DALLAS, TX -- October 31st, 2024 -- Civeo Corporation (NYSE: CVEO): Stonegate Capital Partners updates their coverage on Civeo Corporation. Civeo has consistently generated positive free cash flow every year since 2014 and continues to do so. In 3Q24, CVEO produced $28.3M in FCF, building on the $30.9M achieved in 2Q24. This quarter’s FCF, while slightly lower than the previous quarter, still represents a strong performance. CVEO remains optimistic about maintaining positive free cash flow and has updated its full-year 2024 guidance, raising the low end to its guidance range from $45.0M to $50.0M, increasing the midpoint from $52.5M to $55.0M as the high end of guidance was maintained at $60.0M. We note that this consistent generation of cash flow not only highlights Civeo’s solid financial health but also reflects its strategic commitment to enhancing shareholder returns.

- Quarterly Results: CVEO reported revenue, adj EBITDA, and adj EPS of $176.3M, $18.8M, and ($0.36), respectively. This compares to our/consensus estimates of $161.1M/$168.8M, $22.1M/$21.6M, and ($0.12)/($0.12), respectively. Consolidated revenue exceeded expectations; this outperformance was driven by strength in both pricing and billed rooms volume in the Australian segment, despite the weaker billed rooms volume in the Canadian segment.

- Capital Allocation: CVEO continued to return capital through share repurchases in 3Q24 worth $14.2M, over approximately 515,000 shares. The Company decreased net debt by $63.0M year-over-year and $7.9M since the previous quarter. This translates into a net leverage ratio of 0.3x, a decrease from 0.6x in 1Q24. In addition, the Company declared a quarterly cash dividend of $0.25 per share, equal to a dividend yield of 4.00%.

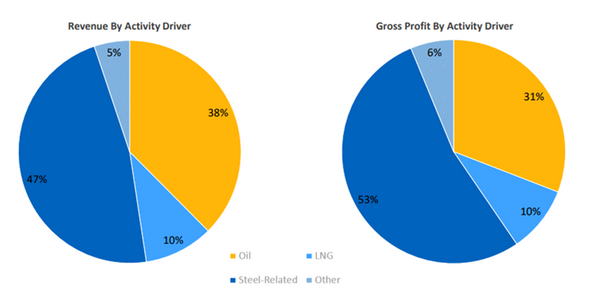

- Canadian Segment: The Canadian market saw a year-over-year revenues and adj. EBITDA decrease of 39% and 85%, respectively. This was mainly driven by the expected wind-down of LNG activities, which included $0.4M in mobile camp demobilization costs, alongside a decrease in billed rooms due to the Canadian wildfires. Additionally, reduced oil sands turnaround activity resulted from customers starting projects earlier in the year, further exacerbating decreases in billed rooms. Despite the headwinds, the Company announced the successful renewal of a contract with a major oil sands producer through June 2027.

- Australian Segment: The Australian market continued to deliver strong growth in 3Q24 year-over-year revenues and adj. EBITDA saw an increase of 33% and 19% respectively. These strong results were despite the FX headwind. Once again, Management noted that the Integrated Services business saw significant growth, driven by recent competitive wins and the expansion of an existing customer relationship.

- Guidance: CVEO tightened its full-year 2024 guidance with revenue projected to range from $675M to $700M and adjusted EBITDA between $83M and $88M. We have adjusted our model accordingly.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $34.21 to $37.83 with a mid-point of $35.88. Our EV/EBITDA valuation results in a range of $32.29 to $36.00 with a mid-point of $34.15.