DALLAS, TX -- May 25th, 2023 -- SSC Security Services Corp. (TSXV: SECU)(OTCQX:SECUF): Stonegate Capital Partners updates their coverage on SSC Security Services Corp. The full report can be accessed by clicking on the following link: SECU Q2 2023

COMPANY UPDATES

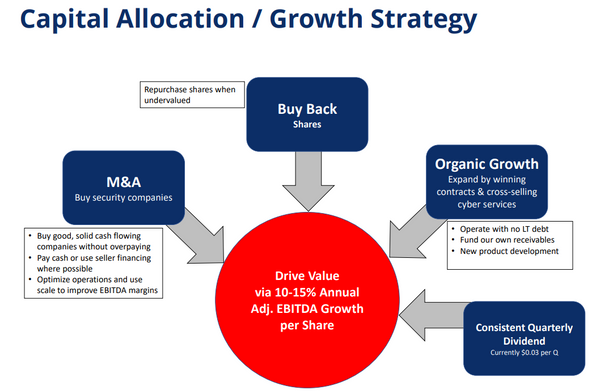

- Continued execution of pivot strategy: The Company has continued to execute on their strategy to grow their security business through acquisitions and organic growth. After a busy 2021, SECU followed up by acquiring Logixx in 2022. The Logixx deal was an all-cash deal that transacted for approximately 3x prior years EBITDA. This presents a phenomenal value considering most private companies in this sector trade for about 4x to 6x EBITDA. In addition to this, the Company announced several multi-year and multi-million dollar contract wins in 2Q23 further highlighting the organic growth potential due to the ever present demand for security services.

- Share buyback plan: In December of 2022 the Company announced a share buyback plan. The specifics of this plan include the intent to purchase 1,200,000 shares representing 10% of float. The share buyback program was initiated on January 4, 2023, and will continue until January 3, 2024 or until all 1,200,000 shares are bought. This is in addition to the 41% of shares outstanding that the Company has bought back through NCIB and Substantial Issuer Bids over the last 5 years. Most recently SECU purchased 51,600 shares in 2Q23.

- Debt free with no plans to change: SECU is in a strong position from a liquidity standpoint. They currently have no debt and management has made it clear that they will be judicious if and when they take on more debt. Additionally, the company is in a strong position from a working capital standpoint with $26.0M in working capital and approx. $33.4M in adjusted working capital which accounts for portions of their legacy business that will most likely become cash within the next year.

- Legacy business: Management has noted that the legacy business is no longer material to the financials. As the Company continues to wind down their remaining legacy assets, we expect that those cash flows allocated to legacy assets will be reallocated to the security services portion of their business. In the meantime, we have accounted for the legacy assets on their balance sheet by including these assets into adjusted working capital. We also subtract these near cash legacy assets from Enterprise Value to arrive at Adjusted EV. We expect SECU to start trading at a multiple that is more in-line with other security services businesses.

- Consistent dividend payer: We note that the Company has paid a dividend of $0.12 annually since inception. This results in a current dividend yield of approximately 4.4%. This consistency proves management’s focus on delivering shareholder returns and has signaled that they intend to maintain this dividend for the foreseeable future.

- Valuation: The Company is currently trading at 2024 expected EV/EBITDA of 3.9x vs average comps of 7.3x. We note that historically comps trade between 8.1x to 9.6x on average. Considering this historical range, we apply a range of 7.0x to 8.0x with a midpoint of 7.5x to our 2024 EBITDA and arrive at a valuation of $3.80 to $4.10 with a midpoint of $3.95. When we look at valuation through a discounted cash flow lens, we apply a discount range of 10.00% to 11.00% with a midpoint of 10.5% leading to a valuation range of $3.73 to $4.37 with a midpoint of $4.02.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.