DALLAS, TX -- December 20th, 2023 -- SSC Security Services Corp. (TSXV: SECU)(OTCQX:SECUF): Stonegate Capital Partners updates their coverage on SSC Security Services Corp.

COMPANY UPDATES

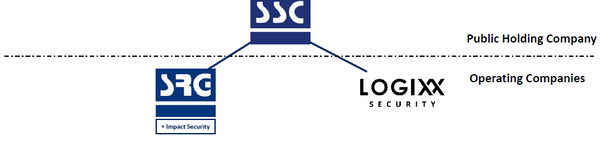

- Continued execution of pivot strategy: In 2022 SECU acquired Logixx Security in an all-cash deal that transacted for approximately 3x prior years EBITDA. In addition to this, the Company announced several multi-year and multi-million dollar contract wins in 2Q23 further highlighting the organic growth potential due to the strong demand for security services and the Company’s new national footprint. This has materialized with full year revenue and adj. EBITDA growth of 119% and 100%, respectively. 2023 was capped with the announcement of a new partnership strategy between SECU and Canada’s premier Managed Service Provider’s (“MSP”). This partnership strategy is expected to help SECU grow its Cyber Security division by delivering a suite of services using technology like AI and behavior analysis to manage client’s internal and external cyberthreats.

- Share buyback plan: In December of 2022 the Company announced a share buyback plan (NCIB) with the potential to purchase up to 1,200,000 shares representing 10% of float. The share buyback program was initiated on January 4, 2023, and continues until January 3, 2024 or until all 1,200,000 shares are bought. The company announced recently that it will be renewing the NCIB for 2024. This is all in addition to the 41% of outstanding shares that the Company has bought back through NCIB and Substantial Issuer Bids over the last 5 years. In FY23 the Company purchased 382,500 shares at an average of $2.87 per share.

- Debt free with no plans to change: SECU continues to maintain a very strong cash position with no debt and management has made it clear that they will be judicious if and when they take on any leverage. Additionally, the Company is in a strong position from a working capital standpoint with $26.5M in working capital and approx. $32.6M in adjusted working capital which accounts for near cash portions of the legacy business.

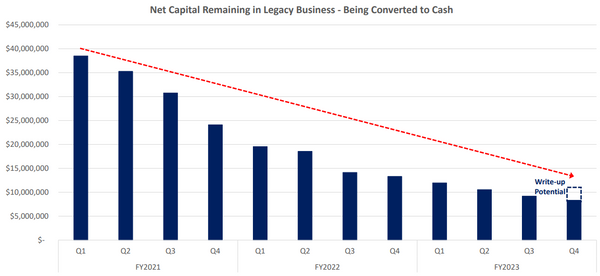

- Legacy business: Management has noted that the legacy business is no longer material to the financials. As the Company continues to wind down its remaining legacy assets, we expect that those cash flows allocated to legacy assets will be reallocated to the security services portion of the business. In the meantime, we have accounted for the legacy assets on their balance sheet by including these assets into adjusted working capital. We also subtract these near cash legacy assets from Enterprise Value to arrive at Adjusted EV. When we account for the near cash assets in relation to SECU’s market cap we note that cash and near cash account for approximately $1.58 per share, or 63% of the current market cap.

- Consistent dividend payer: We note that the Company has paid a dividend of $0.12 annually since it was started 7 years ago. This results in a current dividend yield of approximately 4.8%. This consistency proves management’s focus on delivering shareholder returns and has signaled that they intend to maintain this dividend for the foreseeable future.

- Valuation: We use a comparable analysis and a discounted cash flow analysis to help frame our valuation of SSC. For our comp analysis we apply a range of 6.0x to 7.0x with a midpoint of 6.5x to our 2025 EBITDA and arrive at a valuation of $3.72 to $4.08 with a midpoint of $3.90. For our DCF analysis we arrive at a valuation range of $3.78 to $4.23 with a midpoint of $3.99. Lastly, we note that the Company has an Equity/Share value of $3.47.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.