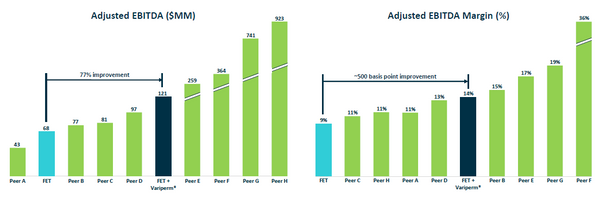

DALLAS, TX -- August 5th, 2024 -- Forum Energy Technologies, Inc. (NYSE: FET) Stonegate Capital Partners updates their coverage on Forum Energy Technologies, Inc. (NYSE: FET). FET reported revenue, adj EBITDA, and adj net income of $207.8M, $25.8M, and ($2.3)M, respectively. This compares to our/consensus estimates of $211.3M/$214.5M, $26.3M/$26.8M, and ($4.4)M/$0.7M. It is noted that revenues were in-line with our expectations. GPM was slightly ahead of expectations, resulting in stronger operating profits. Adj. EBITDA margins were in-line with expectations at 12.4%. Adj. NI was slightly ahead of our expectations due to stronger than expected OPM.

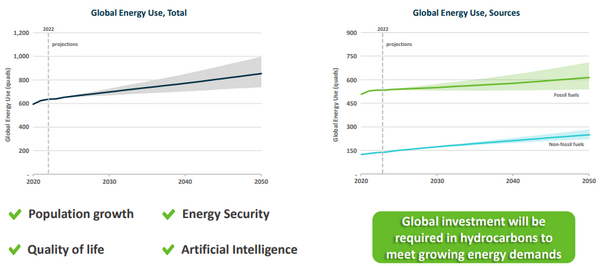

Drilling and Completions: In 3Q24, the Drilling and Completions segment saw a Q/Q revenue increase of 5.6% to $123.6M, driven by higher project revenue from ROVs, launch and recovery systems, and wireline cable. Adj. EBITDA rose to $14.5M due to a favorable product mix with a Y/Y margin expansion of 198bps. The book-to-bill ratio improved to 105%, up from 94% in the previous quarter. This was led by strong international demand for drilling-related capital equipment, which boosted orders by 17.6% Q/Q. Lastly, this segment is expected to benefit from robust international demand for drilling-related capital equipment and handling tools.

Artificial Lift and Equipment: The Artificial Lift and Downhole segment reported $84.2M in revenue, a 4.5% decrease from the previous quarter, primarily due to lower sales of casing hardware and valve products. Despite this, orders increased by 9.0% to $76.3M, driven by higher demand for Production Equipment. The segment’s adj. EBITDA was $17.4M. We anticipate strong and continued growth in the Artificial Lift and Downhole segment, driven by strong demand for production equipment.

Debt Refinance: In the third quarter, FET completed a significant debt refinancing deal by issuing $100.0M in senior secured bonds at a 10.5% coupon rate. This move allowed FET to pay off its 2025 notes and seller term loan, reducing the blended interest rate by 130 bps. The refinancing enhanced FET’s liquidity, offering flexibility for strategic investments and share buybacks.

Cash Flows: FET reported another impressive quarter in cash position with free cash flows of $24.5M for the third quarter, up $3.1M sequentially. This brings the year-to-date FCF to $48.2M, as previously mentioned. This marks a significant improvement from the loss of $7.3M seen in the first nine months of FY23. This strong performance is attributed to the successful integration of Variperm and effective working capital management.

Guidance: FET has maintained its full-year 2024 adjusted EBITDA guidance at $100M to $110M. However, the Company has raised its full-year FCF guidance to $60.0M to $70.0M, up from the previous range of $50.0M to $70.0M. Based on the strong performance of Variperm to date we believe this guidance is reasonable and have adjusted our model accordingly.

Valuation: We use a DCF model and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $28.09 to $32.07 with a mid-point of $29.91. Our EV/EBITDA valuation results in a range of $25.70 to $30.36 with a mid-point of $28.03.