DALLAS, TX -- July 30th, 2024 -- Alliance Resource Partners, L.P. (NASDAQ: ARLP): Stonegate Capital Partners updates coverage on Alliance Resource Partners, L.P.

ARLP Releases 2Q24 Earnings

ARLP reported solid 2Q24 results despite headwinds related to elevated industry inventories. Coal volumes decreased by 11.8% y/y, buoyed by a 3.8% increase in pricing. ARLP slightly reduced its 2024 guidance, noting the industry wide inventory levels as a headwind. We have updated our model accordingly. We note that management is optimistic when looking into FY25 due to the strengthening order book and demand outlook.

- Quarterly results – ARLP reported revenue, adj EBITDA, and adj EPS of $593.3M, $181.4M, and $0.77, respectively. This compares to our/consensus estimates of $620.8M/$629.5M, $215.6M/$215.6M, and $1.00/$0.86, respectively. Pricing was buoyed by the well contracted order book. G&A expenses and outside coal purchases were both above our expectations. This led to an adj. EBITDA that was below our model primarily due to a weaker OPM of 19.4%.

- Coal Opeartions – ARLP 2Q24 coal sales were $512.7M, down 8.5% y/y and 8.7% q/q. Volumes decreased by 11.2% y/y to 7.9M tons. Pricing was up 3.8% y/y to arrive at $65.30 compared to $62.93 in 2Q23. Volumes were impacted by outages at the Baltimore port, longwall moves, and flooding along the Ohio River delaying barge deliveries in 2Q24. Lastly, we expect decreased production for the balance of FY24 due to suppressed international demand and challenging mining conditions, both of which are expected to right-size by year end.

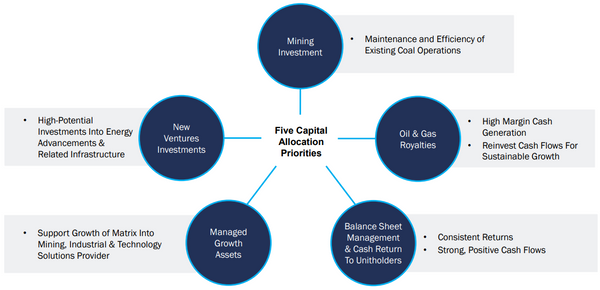

- Royalty Business – Total royalty revenues saw an increase of 6.1% y/y to $53.0M. Volumes were up 6.8% y/y and down 2.8% y/y for BOE sold and coal royalty tons sold, respectively. O&G prices were up 3.1% y/y with coal royalty ASP up 2.8% y/y. The Partnership remains committed to continuously growing its Oil & Gas Royalties business as this segment adds important diversification to revenues and a natural hedge to commodity prices.

- Altrenative Mining – The Partnership announced a change in fair value of digital assets worth $(3.7)M from a decrease in value to the Partnership’s Bitcoin holdings. ARLP has been mining bitcoin as a productive use for its surplus assets. Currently The Partnership holds 452 Bitcoin valued at ~$28.3M. This is a q/q increase in Bitcoins held of 6.3%, with year end holdings expected to be lower than that after ARLP sells Bitcoin to cover operating expenses. Lastly, the Partnership leases excess energy to other Bitcoin miners, further diversifying revenue streams.

- Strong liquidity and cash flow position – During the quarter ARLP announced the successful completion of its Senior Notes offering, adding $400.0M in liquidity to the Partnership. We view this as a significant win, demonstrating the market’s confidence in the Partnership. ARLP ended 2Q24 with a strong liquidity position of $666.0M, of which $203.7M was cash. ARLP also generated $114.9M of free cash flow in the quarter, up from $90.2M in 1Q24.

- Valuation – We are using an EV/EBITDA framework to inform our ARLP valuation. Currently ARLP is trading at a FY25 EV/EBITDA of 4.2x compared to comps at an average of 4.3x. We are using our F25 expected EBITDA, and an EV/EBITDA range of 4.0x to 4.5x with a midpoint of 4.25x. This arrives at a valuation range of $24.62 to $28.02 with a mid-point of $26.32.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.