DALLAS, TX -- August 3rd, 2023 -- International Personal Finance PLC (LSE: IPF): Stonegate Capital Partners updates their coverage on International Personal Finance PLC. The full report can be accessed by clicking on the following link: IPF Report Q2 2023

COMPANY UPDATES

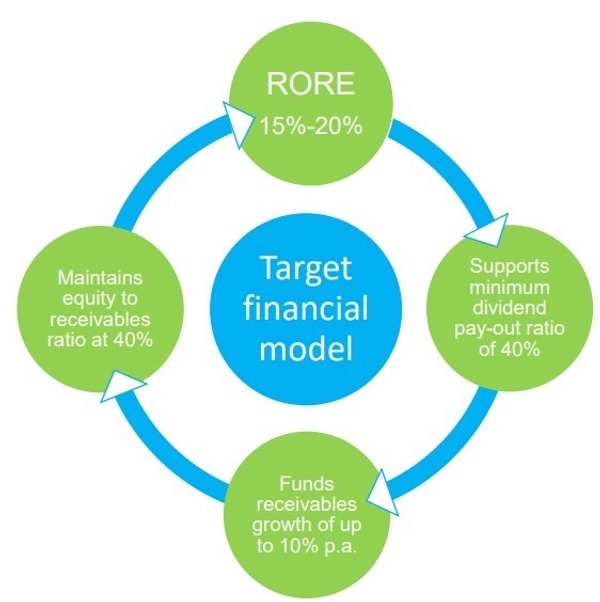

- Strong Half Year Results: IPF ended a strong quarter with net receivables up 9.7% year over year to £893.1M. Additionally customer lending grew 4.8% up to £578.8M. Annualized revenue yield was also strong, moving to 54.2% in 2Q23, up from 49.8% in 2Q22. Impairments remain in-line with expectations at 11.4%, in large part due to robust credit standards and despite the cost-of-living crisis. Lastly, the costs to income ratio is ahead of management plans, down to 57.4% in 2Q23. The Company remains on strong footing with £84M in liquidity available to meet funding requirements through 2024.

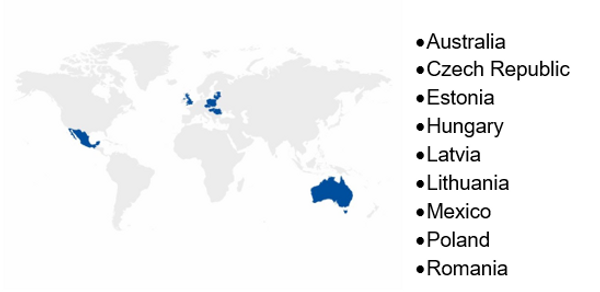

- Continued Expansion in Mexico: IPF continued its expansion into the Mexico Home Market by following the opening of the Tijuana branch in 2022 with the opening of the Tampico branch in March of 2023. There is optimism that the learning curve will be shallow as management has been deliberate in opening at a sustainable pace that is expected to lead to strong market penetration of the several million customers in the area. This has resulted in a 22.8% year-over-year increase in lending for 2Q23, all served by the very critical first cohort of employees.

- Credit Card is Building Traction: The roll out of credit cards in Poland is on track with 53,000 cards issued. The current estimate is that credit card penetration is between 35% to 45% of year end targets, with the pace of uptake expected to increase now that employees have been trained. It is expected that the full transition of the Polish market will be completed by the end of 2024.

- Digital Strength Remains: Digital saw positive momentum in all markets as demand remains strong leading to an 8.1% increase in customer lending up to £117.6M. Of note was the increase in gross receivables to £275.9M, which is up 11.5% year over year. The Company also rolled out its mobile wallet app in Mexico during the quarter, with over 10,000 customers already signing up.

- Revised Guidance: Given the strong performance in all three segments leading to results that are ahead of expectations, coupled with the rise in global interest rates, management was comfortable revising their guidance. This is headlined by a new revenue yield target range of 56% to 58%, up from 53% to 56%. This is in concert with the 15% increase in dividend payments per share to 3.1p, up from 2.7p in 1H22.

- Valuation: We use a DCF Analysis and a Comparison Analysis to frame valuation. For the comparison analysis we used a combination of P/E, P/TBV, and EV/EBT multiples to determine a valuation range for IPF. When we blend these multiple comparisons, in combination with our DCF analysis, we arrive at a median price range of £1.73 to £2.26 with a midpoint of £1.99.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.