DALLAS, TX -- January 30th, 2024 -- Alliance Resource Partners, L.P. (NASDAQ: ARLP): Stonegate Capital Partners updates coverage on Alliance Resource Partners, L.P.

ARLP Releases Full Year 2023 and 4Q23 Earnings

ARLP reported solid 4Q23 results that capped a record year, despite significant headwinds. Full year pricing increased 8.6%, helping to mitigate a slight decrease in volumes. While the Company saw an increase in operating expenses, ARLP still saw year-over-year net income growth. ARLP updated its 2024 guidance, slightly decreasing expected full year coal ASP/ton, and we have updated our model accordingly. We note that management is optimistic when looking into FY24 given the strong futures curve of relevant commodity prices, which is leading to increased demand and an expected corollary increase in export prices.

- Quarterly results – ARLP reported revenue, adj EBITDA, and adj EPS of $636.5M, $247.7M, and $1.18, respectively. This compares to our/consensus estimates of $673.2M/$703.7M, $283.4M/$268.5M, and $1.25/$1.53, respectively. Domestic and export pricing were both challenged in the Illinois Basin, with export pricing slightly buoying the challenged domestic pricing in Appalachia. The net result was a quarter of decreased results as compared to 4Q22.

- Coal Opeartions – ARLP 4Q23 coal sales were $521.9M, down 17.3 y/y and down 4.9% q/q. Volumes decreased by 7.5% y/y to 8.6M tons. Pricing was down 10.7% y/y to arrive at $60.6 asp/ton compared to $67.84 in 4Q22. Volumes were impacted by an unexpected fire at a Gulf Coast export terminal, temporarily halting operations. ARLP is expecting to see a pricing rebound in export pricing through FY24. It is notable that the operational and geological challenges seen in 2H23 have been resolved and are not expected to be an issue moving forward.

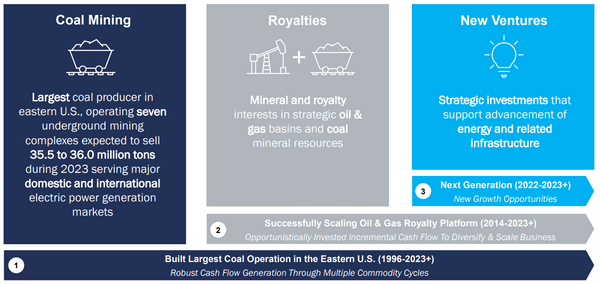

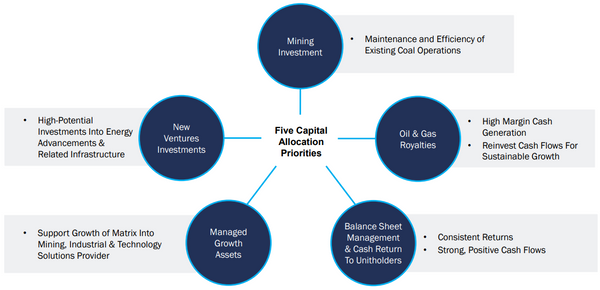

- Royalty Business – Total royalty revenues saw a decline of 1.9% y/y to $53.0M. Volumes were up 13.1% y/y and down 5.4% y/y for BOE sold and coal royalty tons sold, respectively. O&G prices were down 19.7% y/y with coal royalty ASP up 24.3% y/y. For the full year 2023 ARLP completed $110.9M in oil and gas mineral interest acquisitions, with $24.8M in 4Q23.

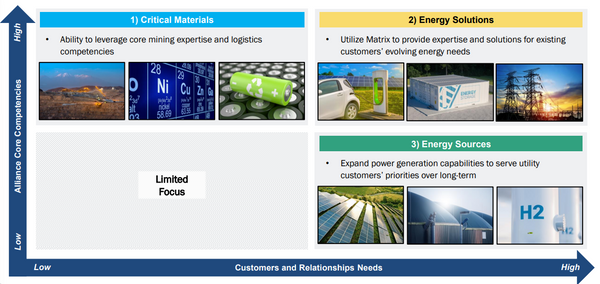

- Strategic Investments – In 4Q23 the Company announced an agreement with Infinitum to bring reliable motor technology to the mining industry. ARLP has been invested in Infinitum since the 2022 Series D funding that Infinitum raised. This motor technology is expected to be lighter, less resource intense, and consume 10% less energy thus providing mining companies with a more efficient and reliable alternative to heavy iron-core motors.

- Strong liquidity and cash flow position – The Company ended 4Q23 with a liquidity position of $492.1M, of which $59.8M is in cash. This strong liquidity position gave ARLP the flexibility to make recent New Venture investments in 2H23. Management is expected to prioritize debt repurchases over the coming quarters with a repurchase of senior notes outstanding worth $22.9M in the quarter and 85.0 in FY23. ARLP also generated $4.6M of free cash flow in the quarter.

- Valuation – We are using an EV/EBITDA framework to inform our ARLP valuation. Currently ARLP is trading at a FY24 EV/EBITDA of 2.9x compared to comps at an average of 4.8x. We are using our F24 expected EBITDA, and an EV/EBITDA range of 3.0x to 5.0x with a midpoint of 4.00x. This arrives at a valuation range of $20.10 to $35.20 with a mid-point of $27.65.