DALLAS, TX -- October 30th, 2023 -- Alliance Resource Partners, L.P. (NASDAQ: ARLP): Stonegate Capital Partners updates coverage on Alliance Resource Partners, L.P.

ARLP Releases 3Q23 Earnings, Maintaining Momentum

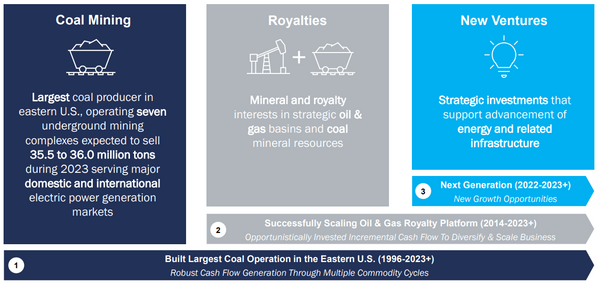

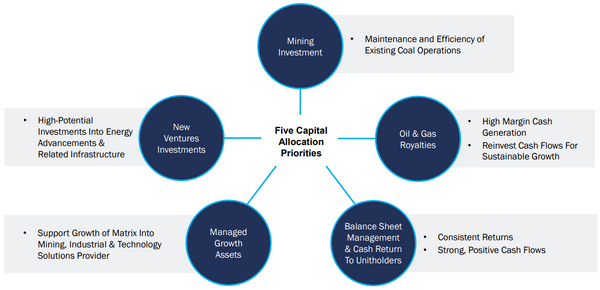

ARLP reported solid 3Q23 results that continued the trend of growth set last quarter, despite significant headwinds. Increased pricing over 3Q22 helped mitigate decreased volumes. While the Company saw a decrease in demand due in part to high inventory levels seen industry wide, ARLP still saw year-over-year top line growth. ARLP updated its 2023 guidance, slightly decreasing expected full year coal ASP/ton, and we have updated our model accordingly. We note that management is optimistic when looking into FY24 given the strong futures curve of relevant commodity prices, which is leading to increased demand.

- Strong 3Q23 results – ARLP reported revenue, adj EBITDA, and adj EPS of $636.5M, $247.7M, and $1.18, respectively. This compares to our/consensus estimates of $673.7M/$669.8M, $263.0M/$276.3M, and $1.48/$1.32, respectively. Volumes were challenged in the quarter, however, increased pricing helped mitigate the slightly softer than expected demand. The net result was another quarter of strong EBITDA, maintaining the momentum seen in 1H23.

- Coal opeartions continue to point positively – ARLP 3Q23 coal sales were $549.1M, relatively flat y/y and down 2.0% q/q. Volumes decreased by 7.9% y/y to 8.5M tons. Pricing (asp/ton) was up 8.3% y/y to arrive at $64.94 compared to $59.94 in 3Q22. While unseasonable weather was a factor in 1H23, ARLP is expected to see a pricing rebound in 2H23, that is expected to continue through the balance of the year. This was despite the significant headwinds seen from the labor market as well as modest setbacks due to operational challenges. The operational challenges have been solved and are not expected to be an issue moving forward.

- Royalty business is challenged – Total royalty revenues saw a decline of 9.0% y/y to $53.1M. Volumes were up 28.2% y/y and down 11.7 y/y for BOE sold and coal royalty tons sold, respectively. O&G prices were down 31.2% y/y with coal royalty ASP up 13.5% y/y. With ~$105M earmarked for O&G acquisitions this year, we expect continued growth in the royalty business.

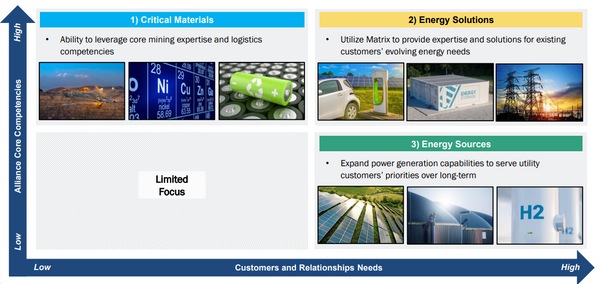

- Strategic Investments – In 3Q23 the Company announced a new strategic investment in Ascend Elements. This $25.0M investment was part of the series D funding round that combined for $480.0M. Ascend is located in Kentucky and is constructing North Americas first commercial scale manufacturing facility for the production of EV battery cathode materials.

- Strong liquidity and cash flow position – The Company ended 3Q23 with a liquidity position of $629.5M, of which $197.2M is in cash. This strong liquidity position gave ARLP the flexibility to make the New Venture investments mentioned above. Management is expected to prioritize debt repurchases over the coming quarters with a repurchase of senior notes outstanding worth $54.6M in the quarter. ARLP also generated $123.7M of free cash flow in the quarter.

- Valuation – We are using an EV/EBITDA framework to inform our ARLP valuation. Currently ARLP is trading at a FY24 EV/EBITDA of 2.8x compared to comps at an average of 3.7x. We are using our F24 expected EBITDA, and an EV/EBITDA range of 3.0x to 4.0x with a midpoint of 3.50x. This arrives at a valuation range of $24.08 to $32.73 with a mid-point of $28.41.