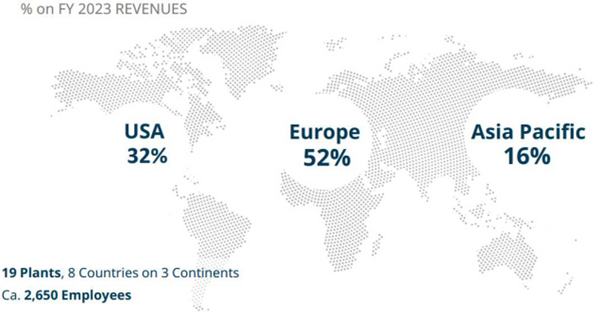

DALLAS, TX -- September 3rd, 2024 -- Aquafil Group (ECNL.MI): Stonegate Capital Partners updates coverage on Aquafil Group (ECNL.MI).

Aquafil Reports 2Q24 Results:

In 2Q24 macro conditions continued to turnaround in EMEA and Asia as volumes grew both year over year and in-line with company expectations. We note that the Company saw volume headwinds in North America. We expect that volumes in North America will increase through the balance of FY24 and into early FY25. On a consolidated basis ECNL reported improved EBITDA margins compared to 2Q23 despite lower revenue. This is in part due to the increasing percentage of ECONYL® sales. The Company also remains focused on debt repayment with a decreasing trend in net financial position. Lastly, ECNL announced a proposal for a capital raise of €40.0M to fund significant growth initiatives that we expect the Company to unveil in early September of 2024. We are encouraged that even though this is an equity raise, the Company major shareholder has expressed its intention to subscribe its pro-quota share of the capital increase further expressing confidence in ECNL.

- Quarterly Results: ECNL reported revenue, adj EBITDA, and adj EPS of €142.3M, €17.3M, and (€0.06), respectively. This compares to our/consensus estimates of €156.1M/€156.4M, €18.7M/€19.7M, and (€0.01)/€0.02, respectively. Revenues were impacted by both lower selling prices, different mix, and lower volumes in the North American market, with volumes seeing a rebound y/y in both Asia and EMEA. This resulted in a y/y revenue decline of 2.9%. GPM was in-line with our expectations as the Company has worked diligently to reduce costs. EBTIDA margin was 12.2% in the quarter, down from 6.7% in 2Q23.

- Outlook: The Company sees a lot of optimism out to 2025. To navigate short term headwinds ECNL is focusing on cost cutting initiatives and has acquired a covenant holiday from lenders for the remainder of FY24. These internal measures are combined with increasing volumes in both EMEA and Asia. The macro tailwinds seem to be strengthening as volumes are already increasing with mix and pricing expected to follow. The combination of reorganization, increasing volumes, and strong cash flows is expected to allow ECNL to focus on debt repayments and cash generation going forward. We expect that the Company will see growing revenues as volumes and mix improve through the remainder of the year.

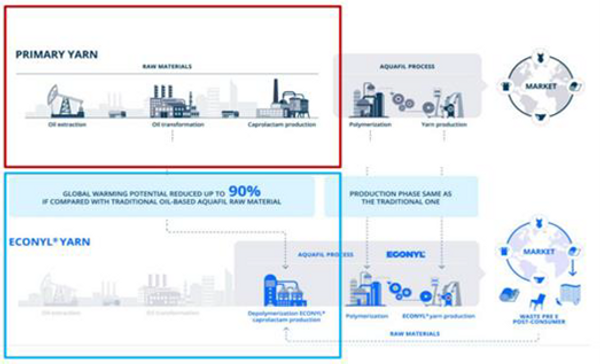

- ECONYL® Expansion on Track: The Company reported another quarter of strong ECONYL® contributions to revenues at 52.8% for 2Q24. This is an increase of 400bps from 48.8% seen in 2Q23. Sales seem to be buoyed by the European market which has been swift to adopt, with the North American market lagging. We expect the North American market to see a rebound over the remainer of FY24. This level of ECONYL® contribution to revenue is in[1]line with management’s expectations and is expected to remain a positive addition to the financials, with the goal of reaching 60% by FY25.

- Valuation: We use both a DCF Model and EV/EBITDA Analysis to frame our valuation of ECNL. Our DCF analysis relies on a range of discount rates between 10.75% and 11.25%. This arrives at a valuation range of €4.14 to €4.76 with a mid-point of €4.44. Our EV/EBITDA analysis relies on a range of 5.5x to 6.0x leading to a valuation range of €4.16 to €5.00, with a midpoint at €4.58.