DALLAS, TX -- December 7th, 2023 -- Grounded Lithium Corp. (TSXV: GRD) (OTCQB: GRDAF): Stonegate Capital Partners updates their coverage on Grounded Lithium Corp.

Business Overview

Grounded Lithium Corp. (“Grounded”, “GLC”, “GRD”, or “the Company”) is a lithium brine explorer and developer based out of Calgary, Alberta that is focused on supplying lithium to the developing electric powered economy. The Company currently has a significant land position in Western Canada consisting of over 333 sections equal to ~86,000 hectares of land with 4.2mn tons of inferred Lithium Carbonate Equivalent (“LCE”). This project involves the Duperow Formation in southwestern Saskatchewan, an area that is well understood and is a top candidate for large accumulations of lithium brine.

Grounded became a publicly traded company following the reverse merger with VAR Resources Corp. (“VAR”) in August of 2022. At the time 100% of Grounded’s voters were in favor of the transaction with the Company commencing trading on the TSX.V exchange on August 25, 2022 under the trading symbol GRD.

On December 9, 2022 the Company also began trading on the OTCQB under the symbol “GRDAF”.

COMPANY UPDATES

- Significant Progress: Grounded Lithium Corp. has accomplished a number milestones since the start of 2023 that we believe warrant a re-rating of the stock. Year to date GLC has selected a DLE provider in Koch Technology Solutions (“Koch” or “KTS”), announced the results of its much-anticipated PEA, closed an oversubscribed funding round and an upgrade of 1.0M tons of LCE to Measured and Indicated. In 1H24 we expect the Company to appreciate as the market digests the PEA results, the Company expands its resource base, and a path to commercial production solidifies though securing financing.

- DLE Selection: Current demand estimates for lithium far exceed current supply options. This is even more acute in North America where Grounded operates. One of the critical components of operating a lithium brine operation is the Direct Lithium Extraction method used. With the selection of Koch, GLC has taken a large step towards serving this demand. This will allow Grounded to get their operations to full economic production on a timescale that will benefit from the supply/demand imbalance. With a 98% lithium extraction recovery rate, the next step is for KTS to deploy a several months long field pilot. The results of this pilot will help inform the overall commerciality of the project. We expect this pilot to begin in FY24 subject to securing funding.

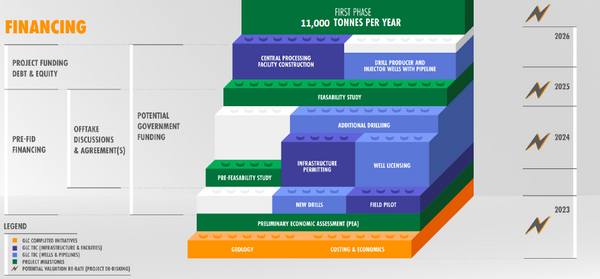

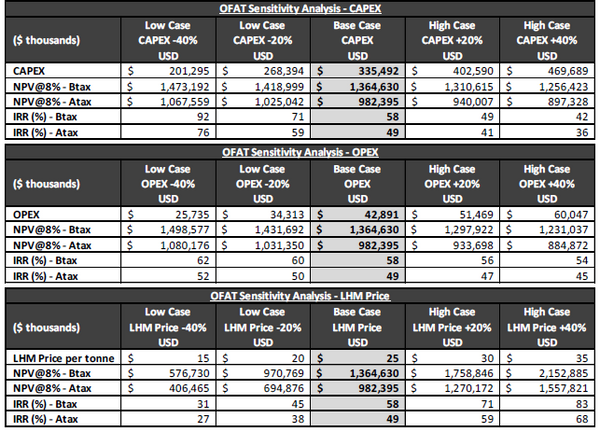

- Impressive PEA Results: The PEA was highlighted by several encouraging results, most notably the after-tax NPV of $1.0B and an internal after-tax IRR of 48.5%. These outcomes are based on an LHM price/ton of $25,000, a discount rate of 8%, and capital investment of $335.0M. Most notable of these variables is the LHM price/ton of $25,000, which is significantly lower than current spot rates. When we consider the highest sensitivity provided with an LHM price/ton of $35,000 it returns an after tax NPV of $1.6B. We believe this NPV is closer to our estimate of the current Phase 1 NPV. Given that these results only consider 24 of GRD’s 300 sections of land holdings, we view this as a very positive step towards realizing the KLP’s potential. Since the completion of the PEA the Company has upgraded 1.0M of the LCE tons to Measured and Indicated without decreasing the resource base. This is significant as it brings GRD one step closer to completing its PFS.

- Clean balance sheet: It is noticeable that the Company does not have any liens on their property, nor have they engaged in any royalty agreements. Additionally, there is no debt on the balance sheet, putting GLC in a strong position going forward. We also note that the Company has enough working capital to maintain operations through near-term catalyst, in part due to the low cash burn rate. We think that this strong balance sheet along with management’s personal investment into the project shows the alignment between investors and management. This was shown once again in 2H23 as the Company closed an oversubscribed financing round that was ~150% of initial targets, without incurring finders fees. Insiders were a meaningful part of this financing round, further showing confidence in the project.

- Valuation: Our valuation uses an EV/NPV multiple in comparison to peer companies. After adjusting for the likely expansion beyond Phase 1, our valuation returns a range of C$0.72 to C$1.43 with a midpoint of C$1.08. We believe this range is more accurate and is further supported by the Arizona Lithium acquisition in December 2022, which would value GRD at ~C$1.04

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.