DALLAS, TX -- April 16th, 2024 -- Pathfinder Bancorp, Inc. (Nasdaq:PBHC): Stonegate Capital Partners updates coverage on Pathfinder Bancorp, Inc. (Nasdaq:PBHC).

Company Summary

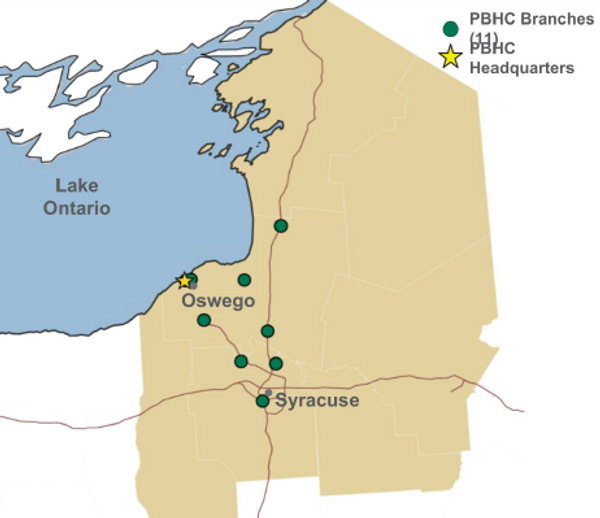

- Growth Through Acquisition: During 1Q24 the Company announced an agreement to purchase the East Syracuse Branch from Berkshire Bank. This branch is in a high traffic area of Syracuse, NY which is expected to see 8.46% growth in median HHI over the next 5 years. We also note that Syracuse is the future home of the Micron Mega Complex, which will be the largest semiconductor fabrication facility in the U.S. We view this acquisition as highly accretive, despite an estimated $1.1M in pre-tax one-time acquisition costs, and expect it to strengthen the balance sheet with low-cost stable deposits. We expect the transaction to close in early 2H24.

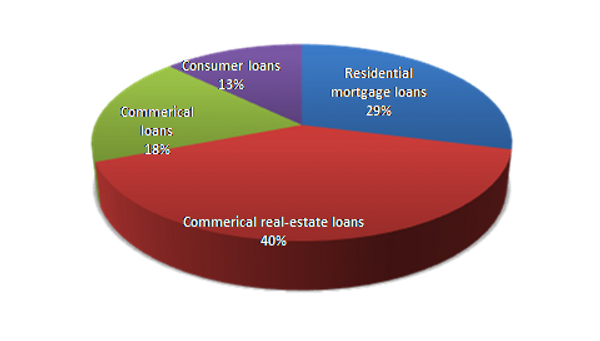

- Commercial Loans: Many banks in the industry are facing pressures due to their exposure to commercial real estate (“CRE”) loans. We note that banks with less than $10.0B in assets tend to have the greatest exposure. PBHC saw net charge-offs to average loans increase to 0.48% in FY23, up from 0.04% in FY22. This increase was largely due to the increase in nonperforming loans in the Company’s CRE portfolio. We recognize that the downgrade was only on a limited number of relatively large CRE loans. Going forward we do not believe that PBHC has outsize exposure to CRE loans given that the Company currently holds approximately 40% of its loan portfolio in CRE loans and we remain encouraged by the continued focus on diligent underwriting. Lastly, we point out that PBHC operates in markets that are less exposed to office buildings with only 4% of its loan portfolio allocated to office space, which is in-line with the rest of the industry.

- Well Diversified Portfolio: Pathfinder Bank’s loan portfolio is well diversified and primarily consists of commercial real-estate loans, commercial loans, and residential mortgage loans. Net charge-offs to average loans were 0.48% for FY23, which is down from 0.61% in 3Q23 and up from 0.04% in 4Q22.

- Improving Profitability Metrics: The Bank has experienced improving metrics over the years with a 24bps increase in ROAA (return on avg. assets) and a 275bps increase in ROAE (return on avg. equity) from 2019 to 2023. Notably, the Company has seen decreased metrics year over year, though this is expected to be a short-term effect from the increase in provision for credit losses in 2023. These metrics have improved sequentially growing by 9bps and 122bps for ROAA and ROAE respectfully since last quarter.

- Pathfinder Bank is Well Capitalized: At the end of 4Q23, the Bank’s Tier 1 capital ratio was 10.11%. Additionally, its Total Capital ratio was 15.05% as of 4Q23. The Company has historically been proactive in supplementing its ratios for future growth as evidenced by its subordinated debt offerings in FY15 and FY20, and an equity offering in FY19. Lastly, the Company had $48.7M in cash as of 4Q23.

- Valuation: We are using P/TBV and P/E multiples to frame our valuation of Pathfinder Bank. Using a P/TB value range of 1.0x to 1.1x, with a mid-point of 1.05x we arrive at a valuation range of $18.83 to $20.71, with a mid-point of $19.77. When applying a P/E range of 9.0x to 11.0x with a midpoint of 10.0x we arrive at a valuation range of $17.40 to $21.27 with a midpoint of $19.33. Based on the factors laid out on Page 8 of this report we believe PBHC should be trading more in line with comps

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.