DALLAS, TX -- June 4th, 2024 -- Bio-Path Holdings, Inc. (Nasdaq:BPTH): Stonegate Capital Partners Updates Coverage on Bio-Path Holdings, Inc. (Nasdaq:BPTH) for Q1 2024.

Multiple Milestones Achieved Q1 2024

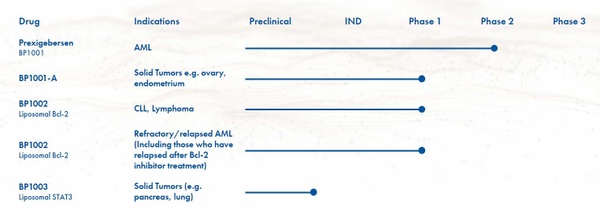

- Ongoing Clinical Trials: The Company has various product candidates in different stages of development and continues to expect near-term results in key cohorts.

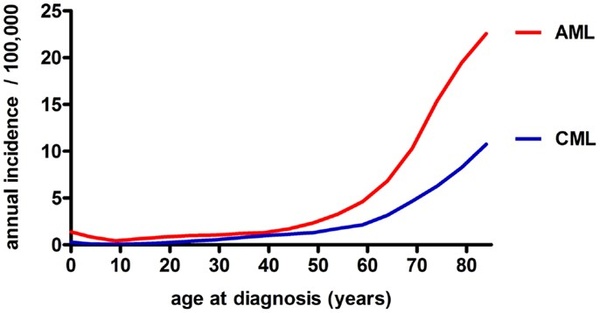

- Prexigebersen - Bio-Path has completed Phase 1 clinical trials for its lead candidate prexigebersen for acute myeloid leukemia (AML) and other blood cancers and is in the midst of a Phase 2 clinical trial for AML. The Company reported positive interim data in August 2023 that represented a potential breakthrough for the very sick patients facing this complicated disease with limited options.

- BP1001-A – BP1001-A (prexigebersen with enhanced nanoparticle properties) has begun Phase 1 trials for the treatment of solid tumors and recently reported successful completion of first dose cohort in its Phase 1/1b clinical trial, further demonstrating the drug’s favorable safety profile.

- BP1002 – Bio-Path is conducting two clinical trials for BP1002. A Phase 1 clinical trial of BP1002 in patients with advanced lymphoid malignancies is ongoing. Also, a Phase 1 is underway for patients with refractory/relapsed AML, including those who have relapsed from venetoclax-based treatment, and recently reported completion of the second dose cohort of the dose escalation portion of the trial

- BP1003 - BP1003 is in pre-clinical development in a pancreatic patient-derived tumor model. In previous preclinical trials, it has been successful at penetrating pancreatic tumors.

- Owning the Breakthrough Technology: Bio-Path has developed a proprietary antisense and liposome delivery technology for DNA drugs, DNAbilize®, potentially solving the challenges of delivering these molecules directly to target cells without side effects. DNAbilize® is Bio-Path’s novel and patented method for producing antisense DNA therapeutics for a broad spectrum of indications, including cancer. This technology overcomes certain drawbacks and challenges of the more traditional methods.

- Strategic Relationships: The original technology platform was licensed from The MD Anderson Cancer Center; BPTH maintains a strong relationship with the Cancer Center as well numerous leading cancer centers across the US, with several hosting clinical trials.

- Strong IP Position: Bio-path has a strong IP position with composition of matter and method patents for antisense targets and manufacturing, which helps ensure technology preservation and offers protection against competitors.

- Cash Runway: The Company reported $0.2M as cash on hand as of 3/31/24; however, in Q224 the Company raised ~ $3.5M of funds for working capital through its At-The-Market Offering Agreement and a registered direct offering.

- Valuation: Using comparable companies’ EV/R&D multiple - we gauge that Bio-Path is significantly undervalued next to its peers with numerous drug candidates in the pipeline and its lead drug candidate quickly approaching Phase 2 milestones that could indicate potential for approval. See page 12 for further details.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.