DALLAS, TX -- April 11th, 2024 -- Eagle Financial Services, Inc (OTCQX:EFSI): Stonegate Capital Partners updates coverage on Eagle Financial Services, Inc (OTCQX:EFSI).

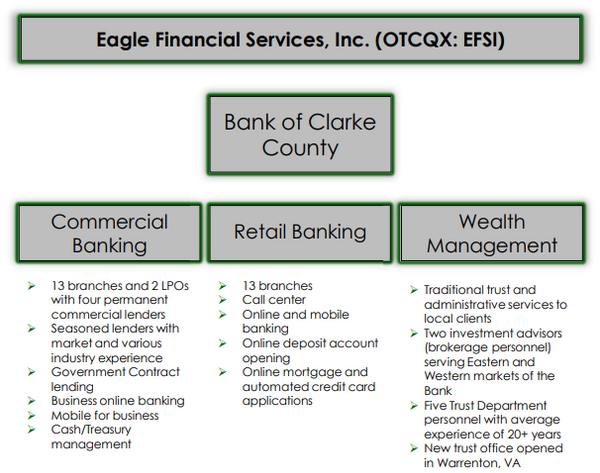

Company Summary

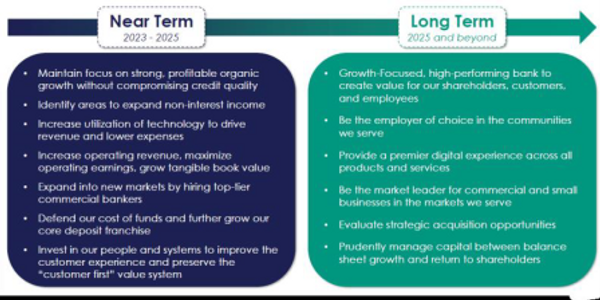

- Proven record of sustained profitability: Over the past four years, Eagle Financial has consistently shown increasing net income and EPS growth. From 2018 to 2023, net income and EPS have grown at a CAGR of 13.7% and 13.3%, respectively. Additionally, total assets grew at a CAGR of 18.0%, and its loan portfolio also grew at a CAGR of 19.0% for the same period. In 4Q23 y/y net income decreased by 25.1% with assets and loans growing 12.9% and 10.3% over that same period. Investments in people and technology, along with market expansion and more diversified revenue sources are the drivers of this performance. When considering the headwinds in the overall banking sector we are impressed with the Company’s performance in FY23 and strong finish to the year.

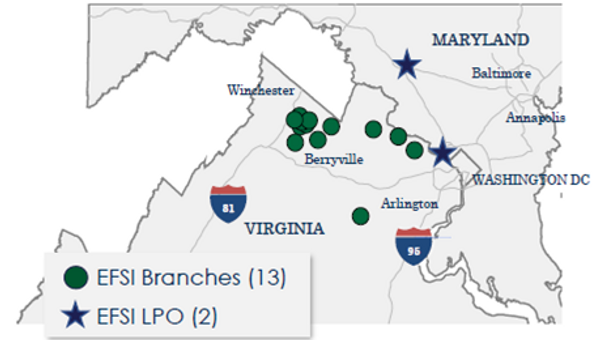

- Diverse market exposure: The Bank’s performance is tied to its primary market area in Northern Virginia and the Shenandoah Valley. The Bank has a solid market position in the counties it serves. Additionally, the market areas possess excellent demographics, as evidenced by its population numbers, median household income, and median home values. Furthermore, there are nearby expansion opportunities for the Bank in Fairfax County, VA, and Washington, DC. Per the most recent company report, all the regions that the Company operates in are expected to see population growth higher than the national average through 2027.

- Experienced management team with high levels of ownership: Eagle Financials’ management team has decades of experience, ranging from community banks to larger banking operations. Additionally, management’s interest is tied to shareholders with insider ownership above 10%.

- The Company has strong ratios: At the end of 4Q23, tier 1 leverage ratio was 8.48%, down from 9.15% at the end of 4Q22. Additionally, its non-performing loans to total loans percentage was at 0.40% at 4Q23, up from 0.19% at 4Q22. The Company has historically maintained solid capital ratios and has grown consolidated equity at a 4.2% CAGR from 2016 to 4Q23. Furthermore, the Company has $138.4M in cash as of 4Q23.

- Consistent dividend payer: The Company maintained its dividend level at $0.30 per share. This translates to a 4.0% dividend yield. Eagle Financials has a history of raising its annualized dividend payments when prudent.

- Impressive Balance Sheet: At the end of 4Q23, book value per share was $30.78. Additionally, the return on average assets was 0.53%, an increase from 0.51% seen in the prior quarter. Return on average equity also improved to 9.33% from 8.87% in the prior quarter.

- Valuation: We use a P/TBV to help frame our valuation of Eagle Financial. Using a P/TBV range of 1.0x to 1.2x with a mid-point of 1.1x. Using these assumptions, we arrive at a valuation range of $31.29 to $37.54 with a mid-point of $34.42.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.