DALLAS, TX -- October 30th, 2023 -- Civeo Corporation (NYSE: CVEO): Stonegate Capital Partners updates their coverage on Civeo Corporation.

Business Overview

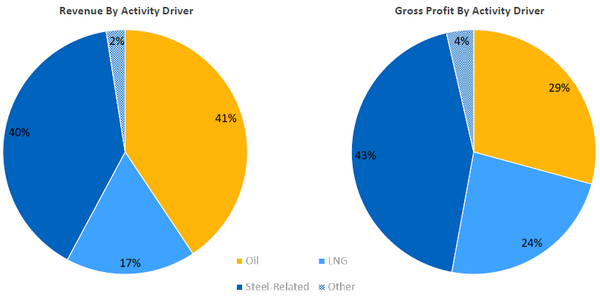

Civeo Corporation provides workforce accommodations and hospitality services in the United States, Canada, and Australia. These services include lodging, catering/food service, housekeeping and maintenance at accommodation facilities either owned by Civeo or owned by the customer and leased by Civeo. Civeo serves oil, mining, engineering, and oilfield and mining service companies. The Company currently owns and operates 26 lodges & villages with approximately 28,000 rooms.

COMPANY UPDATES

- Initiation of Cash Dividend: In September of 2023 CVEO announced the initiation of a cash dividend as part of the Company’s capital allocation program (discussed further below). This initial quarterly dividend of $0.25 is underpinned by management’s confidence in the Company’s liquidity position. At an annualized value of $1.00, the dividend yield equals ~5.3%.

- Significant Free Cash Flow Generation: Civeo has been free cash flow positive every year since 2014 and is expected to maintain positive FCF going forward. After posting a negative FCF in 1Q CVEO became FCF positive YTD with a current FCF of $42.4M. CVEO updated its FCF guidance for the year to $68.0M to $78.0M with a midpoint of $73.0M.

- 3Q23 Results In-Line: CVEO reported revenue, adj EBITDA, and adj EPS of $183.6M, $32.9M, and $0.61, respectively. This compares to our/consensus estimates of $165.3M/$166.7M, $27.8M/$27.8M, and $0.16/$0.21, respectively. Revenue was higher than expectations, driven by strength in the Australian market and greater than expected billed rooms. GPM was also above our expectations by ~300bps. This led to an Adj. EBITDA beat of $5.1M vs our expectations.

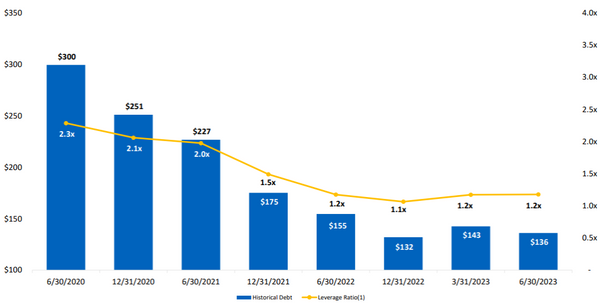

- Capital Allocation: In 2022 Civeo initiated a share repurchase program as part of its plan to return capital to shareholders. CVEO continued to return capital through share repurchases in 2Q23 with 212,000 shares repurchased for an approximate value of $4.2M. The share repurchase program has been renewed with an additional 5% of shares authorized for repurchase. Additionally, the Company used cash to decrease debt by $32.9M Q/Q to $103.2M. This translates into a net leverage ratio of 0.9x. CVEO ended the quarter with $102.8M in revolver availability and $7.8M in cash for $110.6M in liquidity.

- Canadian Market: With the upcoming construction wind down of the TMX and Coastal GasLink pipelines, Civeo will begin demobilizing its mobile camps 4Q23 and into 2024. The Company will incur demobilization costs of $10M in 2023 and $6M in 2024, which will significantly impact EBITDA. CVEO also announced the sale of its McClelland Lake Lodge for a total price of $36.0M. The Company expects to record $25.0M of this sale in 4Q23, with the remaining to be recorded in 1H24.

- Room Rates: The Canadian segment saw a decrease in its average daily room rates from $99 in 3Q22 to $98 in 3Q23. while the Australian segment saw an increase, going from $73 in 3Q22 to $74 in 3Q23. The movements in roommates were affected by the weakening of the Australian and Canadian dollars compared to the U.S. dollar. This was buoyed by the Australian segment seeing a 24% Y/Y constant currency revenue increase.

- Guidance Update: Current 2023 Adj. EBTIDA guidance is in range of $95.00M to $100.0M. EBITDA guidance was raised to account for the proceeds from the McClelland Lake transaction. We have adjusted our model.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $30.75 to $35.96 with a mid-point of $33.02. Our EV/EBITDA valuation results in a range of $29.77 to $35.71 with a mid-point of $32.74.

About Stonegate Capital Partners

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.