DALLAS, TX -- November 3rd, 2023 -- Independence Contract Drilling, Inc (NYSE: ICD): Stonegate Capital Partners updates coverage on Independence Contract Drilling, Inc.

COMPANY UPDATES

ICD continues to position itself for long-term growth while maintaining impressive operating results despite the softness seen in the market overall. The Company saw year-over-year revenue decrease by 10% and Adj. EBITDA growth of 3%. Management noted that the Permian Basin market remains strong and is expected to strengthen. In the quarter, ICD redeemed $5.0m of the convertible notes outstanding at par. Rig reactivations are expected to continue through the balance of 2023 and through the first half of 2024. With a large portion of contracts to be resigned in early 2024, ICD is positioned to capitalize on the expected market turn in 2024. Lastly, ICD has completed four rig conversions to date with the potential for more in 2024 pending market conditions.

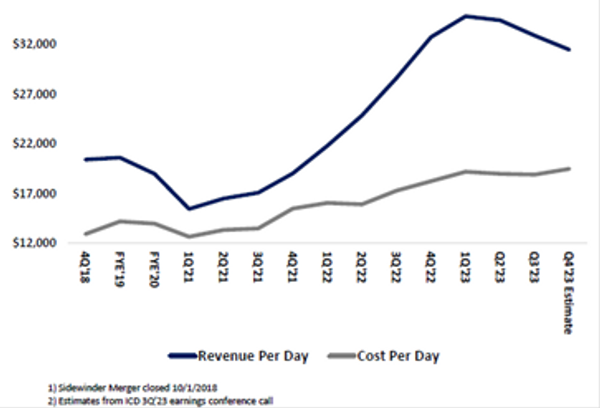

- Operating Days and Margin: ICD exited 3Q23 with 14 activated rigs and an average rig count of 13.5. Dayrates averaged $32,925 and margins were $14,005. Revenues for 3Q23 were $44.2M, representing a 10.1% decrease as compared to revenues of $49.1M 3Q22. ICD ended 3Q23 with a backlog of $44.2M.

- Quarterly Results: ICD reported revenue, adj EBITDA, and adj EPS of $44.2M, $12.9M, and ($0.54), respectively. This compares to our/consensus estimates of $43.1M/$45.1M, $13.7M/$13.9M, and ($0.59)/($0.42), respectively. Both revenue and gross profit were in-line with expectations. Operating expenses were lower than expectations due to higher SG&A expenses, leading to slightly lower Adj. EBITDA.

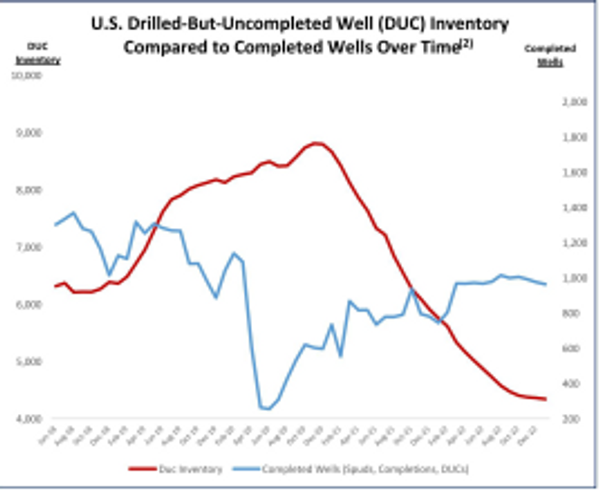

- Headwinds in Haynesville Market: The Company, along with the rest of the industry, is seeing softness in natural gas prices. This is reducing drilling activity in the Haynesville market, where the company operates. To navigate this challenge ICD has moved six of its ten rigs out of the Haynesville market. This operation was complete as of 2Q23. Of the remaining 4 rigs it is notable that 3 are revenue generating, and management believes that the fourth could be put to work soon with a fifth rig that could be moved back should it make economic sense. We are encouraged by how efficiently the Company completed the transition. We expect this market to rebound in late 2024.

- Debt Goals in Focus: The Company redeemed another $5.0m of the convertible notes outstanding at par in 3Q23. ICD also ended the quarter with liquidity of $21.7m between the $6.0m cash balance and $15.7m revolver availability. Management continues to prioritize de-leveraging as a strategic priority, and we expect this to continue over the coming quarters.

- Valuation – We use both an EV/EBITDA and EV/Rig comparison for our valuation of ICD.

- ICD is trading at a FY24 EV/EBITDA of 2.5x compared to comps at an average of 4.7x. We are using a range of 2.5x to 3.5x. This arrives at a valuation range of $2.75 to $8.16 with a mid-point of $5.46.

- ICD is also trading at a discount relative to peers when comparing the EV/Rig multiples. ICD currently has 26 marketable rigs and is trading at 7.2x EV/Rig multiple vs median comps at 11.5x. We believe the Company should be trading in a range of 8.0x to 10.0x with a midpoint of 9.0x. This arrives at a valuation range of $4.00 to $7.70 with a mid-point of $5.85.