DALLAS, TX -- July 31st, 2024 -- Civeo Corporation (NYSE: CVEO): Stonegate Capital Partners updates their coverage on Civeo Corporation.

COMPANY UPDATES

- Significant Free Cash Flow Generation: Civeo has been free cash flow positive every year since 2014 and is expected to maintain positive FCF going forward. CVEO built on the $7.2M in FCF posted in 1Q24 by finishing the quarter with $30.9M in FCF for 2Q24. This is a noticeable gain when compared to the FCF in 2Q23 of 12.9M. CVEO maintained its FCF guidance for FY24, providing a range of $45.0M to $60.0M with a midpoint of $52.5M.

- Quarterly Results: CVEO reported revenue, adj EBITDA, and adj EPS of $188.7M, $31.3M, and $0.57, respectively. This compares to our/consensus estimates of $170.3M/$172.6M, $24.2M/$21.4M, and $0.28/$0.38, respectively. Consolidated revenue exceeded expectations, with a 5.5% year-over-year increase, fueled by higher occupancy rates at Civeo-owned villages and continued growth in its integrated services offering. The operating margin was above our expectations by 272bps, leading to Adj. EBITDA outpacing our expectations.

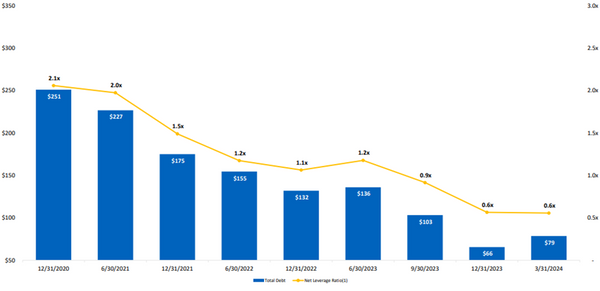

- Capital Allocation: CVEO continued to return capital through share repurchases in 2Q24 worth $6.6M, over approximately 274,000 shares. The Company decreased net debt by $84.2M year-over-year and $21.8M since the previous quarter. This translates into a net leverage ratio of 0.3x, a decrease from 0.6x in 1Q24. In addition, the Company declared a quarterly cash dividend of $0.25 per share, equal to a dividend yield of 3.8%. CVEO ended the quarter with $151.5M in revolver availability and $7.4M in cash for $159.0M in liquidity.

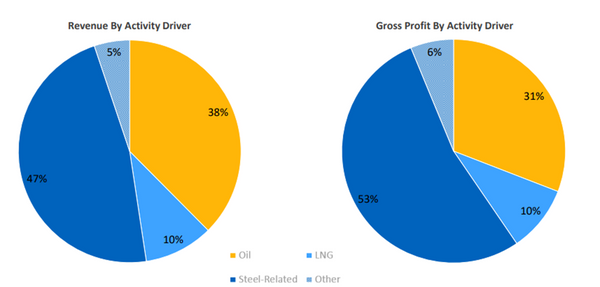

- Canadian Segment: The Canadian market saw a period-over-period revenues and adj. EBITDA decrease of 17% and 13%, respectively. This was primarily due to the expected reduction in LNG-related mobile camp activity, as well as a $1.4 million in mobile camp demobilization costs. CVEO anticipates the completion of demobilization in the third quarter, which will have a final impact of approximately $1.5M. CVEO’s near-term focus has been and will continue to be on the management of current wildfire activity in Western Canada as well as growing the Canadian Segment.

- Australian Segment: The Australian market continued to deliver strong growth in 2Q24 as billed rooms and gross profits were up 6.4% and 14.9%, respectively. These strong results were despite the FX headwind. Management noted that the Integrated Services business saw significant growth, driven by recent competitive wins and the expansion of an existing customer relationship. As a result, CVEO reiterated its goal to grow integrated services to A$500.0M in top line revenues by 2027.

- Guidance Update: CVEO maintained its full-year 2024 guidance with revenue projected to range from $625M to $700M and adjusted EBITDA between $80M and $90M. Additionally, its CAPEX guidance remains at $30M to $35M for the year. With CVEO upholding guidance, we have adjusted our model accordingly.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $31.03 to $36.25 with a mid-point of $33.30. Our EV/EBITDA valuation results in a range of $30.39 to $36.76 with a mid-point of $33.58.

About Stonegate Capital Partners

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.