DALLAS, TX -- May 30th, 2023 -- Borqs Technologies Inc. (NASDAQ: BRQS): Stonegate Capital Partners updates their coverage on Borqs Technologies Inc. The full report can be accessed by clicking on the following link: https://stonegateinc.com/download/brqs-2h-2022/?wpdmdl=570&refresh=6476507693ecb1685475446

Company Summary

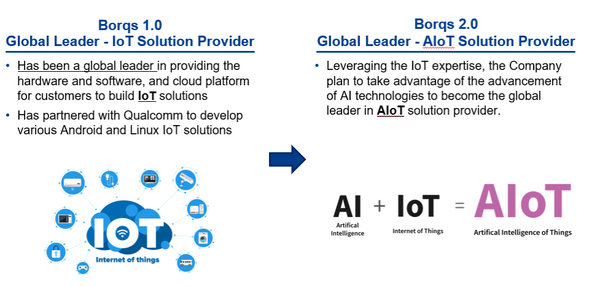

- Revamped Business Strategy: Borqs is positioned to revamp its business strategy and along with continuing in its legacy business in providing the hardware and software IoT solutions, it is seeking to develop Borqs’ branded products.

- One Stop Solution for IoT devices: Borqs operates as a connected products and solutions company that provides technical expertise to help OEMs and businesses at the idea stage helping them to productize. The Company also supports their clients until the mass production stage when the products are available to the customers. Borqs streamlines the entire product development and handles the challenges of selecting and managing component vendors and service providers (i.e., EMS, certification bodies and test labs), allowing customers to bring their products to market faster.

- Transition to AIoT: Given the current state of the technology industry the Company is taking steps to diversify their offerings to implement AI technologies. This is leading Borqs to roll out their “IoT + AI = AIoT” campaign that will combine the technical expertise already found at Borqs with the growth potential of AI implementation to take advantage of AI technologies that will have a direct impact on customers lives. We expect more details on this transition over the coming months.

- Divesting Solar Business: On December 13, 2022, the U.S. Department of Treasury, on behalf of the Committee in Foreign Investment in the United Sates (CIFUS), ordered Borqs to negotiate with CIFUs to fully divest Holu Hou Energy (HHE). On March 22, 2023, the Company announced that it reached an agreement with CIFUS and has 6 months to complete the divestment and a possible extension of 6 months to complete the transaction.. We expect the Company to receive a strong valuation given the attractiveness of the solar energy market and the work that BRQS has done to expand the HHE business. The cash from the sale should provide the Company with the ability to expand the business by exploring other business avenues.

- Outlook: From the divestiture of HHE, we believe Borqs will be active in expanding its business. Historically, management has shown the ability to make prudent acquisitions as seen by their acquisition of HHE. A strong cash position from the sale will allow the Company to continue making strategic acquisitions to drive the business forward.

- Valuation: Given the remaining uncertainty surrounding the Holu Hou divestiture, we used an EV/Rev multiple to value the IoT portion of the business and then applied a range of sales prices for the divestiture to calculate a Combined Value for BRQS. We estimate the IoT EV range to be between $98.3M to $156.3M, which arrives at a valuation of $0.56 to $0.89 with a midpoint of $0.79, or 227% upside for strictly the IoT Segment. When we add a potential sale price range of $80M to $120M for the HHE divestiture, applied to the IoT Market Cap range, we believe the valuation for BRQS could be in the range of $1.13 to $1.46 per share with a midpoint of $1.30.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.