DALLAS, TX -- March 1st, 2024 -- Civeo Corporation (NYSE: CVEO): Stonegate Capital Partners updates their coverage on Civeo Corporation.

COMPANY UPDATES

- Significant Free Cash Flow Generation: Civeo has been free cash flow positive every year since 2014 and is expected to maintain positive FCF going forward. After posting a negative FCF in 1Q CVEO became FCF positive ending FY23 with FCF of $81.7M. CVEO stated its FCF guidance for FY24 in a range of $45.0M to $60.0M with a midpoint of $52.5M.

- Quarterly Results: CVEO reported revenue, adj EBITDA, and adj EPS of $170.8M, $17.4M, and $1.57, respectively. This compares to our/consensus estimates of $153.5M/$151.1M, $12.5M/$12.5M, and $0.74/($0.27), respectively. Revenue was higher than expectations, driven by strength in the Australian market and greater than expected billed rooms. The operating margin was above our expectations by ~880bps. This led to an Adj. EBITDA beat of $4.8M vs our expectations.

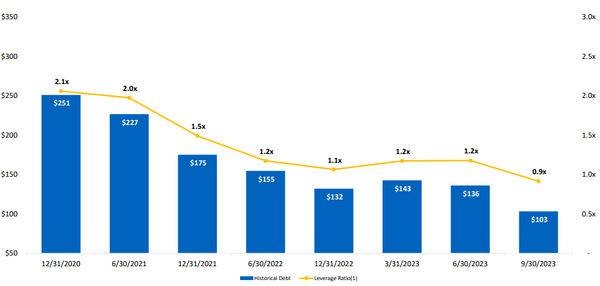

- Capital Allocation: In 2022 Civeo initiated a share repurchase program as part of its plan to return capital to shareholders. CVEO continued to return capital through share repurchases in FY23 worth approximately $18.8M, or 23% of full year free cash flows. Additionally, the Company used cash to decrease debt by $37.7M sequentially to $65.6M. This translates into a net leverage ratio of 0.6x. CVEO also maintained its dividend for a third straight quarter at an annualized value of $1.00, equal to a dividend yield of 4.3%. CVEO ended the quarter with $133.1M in revolver availability and $3.3M in cash for $136.4M in liquidity.

- Canadian Market: With the upcoming construction wind down of the TMX and Coastal GasLink pipelines, Civeo saw further demobilization of its mobile camps in 4Q23. The Company will incur demobilization costs of$6M in 2024, which will significantly impact EBITDA and is expected to be contained to the first half of the year. CVEO has now completed the sale of its McClelland Lake Lodge for a net gain of ~$28.3M in the year.

- Room Rates: The Canadian segment saw an increase in its average daily room rates from $93 in 4Q22 to $95 in 4Q23 and billed rooms decreasing 0.8% over the same period. The Canada segment saw a year over year EBITDA decrease of 72% due to the wind-down of mobile camp activities. The Australian segment saw an increase in rates, going from $73 in 4Q22 to $75 in 4Q23 and an increase in billed rooms of 22.9% over that time. This resulted in a year over year EBITDA increase of 64% in Australia further aided by an increase in integrated services. Notably, CVEO stated a goal to get integrated services to A$500.0M in top line revenues by 2027. The movements in roommates were affected by the weakening of the Australian and Canadian dollars compared to the U.S. dollar.

- Guidance Update: Current 2024 Adj. EBTIDA guidance is in the range of $80.0M to $90.0M. This is a year-over-year decrease of 16.7% at the midpoint to account for the McClelland Lake sale as well as demobilization costs. We have adjusted our model accordingly.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $30.30 to $36.06 with a mid-point of $32.81. Our EV/EBITDA valuation results in a range of $30.65 to $37.33 with a mid-point of $33.99.

About Stonegate Capital Partners

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.