DALLAS, TX -- April 30th, 2024 -- Alliance Resource Partners, L.P. (NASDAQ: ARLP): Stonegate Capital Partners updates coverage on Alliance Resource Partners, L.P.

ARLP Releases 1Q24 Earnings

ARLP reported solid 1Q24 results that kicked off 2024. Coal volumes increased by 2.4% y/y, to help buoy the decrease in pricing of 5.2%. ARLP reiterated its 2024 guidance, noting the strong quarter is challenged by the industry wide inventory levels, and we have updated our model accordingly. We note that management is optimistic when looking into FY24 the confidence in the export markets and the expected predictability in production following the completion of ARLP’s infrastructure projects.

- Quarterly results – ARLP reported revenue, adj EBITDA, and adj EPS of $651.7M, $238.4M, and $1.21, respectively. This compares to our/consensus estimates of $611.4M/$629.6M, $236.0M/$215.1M, and $1.04/$1.01, respectively. Pricing was buoyed by the contracts entered that were above spot markets. G&A expenses and outside coal purchases were both above our expectations. Despite this, adj. EBITDA outpaced our model primarily due to a strong OPM of 24.6%.

- Coal Opeartions – ARLP 1Q24 coal sales were $561.9M, down 2.9 y/y and up 7.6% q/q. Volumes increased by 2.4% y/y to 8.7M tons. Pricing was down 5.2% y/y to arrive at $64.78 compared to $68.34 in 1Q23. Volumes were not impacted by outages at the Baltimore port, however, ARLP did note that it expects to do three longwall moves in 2Q24 after completing one longwall move in 1Q24. It is notable that the operational and geological challenges seen in 2H23 have been resolved and are not expected to be an issue moving forward.

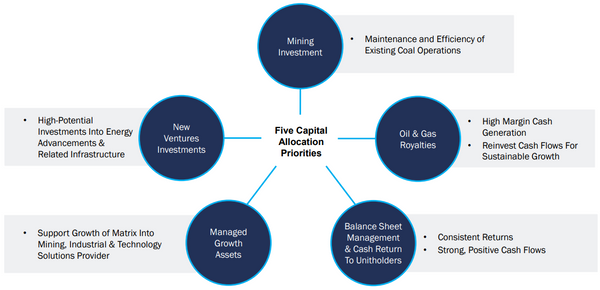

- Royalty Business – Total royalty revenues saw an increase of 9.8% y/y to $56.1M. Volumes were up18.3% y/y and 9.0% y/y for BOE sold and coal royalty tons sold, respectively. O&G prices were down 9.2% y/y with coal royalty ASP up 10.4% y/y. The Company remains committed to continue growing its Oil & Gas Royalties business as this segment adds important diversification to revenues and a natural hedge to commodity prices.

- Altrenative Mining – The Company announced a change in fair value of digital assets worth $11.9M from an increase in value of the Company’s Bitcoin holdings. ARLP has been mining bitcoin as a productive use for its surplus assets. Currently the Company holds 425 Bitcoin valued at ~$30.0M. Current projections show the potential to mine 175-190 Bitcoin per year, with year end holdings being lower than that after ARLP sells Bitcoin to cover operating expenses. Lastly, the Company leases excess energy to other Bitcoin miners, further diversifying revenue streams.

- Strong liquidity and cash flow position – The Company ended 1Q24 with a liquidity position of $551.3M, of which $134.0M is in cash. This allowed the management team to announce that it expects to retire $284.6M worth of senior notes throughout 2024. ARLP also generated $90.5M of free cash flow in the quarter.

- Valuation – We are using an EV/EBITDA framework to inform our ARLP valuation. Currently ARLP is trading at a FY25 EV/EBITDA of 3.6x compared to comps at an average of 4.6x. We are using our F25 expected EBITDA, and an EV/EBITDA range of 4.0x to 4.5x with a midpoint of 4.25x. This arrives at a valuation range of $24.53 to $27.93 with a mid-point of $26.23.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.