DALLAS, TX -- May 20th, 2024 -- Aquafil Group (ECNL.MI): Stonegate Capital Partners updates coverage on Aquafil Group (ECNL.MI).

Aquafil reports 1Q24 results

In 1Q24 Aquafil macro conditions begin to turnaround in EMEA and Asia as volumes grew both year over year and in-line with company budgets. We note that the Company saw the last high-cost inventory in the quarter as well as volume headwinds in North America. We expect that volumes in North America will increase through the balance of FY24, with further clarity expected in 2Q24. ECNL reported lower than expected capital expenditures in the quarter, however, we still anticipate that the Company will see full year CapEx within guidance. This indicates to us that the Company remains focused on growth where applicable. The Company also remains focused on debt repayment with the covenant holiday remaining in effect. The inventory correction along with the expected volume increase and cost savings leads us to believe that the Company will see margin expansion over the coming year, giving us the confidence to look through the short-term headwinds when valuing ECNL.

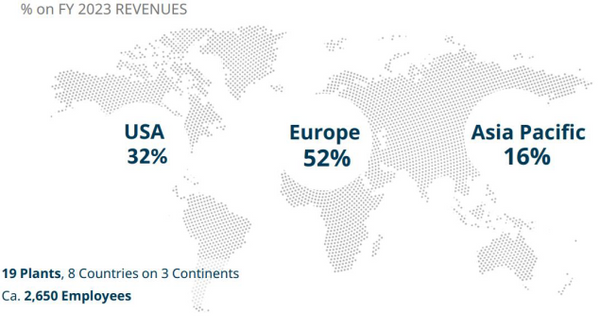

- Quarterly results: ECNL reported revenue, adj EBITDA, and adj EPS of $149.1M, $15.2M, and ($0.06), respectively. This compares to our/consensus estimates of $153.2M/$150.1M, $17.6M/$17.2M, and ($0.02)/($0.02), respectively. Revenue were impacted by both lower selling prices, different mix, and lower volumes in the North American market, with volumes seeing a rebound y/y in both Asia and EMEA. This resulted in a y/y revenue decline of 12.0%. GPM was in-line with our expectations as the Company has worked diligently to reduce costs. EBTIDA margin was 10% in the quarter, down from 12.9% in 1Q23.

- Outlook: The Company sees a lot of optimism out to 2025. To navigate short term headwinds ECNL is focusing on cost cutting initiatives and has acquired a covenant holiday from lenders for the remainder of FY24. These internal measures are combined with increasing volumes in both EMEA and Asia. The macro tailwinds seem to be strengthening as volumes are already increasing with mix and pricing expected to follow. The combination of reorganization, increasing volumes, and strong cash flows is expected to allow ECNL to focus on debt repayments and cash generation going forward. We expect that the Company will see growing revenues as volumes and mix improve through the remainder of the year.

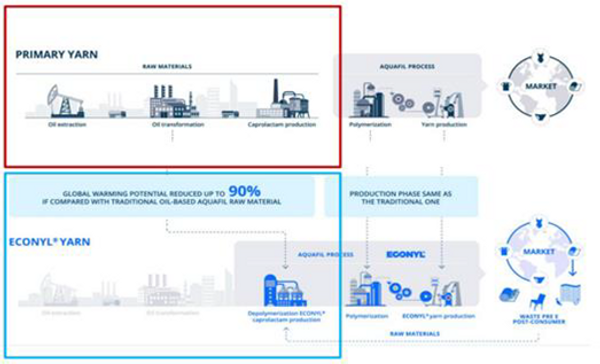

- ECONYL® Expansion on Track: The Company reported another quarter of strong ECONYL® contributions to revenues at 52.0% for 1Q24. This is an increase of 510bps from 46.9% seen in 1Q23. Sales seem to be buoyed by the European market which has been swift to adopt, with the North American market lagging. We expect the North American market to see a rebound over the remainer of FY24. This level of ECONYL® contribution to revenue is in-line with management’s expectations and is expected to remain a positive addition to the financials, with the goal of reaching 60% by FY25.

- Valuation: We use both a DCF Model and EV/EBITDA Analysis to frame our valuation of ECNL. Our DCF analysis relies on a range of discount rates between 9.75% and 10.50%. This arrives at a valuation range of €3.74 to €4.99 with a mid-point of €4.47. Our EV/EBITDA analysis relies on a range of 5.5x to 6.0x leading to a valuation range of €4.14 to €4.98, with a midpoint at €4.56.