DALLAS, TX -- August 5th, 2024 -- Forum Energy Technologies, Inc. (NYSE: FET) Stonegate Capital Partners updates their coverage on Forum Energy Technologies, Inc. (NYSE: FET).

Company Update

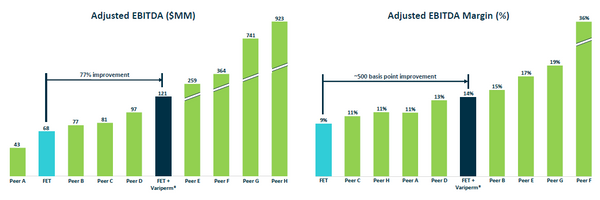

- Quarterly Results: FET reported revenue, adj EBITDA, and net income of $205.2M, $25.7M, and ($6.7)M, respectively. This compares to our estimates of $211.1M, $26.9M, and $0.6M. It is noted that revenues and GPM were in-line with our expectations and OPM was below our expectations due to expenses related to the Variperm acquisition. Adj.EBITDA margins were in-line with expectations at 12.6%.

- Drilling and Completions: The drilling and completions segment saw y/y revenue declines of 10.5% and EBITDA margin declines of 65bps. Subseatechnologies helped buoy the results by growing 26.3% year over year.Gross margins were strained in the segment, declining 197bps due to unfavorable mix. Book to bill for the quarter was at 94%, flat from 2Q23.

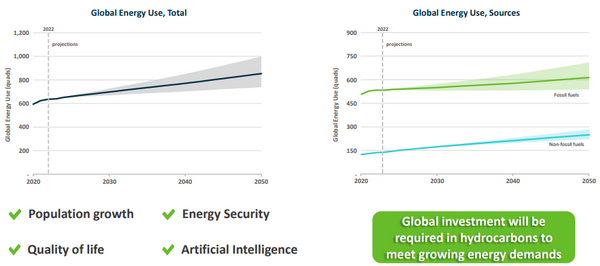

- Artificial Lift and Equipment: The artificial lift and equipment segment grew 62.3% y/y with an EBITDA margin expansion of 640bps. Orders in the quarter were $70.0M, which is an increase of 8.7% compared to 2Q23. This resulted in a book-to-bill ratio of 70%. We note that this strong quarter is largely attributable to the Variperm acquisition, and we believe there is still room for expansion as oil sands activity increases through FY24.

- Growth: FET completed its acquisition of Variperm Energy, a leading manufacturer of customized downhole technology solutions, providing sand and flow control products for heavy oil applications, on January 5, 2024. We note that this acquisition is highly accretive to both the top and bottom line with Variperm reporting TTM revenue of $129.0M and TTM adj. EBITDA of $53.0M, as of 3Q23. Variperm integration continues ramping up as FET is poised to grow revenues significantly from potential synergies.

- Cash Flows: FET saw very impressive free cash flows in the quarter, up from $(7.3)M in 2Q23, to $21.4M in 2Q24. This brings YTD cash flows to $21.7M, up from $(31.2)M in 2Q23. Given this strong growth through Variperm’s contribution and working capital management, the Company has indicated that it is committed to retiring its 2025 Notes, which we expect to be completed by year end, as well as the Variperm Seller Term Loan by mid[1]2025. Given the Company’s cash flow outlook the potential remains for debtretirement to take place earlier. We note that the Company’s current midpoint of FCF guidance accounts for 29.3% of market value and 14.1% of enterprise value.

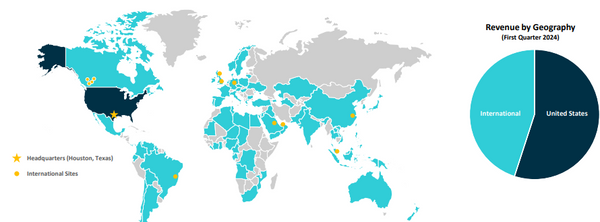

- Guidance: FET adjusted its FY24 Adj. EBITDA guidance to a range of $100.0M to $110.0M, a decrease of $10.0M at the top end. Full-year FCF guidance was increased to a range of $50.0M to 70.0M, an increase from $40.0M to 60.0M. Given the Variperm acquisition, continued growth in international markets, and cash flow outlook we believe this guidance is reasonable.

- Valuation: We use a DCF model and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $27.94 to $32.06 with a mid-point of $29.83. Our EV/EBITDA valuation results in a range of $22.56 to $32.68 with a mid-point of $27.62.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.