DALLAS, TX -- October 29th, 2024 -- Alliance Resource Partners, L.P. (NASDAQ: ARLP): Stonegate Capital Partners updates coverage on Alliance Resource Partners, L.P.

ARLP Releases 3Q24 Earnings:

ARLP reported modest 3Q24 results despite headwinds related to lower export pricing and lower transportation revenues. Coal sales volumes increased by 6.7% q/q, offset by a 2.1% decrease in pricing. ARLP maintained its FY24 guidance, following the slight reduction made in 2Q24. Therefore, we have updated our model accordingly. We also note that management is optimistic when looking into FY25 due to the strengthening order book and demand outlook, which is expected to result in modest ASP improvement. This combined with the numerous capital intensive projects designed to improve efficiencies that are expected to wrap prior to FY25 gives us confidence in ARLP’s ability to drive profitability when looking into 2025, supported by a long dated and growing order book.

- Quarterly Results – ARLP reported revenue, adj EBITDA, and adj EPS of $613.6M, $170.4M, and $0.66, respectively. This compares to our/consensus estimates of $643.8M/$641.9M, $207.1M/$201.9M, and $0.89/$0.82, respectively. Pricing was buoyed by the well contracted order book, which looks to add more commitments heading into FY25. G&A expenses were slightly higher y/y, as continued changes in mining conditions impacted overall cost, which we do not per see being an issue going forward. In addition, outside coal purchases were slightly above our expectations despite a 29% decrease y/y. This led to an adj. EBITDA that was below our model primarily due to a weaker adj. OPM of 15.3%.

- Coal Opeartions –In 3Q24 ARLP reported coal sales of $532.6M, down 3.0% y/y, while being up 3.9% q/q. Volumes increased by 6.7% sequentially, while remaining relatively stable y/y at 8.4M tons. Pricing was down 2.6% q/q to arrive at $63.57 per ton compared to $65.30 per ton in 2Q24. This is also a decrease of 2.1% y/y from $64.94 per ton in 3Q23. The increase in sales volumes was primarily due to higher sales through the Illinois Basin as well as improved conditions on the Ohio River, allowing for more shipments from the Tunnel Ridge operation. Lastly, we note that management has reiterated its expectation that inventories will be reduced to approximately 0.5 to 1 million tons by year end.

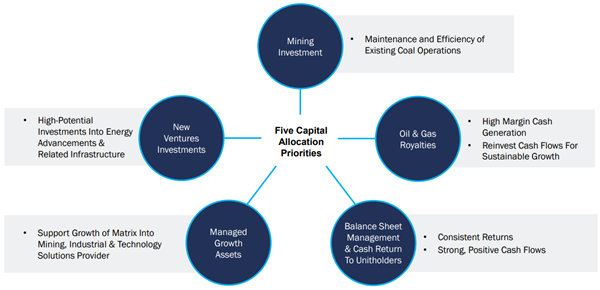

- Royalty Business – Total royalty revenues saw a decrease of 3.3% y/y to $51.3M. Volumes were up in both segments with 11.9% y/y and 2.3% y/y for BOE sold and coal royalty tons sold, respectively. O&G prices were down 9.8% y/y with coal royalty ASP down 3.0% y/y. The Partnership remains committed to continuously growing its Oil & Gas Royalties business as this segment adds important diversification to revenues and a natural hedge to commodity prices, with $10.5M worth of additions in the quarter.

- Strong Liquidity and Cash Flow Position – ARLP ended 3Q24 with a strong liquidity position of $657.7M, of which $195.4M was cash. ARLP also generated $103.2M of free cash flow in the quarter, marking $308.3M in FCF for the YTD period. Valuation – We are using an EV/EBITDA framework to inform our ARLP valuation. Currently ARLP is trading at a FY25 EV/EBITDA of 4.6x compared to comps at an average of 4.2x. We are using our F25 expected EBITDA, and an EV/EBITDA range of 4.5x to 5.0x with a midpoint of 4.75x. This arrives at a valuation range of $24.86 to $27.91 with a mid-point of $26.39.