DALLAS, TX -- June 7th, 2024 -- Steppe Gold Ltd. (TSX:STGO): Stonegate Capital Partners Updates Coverage on Steppe Gold Ltd. (TSX:STGO).

Company Updates

- Updated Technical Report: In February of 2023 the Company released an updated technical report that showed very promising updates to the ATO project. Highlights include an increase in proven and probable reserves to 29.1 million tons, up from 26.4 million tons. This is at a grade of 1.13 g/t gold and 12.43 g/t silver for a total estimation of 1.1million ounces of gold and 11.7 million ounces of silver at the ATO site. This brings the total expected gross revenue for the project to $2.2 billion.

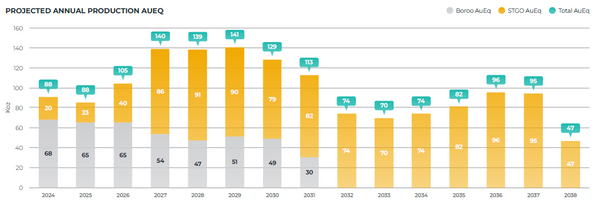

- ATO Expansion Project Moving Forward: Steppe operates the ATO project. This project is highlighted by an expected production of >90,000 oz of gold annually with an AISC of ~$800 per ounce. The technical report estimates after-tax NPV5% of US$242M, an IRR of 67%, and a payback in 3 years with the assumption of $1,700 per ounce gold, $20 per ounce of silver zinc price of $2,500/t, and lead price of $1,970/t. Production in phase 2 is expected to start in 1Q26, with the first $50M tranche drawn from the fully funded $150M finance package to accelerate the construction and development of Phase 2 Expansion. Steppe has also recently entered into a turnkey engineering, production, and construction contract with Hexagon Build Engineering LLC for the Phase 2 Expansion.

- ATO Continues Production: Steppe Gold’s flagship project is the ATO Gold Mine, with Phase 1 fully constructed and commenced producing gold and silver in the Spring of 2020. For 1Q24, the Company mined 133,090 tonnes of ore, with 145,479 tonnes stacked at an average grade of 0.56g/t.

- Boroo Gold Acquisition: In April of 2024 the Company announced an agreement to acquire Boroo Gold from Boroo Singapore, bringing the Boroo Mine located in Mongolia under the Steppe umbrella. The Boroo Mine currently produces approximately 65Koz to 70Koz of gold per year with an expected 430Koz production to 2031. Per the most recent technical report the Boroo Mine has an NPV of $191.0M using a discount rate of 5% and a gold price of $1,750 per ounce. We note that this gold price per ounce is significantly lower than current spot prices giving upside to the last stated NPV.

- Tres Cruces Sale: In April of 2024 the Company announced another transaction with Boroo Singapore to sell the Tres Cruces Project for approximately CAD$12.0M, payable in instalments. This will be in the form of cash payments over 18 months from the closing date, expected in 3Q24. We note that this brings Steppe’s focus back to Mongolia and provides additional liquidity into the company.

- Valuation: When valuing STGO we apply a EV/NAV range of 0.6x to 0.8x which results in a valuation of $1.69 to 2.49 with a midpoint of 2.09. When using an EV/Reserves valuation method we apply a multiple range of 100x to 150x, which results in a valuation range of $1.49 to $2.57 with a midpoint of $2.03. We believe these valuation ranges bring STGO in-line with comparable companies.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.