DALLAS, TX -- November 22nd, 2024-- Electro Optics Systems Holdings Ltd (ASX: EOS): Stonegate Capital Partners updates their coverage on Electro Optics Systems Holdings Ltd (ASX: EOS). In November of 2024 EOS announced the signing of a binding agreement to divest the Company’s EM Solutions segment for an enterprise value of $144.0M to Cohort, a UK based company. We note that this transaction triggers the repayment of its current debt facility. We estimate that following the closing of this transaction, which is expected to be completed within the next six months, the Company will have ~$135.0M in cash on the balance sheet and zero debt outstanding. We view this transaction as accretive to the Company’s gross margin and expect that it will provide EOS with sufficient liquidity to pursue growth objectives closer to the Company’s core operations.

COMPANY UPDATES:

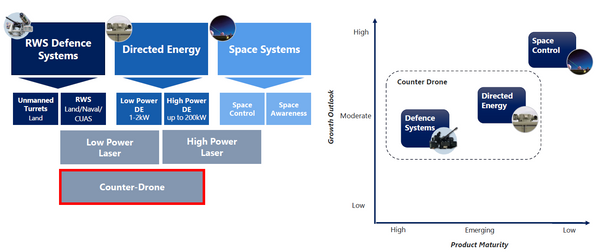

Continued Diversification: EOS continues to diversify its product offerings as well as the geographies that it services. We note the strong demand for counter drone products is driven by the current market conditions. As the Company continues to grow its RWS offerings we expect the same market conditions to drive demand. Going forward EOS has noted that it will be launching new terminals as well as High Energy Laser Weapons (HELW). This diversification in product offerings gives us confidence that the growth will continue. Of note, EOS has secured a cannon supply agreement for a 3-year total commitment worth approximately AUD$104.0m. For the remainder of the year, we anticipate that EOS will capture further contracts.

New Contracts: EOS has been busy adding new contracts with the most recent addition being in the Space Technologies segment. In 2H24 the Company secured a AUD$9.0m contract with the Australian Defense Force Joint Capabilities Division to further develop its space capabilities with expected delivery in 2H24 and FY25

Turnaround Program: To date, Management has implemented a disciplined multiphase restructuring plan to turn EOS around. Phase 2 is now underway and is focused on collecting cash from existing customers and securing new orders. The turnaround is the Company’s new approach of giving honest expectations and clearly displaying their goals to repair its credibility and drive growth. In 1H24, receipts from customers were AUD$120.3m, a decrease from AUD$123.3m in 1H23, illustrating the lumpy nature of cash receipts.

Strong Backlog: As of 1H24, the Company has a strong order backlog totaling AUD$567.0m which includes the conditional AUD$181m contract to supply Ukraine. The backlog makes up customer contracts primarily in the Defense and EM Solutions segments and work is expected to be done in 2024 and 2025. This backlog is almost double the AUD$312m seen in 2H22.

Top Line Growth: The Company saw year-over-year revenue growth of 92.0% up from AUD$74.3m in 2H23 to AUD$142.6m in 2H24. We believe that, given the strong backlog and continued expansion of product offerings with new products like the “Slinger”, R800, and HELW line, the Company will continue to grow revenue at a strong rate in the short term.

Valuation: We use both a DCF Analysis and Comparable Analysis to inform our valuation of EOS. Our DCF analysis arrives at a valuation range of AUD$2.26 to AUD$2.40 with a midpoint of AUD$2.32. For the Comparable Analysis we arrive at a valuation range of AUD$2.06 to AUD$2.11 with a midpoint of AUD$2.08.