DALLAS, TX -- May 6th, 2024 -- Forum Energy Technologies, Inc. (NYSE: FET) Stonegate Capital Partners updates their coverage on Forum Energy Technologies, Inc. (NYSE: FET).

Company Update

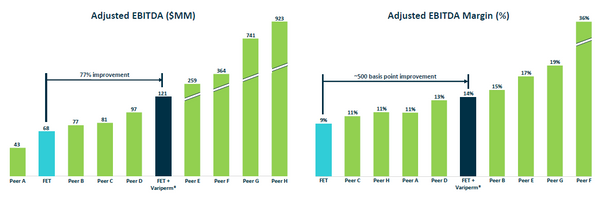

- Quarterly Results: FET reported revenue, adj EBITDA, and net income of $202.4M, $26.1M, and ($10.3)M, respectively. This compares to our estimates of $211.6M, $23.2M, and ($8.3)M. It is noted that revenues were slightly below expectations due to a weaker oil sands market, made up for by the strong GPM. Both adj. EBITDA and adj. EBITDA margins of 12.9% outpaced our expectations due to the impact of Variperm.

- Drilling and Completions: The drilling and completions segment saw y/y revenue declines of 6.1% and EBITDA margin growth of 86bps. Subsea technologies helped buoy the results by growing 70.3% year over year. Despite the softness seen in revenues, book to bill for the quarter was at 98%, a notable increase from 96% in 1Q23 and 90% in 4Q23.

- Artificial Lift and Equipment: The artificial lift and equipment segment grew 33.9% y/y with an EBITDA margin expansion of 537bps. Orders in the quarter were $87.8M, which is an increase of 52.4% compared to 1Q23. This resulted in a book-to-bill ratio of 105%. We note that this strong quarter is largely attributable to the Variperm acquisition, and we believe there is still room for expansion as oil sands activity increases through FY24.

- Growth: FET completed its acquisition of Variperm Energy, a leading manufacturer of customized downhole technology solutions, providing sand and flow control products for heavy oil applications, on January 5, 2024. We note that this acquisition is highly accretive to both the top and bottom line with Variperm reporting TTM revenue of $129.0M and TTM adj. EBITDA of $53.0M, as of 3Q23. While the Company saw results from Variperm that were slightly lower than the historical run rate in 1Q24, these results are still in-line with expectations and projected to continue ramping as integration progresses.

- Cash Flows: FET saw very impressive free cash flows in the quarter, up from $(23.9)M in 1Q23, to $2.3M in 1Q24. This is notable due to the first quarter typically being a very weak quarter from a cash flow perspective. Given this strong growth through Variperm’s contribution and working capital management, the Company has indicated that it still intends to retire ~$134.0M worth of debt in FY24, followed by paying off the seller note in FY25. This will put the Company’s net leverage ratio at ~1x, freeing up significant amounts of capital.

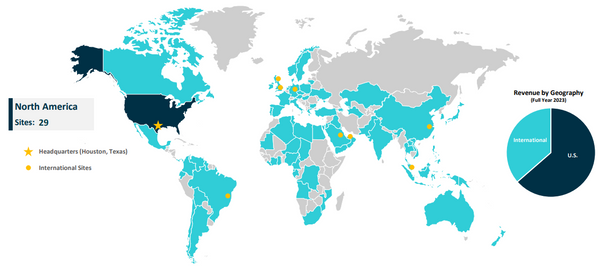

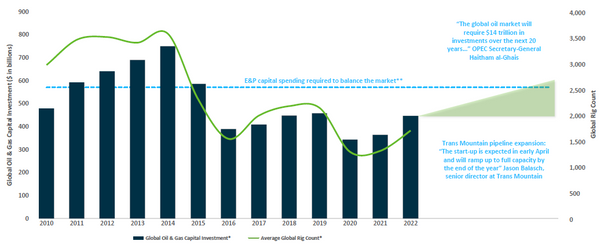

- Guidance: FET reiterated its adj FY24 EBITDA guidance in a range of $100.0M to $120.0M. Full year FCF guidance was stable in a range of $40.0M to 60.0M. For 2Q24 the Company gave revenue guidance in a range of $200.0M to $220.0M. Given the Variperm acquisition, continued growth in international markets, and rig count outlook we believe this guidance is reasonable. We made minor changes to our model.

- Valuation: We use a DCF model and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $22.17 to $26.18 with a mid-point of $24.02. Our EV/EBITDA valuation results in a range of $20.84 to $30.96 with a mid-point of $25.90.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.