separate DCF analysis of our mine models to arrive at a range of C$4.43 to C$5.59 with a mid-point of C$5.00. See pages 9 and 10 for further details.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.